PSEi nears 6,200 on dovish bets

MANILA, Philippines – Expectations that the Bangko Sentral ng Pilipinas (BSP) may slash its policy interest rate again in June energized investors on Tuesday, with the index closing just below the 6,200 barrier.

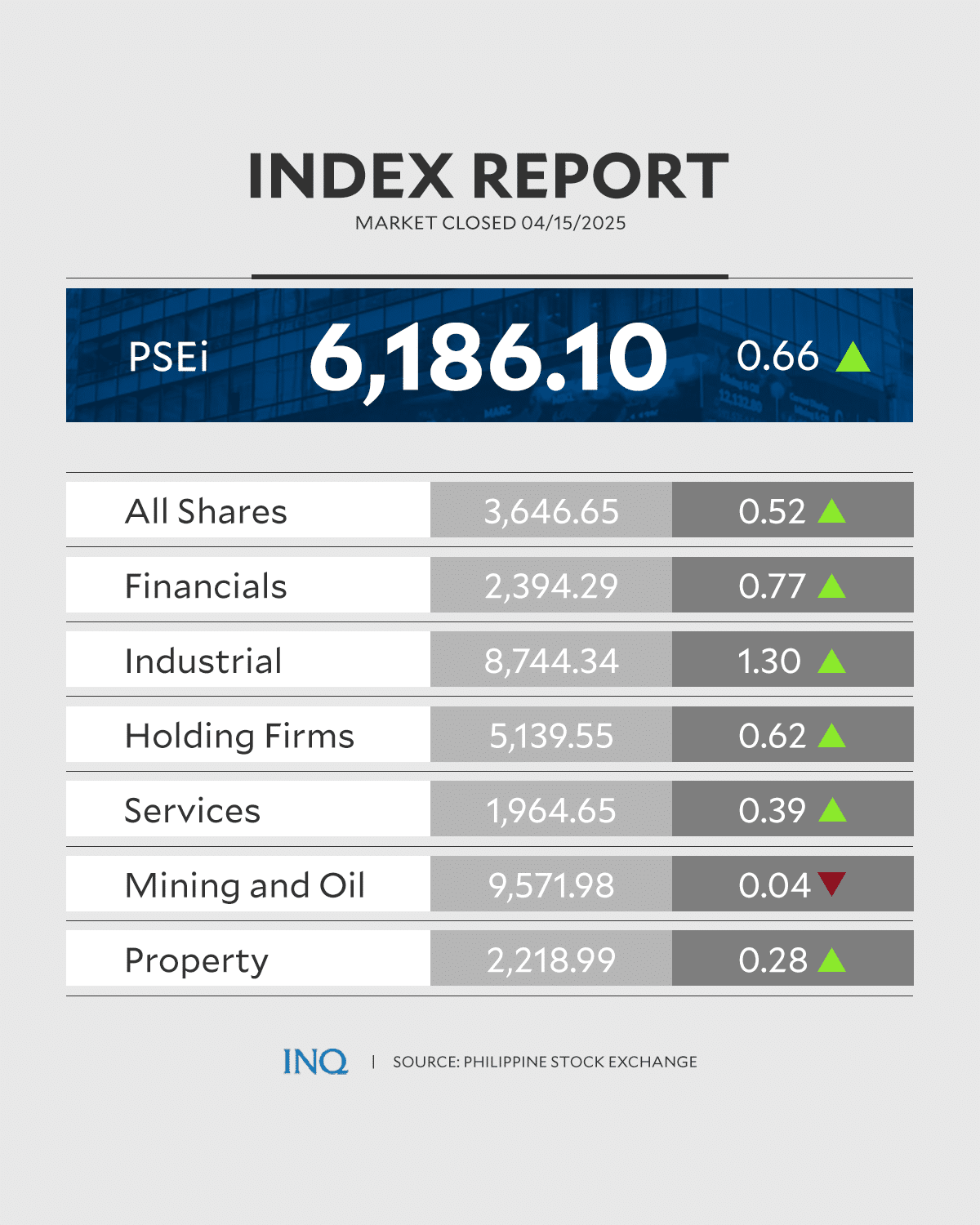

The benchmark Philippine Stock Exchange Index (PSEi) added 0.66 percent, or 40.58 points, to close at 6,186.10.

Likewise, the broader All Shares Index climbed by 0.52 percent, or 18.76 points, to 3,646.65.

READ: More BSP rate cuts on the table to spur growth

A total of 1.4 billion shares worth P4.46 billion changed hands, stock exchange data showed.

The local stock barometer rose due mainly to expectations that the BSP would again cut the benchmark rate for overnight borrowing during its next rate-setting meeting, said Luis Limlingan, head of sales at stock brokerage house Regina Capital Development Corp.

At the same time, traders also cheered US President Donald Trump’s move to exempt smartphones, computers and semiconductor chips from his “Liberation Day” tariffs, Limlingan noted.

The industrial subsector registered the steepest gain, along with banks.

International Container Terminal Services Inc. was the top-traded stock as it shed 0.17 percent to close at P354 each.

It was followed by BDO Unibank Inc., up 1.39 percent to P160; Ayala Land Inc., up 0.63 percent to P23.95; SM Prime Holdings Inc., down 0.44 percent to P22.65; and Jollibee Foods Corp., up 4.72 percent to P230.60 each.

Other actively traded stocks were: Converge ICT Solutions Inc., up 4.11 percent to P18.74; SM Investments Corp., up 1.78 percent to P829.50; Bloomberry Resorts Corp., down 1.69 percent to P2.90; Manila Electric Co., up 3.21 percent to P578; and Bank of the Philippine Islands, up 0.69 percent to P132 per share.

Gainers edged out losers, 102 to 79, while 66 companies closed flat, stock exchange data also showed. INQ