PSEi falls to 5,800 territory, slides 4.3% on global recession fears

PSEi closing April 07, 2025

Updated at 4:55 p.m. on April 7, 2025

MANILA, Philippines – The Philippine Stock Exchange Index (PSEi) saw its worst single-day fall of the year on Monday as the global trade war ravaged Asian markets.

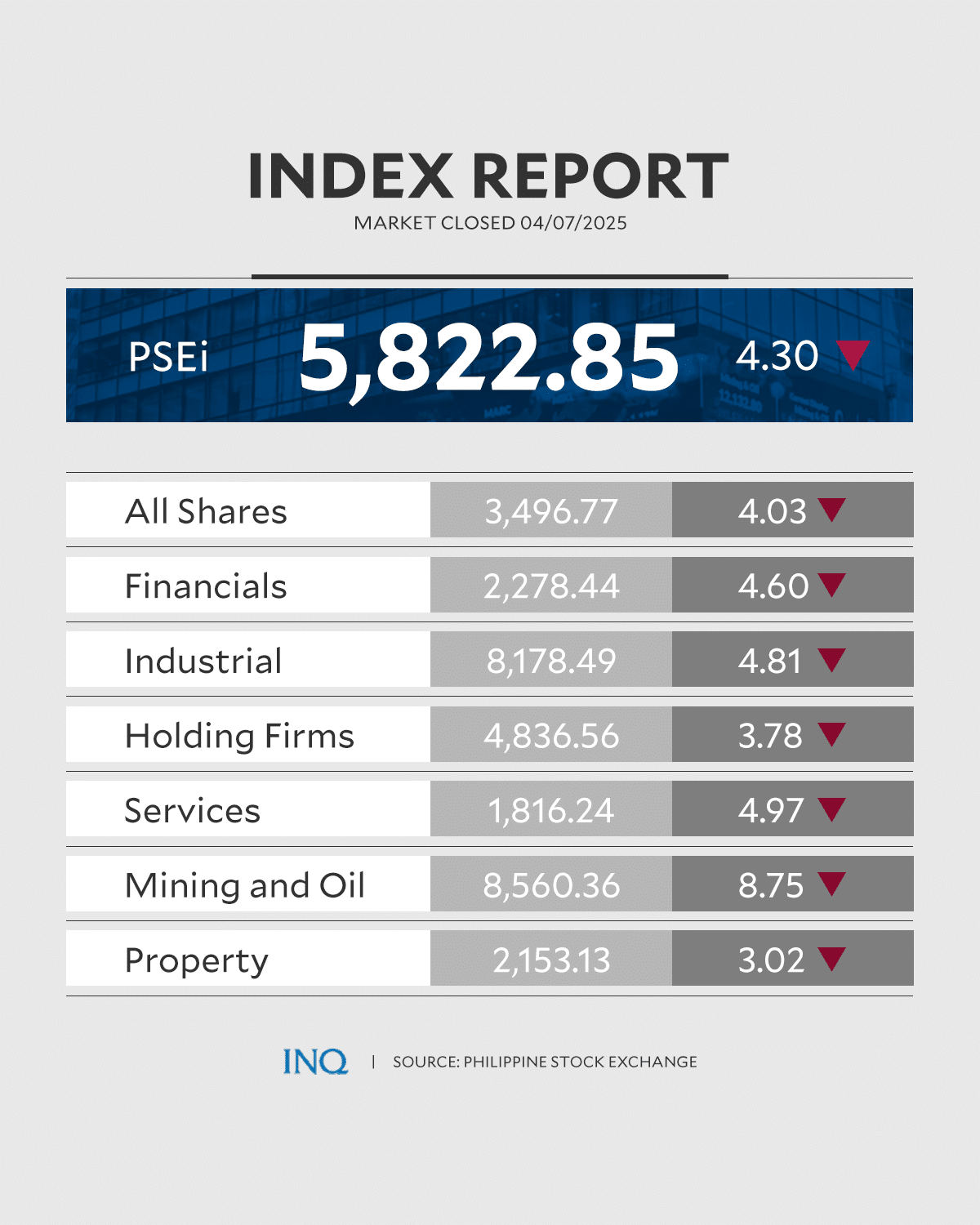

By the closing bell, the benchmark index slid by 4.3 percent, or 261.34 points, to 5,822.85.

The PSEi last fell by 4 percent on Jan. 31, when investors digested sticky inflation and weak economic growth.

The broader All Shares Index likewise plunged by 4.03 percent, or 146.67 points, to close at 3,496.77.

Luis Limlingan, head of sales at stock brokerage house Regina Capital Development Corp., noted that U.S. equities had fallen last Friday following China’s imposition of a 34-percent tariff on goods coming from America.

According to Limlingan, this “[intensified] concerns that President Donald Trump’s trade policies may escalate into a global trade war and potentially trigger a recession.”

The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite all fell by more than 5 percent last Friday.

READ: Market panic mounts as world scrambles to temper Trump tariffs

Across the region

Asian markets took a huge plunge Monday as US futures pointed to significant losses on Wall Street over Donald Trump’s punishing tariffs, even as countries sought compromise with the defiant president.

Trump denied Sunday he was intentionally engineering a selloff and insisted he could not foresee market reactions, saying he would not make a deal with other countries unless trade deficits were solved.

