PSEi torn between local optimism, tariff woes

FILE PHOTO: The trading floor at PSE Center in BGC, Taguig

MANILA, Philippines – There may be a tug-of-war between domestic optimism and global uncertainty this week at the bourse, as a crucial monetary policy meeting tangles with tariff anxiety.

The benchmark Philippine Stock Exchange Index (PSEi) has so far declined for four consecutive weeks after closing 1.03 percent lower week-on-week on Friday to 6,084.19.

The PSEi last slipped below 6,100 on March 4, or days after US President Donald Trump threatened to impose higher duties on goods from the European Union.

“The market is drawn to more attractive levels from a fundamental standpoint,” said Japhet Tantiangco, research head at Philstocks Financial Inc. “Hence, we may see bargain hunting in [this] week’s trading.”

Monetary policy watch

Traders will likewise look out for the Bangko Sentral ng Pilipinas’ next monetary policy stance on Thursday, as sentiment has been positive after cooler March inflation, Tantiangco added.

Data from the Philippine Statistics Authority show that inflation settled at 1.8 percent last month from 2.1 percent in February, or still within the BSP’s 1.7- to 2.5-percent target range.

READ: Philippine inflation slowed to 1.8% in March, a near 5-yr low

At the same time, however, the market may continue taking a hit from the barrage of reciprocal tariffs imposed by Trump, according to Unicapital Securities Inc. research head Wendy Estacio-Cruz.

“We anticipate the index to continue trading within the 5,800 to 6,300 range, as the impact of tariffs imposed by the US government has yet to be fully felt,” Cruz said.

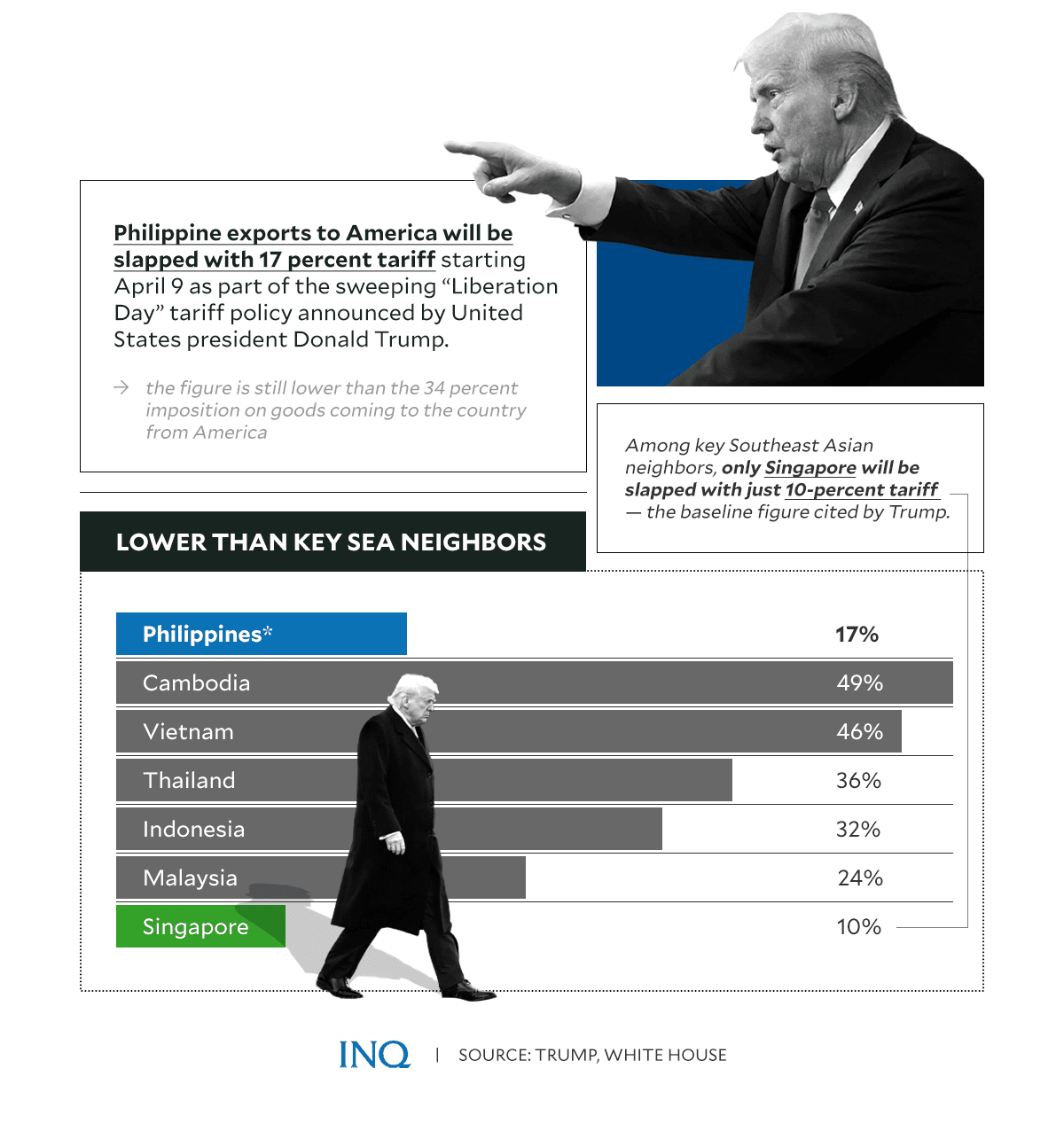

Last week, Trump slapped a 17-percent import tariff on goods coming from the Philippines, spooking investors and pushing the PSEi to its worst fall since the arrest of former President Rodrigo Duterte in March.

READ: Trump sets 17% tariff on Philippine goods coming to America

Still, analysts pointed out that the index’s decline may only be a knee-jerk reaction to the new duties. They anticipate the market to eventually recover, especially since domestic consumption accounted for 75 percent of the Philippines’ gross domestic product in 2024.

Exports to the United States, meanwhile, accounted for only 1 percent, data from Bank of the Philippine Islands show.

Trump sets 17% tariff on Philippine goods