91-day T-bills rise, longer yields ease ahead of BSP meet

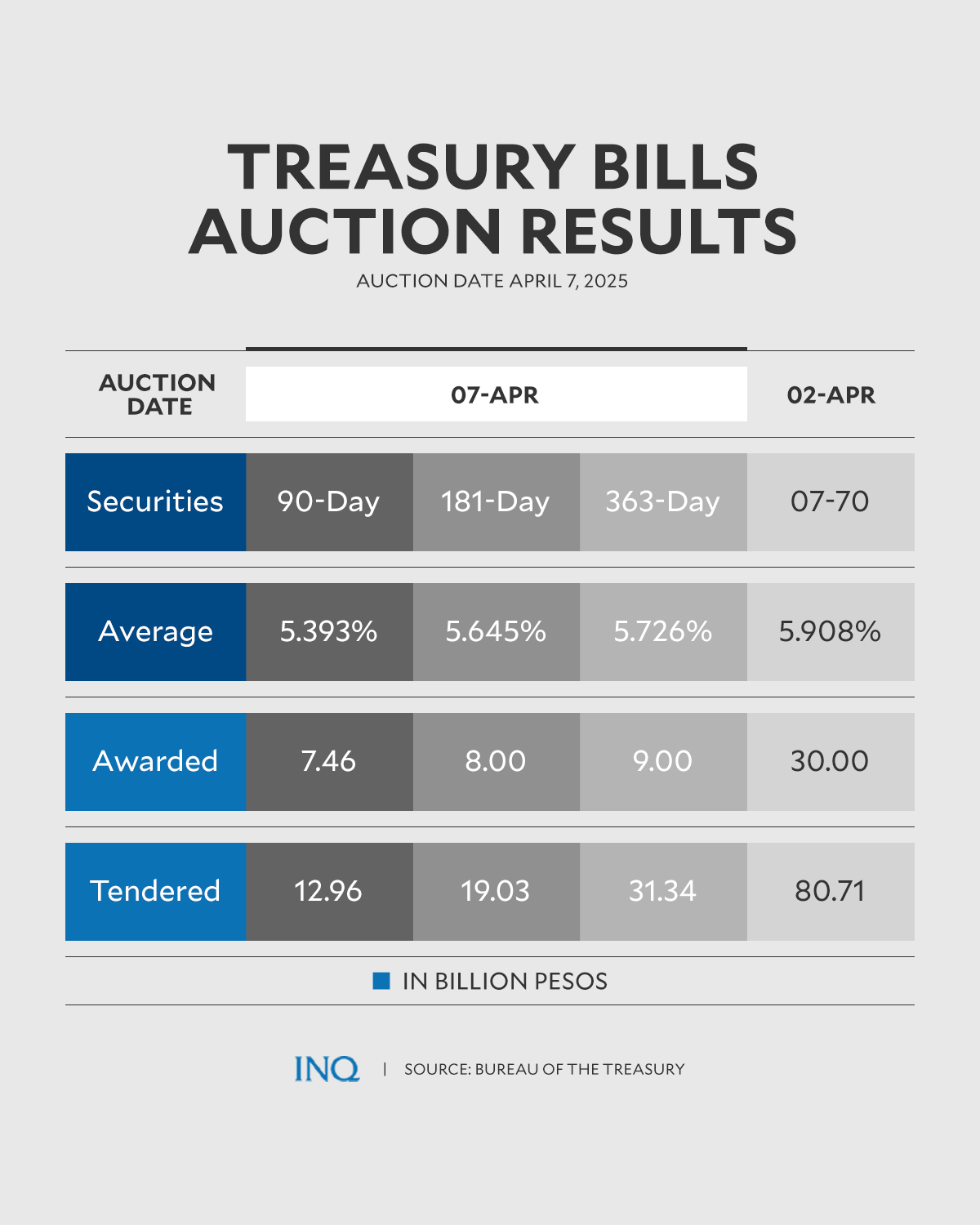

Results of the Treasury Bills auction on Monday, April 7, 2025.

MANILA, Philippines — The Marcos administration was not able to raise its target amount of the short-dated local debt paper during Monday’s sale of Treasury bills (T-bills) following mixed movements of yields ahead of the next policy meeting of the central bank.

Auction results showed the Bureau of the Treasury (BTr) was able to borrow P24.5 billion via sale of T-bills, slightly short of its initial plan to raise P25 billion.

This was despite the robust demand for the debt paper. The BTr said the offer had attracted total bids amounting to P63.3 billion, 2.5 times larger than the original size of the offering.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said rates were mostly lower as the Bangko Sentral ng Pilipinas (BSP) was widely expected to resume monetary easing at its April 10 monetary policy meeting.

An Inquirer poll of 13 economists predicted a quarter-point reduction to the local key rate.

READ: Bangko Sentral rate cut penciled in

“The latest Treasury bill average auction yields mostly corrected slightly lower ahead of the possible 25-basis point local policy rate cut on the next BSP rate-setting meeting on Thursday,” Ricafort said.

Mixed results

The BTr said the three-month T-bill fetched an average rate of 5.393 percent, more expensive than the 5.307 percent seen during the previous auction.

The government only accepted bids amounting to P7.46 billion for this tenor, below the initial target of P8 billion.

On the other hand, average rate for the six-month debt paper went down to 5.645 percent from 5.646 percent before.

Lastly, local creditors asked for an average yield of 5.726 percent for the one-year T-bill, lower than the 5.748 percent seen in the last auction.

For this year, the Marcos administration is targeting to borrow P2.55 trillion from creditors at home and abroad to plug a projected budget hole amounting to P1.54 trillion, or equivalent to 5.3 percent of the country’s gross domestic product.

By sources of financing, the government will borrow P507.41 billion from foreign investors in 2025. The remaining P2.04 trillion is targeted to be raised domestically, of which P60 billion will be via T-bills and P1.98 trillion via longer-dated Treasury bonds.