“Sometimes you have to take medicine to fix something,” he said of the market pain that has seen trillions of dollars wiped off the value of US companies since the beginning of his tariff rampage.

Speaking to reporters aboard Air Force One, he added that he had sought to resolve the issue with world leaders over the weekend, claiming “they’re dying to make a deal.”

China retaliated against the United States on Friday, announcing it would impose tit-for-tat tariffs of 34 percent on all US goods from April 10 after Asian markets closed last week.

With the trade war escalating, stocks in Asia took a heavy hammering when trading resumed.

In early trade on Monday in Japan the Nikkei 225 was off an eye-watering 6.5 percent, while stocks in Taiwan were down almost 10 percent and in Singapore 8.5 percent.

Futures contracts for the New York Stock Exchange’s main boards were sharply down Sunday, suggesting more pain for battered Wall Street stocks when markets open Monday, while US oil dropped below $60 a barrel for the first time since April 2021.

In Saudi Arabia, where the markets were open Sunday, the bourse was down 6.78 percent — the worst daily loss since the Covid-19 pandemic, according to state media.

Larry Summers, formerly Director of the National Economic Council under president Barack Obama, said “there is a very good chance there’s going to be more turbulence in markets the way we saw on Thursday and Friday.”

Peter Navarro, Trump’s tariff guru, has pushed back against the mounting nervousness and insisted to investors that “you can’t lose money unless you sell,” promising “the biggest boom in the stock market we’ve ever seen.”

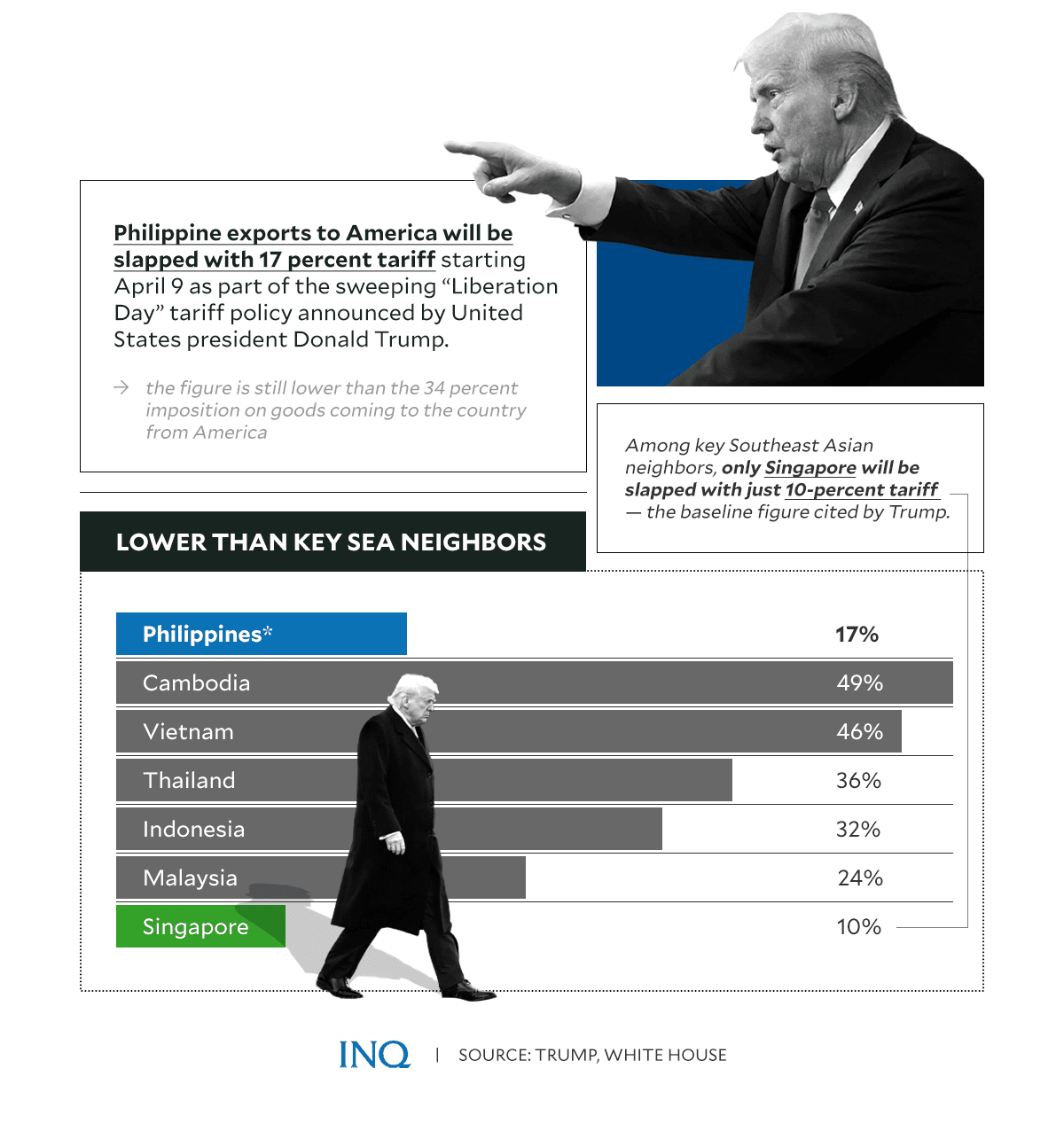

Trump sets 17% tariff on Philippine goods