China retaliates as Trump’s tariffs affect world markets

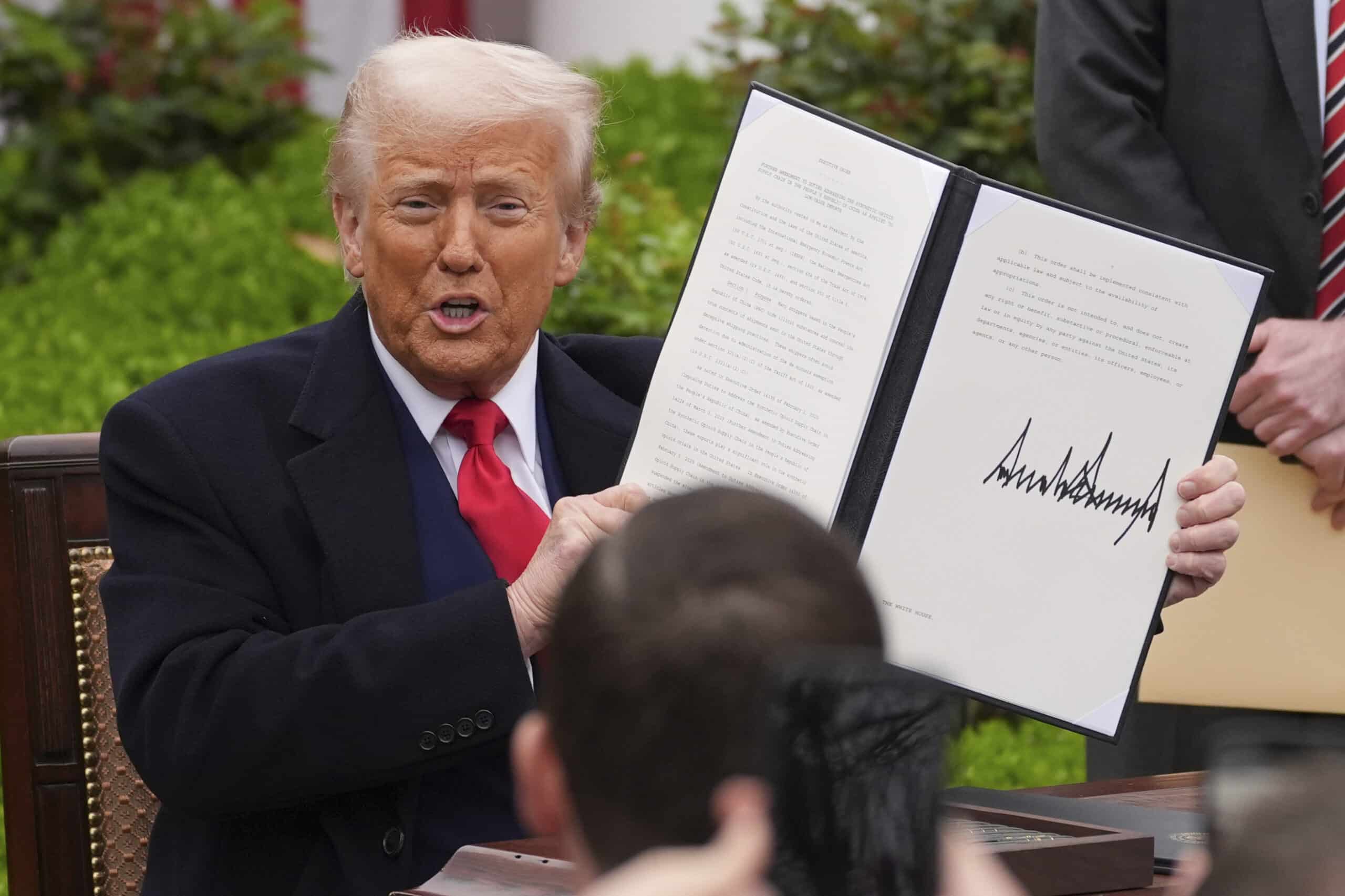

President Donald Trump holds a signed executive order during an event to announce new tariffs in the Rose Garden of the White House, Wednesday, April 2, 2025, in Washington. (AP Photo/Evan Vucci)

World shares slid further and US futures also fell Friday as investors counted the potential costs of US President Donald Trump’s latest set of tariffs, even as China retaliated by announcing a 34 percent tariff on imports of all US products and other retaliatory moves.

Major US indexes, which had already plunged sharply before Friday’s opening bell, doubled their losses after the announcement from China.

The Dow Jones fell 1,200 points, almost 3 percent. The growth and tech focused Nasdaq fell harder.

‘Not standard economics’

A top trade analyst says the Trump administration’s calculations that led to the tariffs are “not standard economics” and in many cases impose rates far higher than those that the targeted countries apply to US goods.

Julia Spies, chief of trade and market intelligence at the International Trade Center, said uncertainties remain about the exact way the US Trade Representative’s office and other US officials came up with the tariffs.

She said the figures presented by Trump roughly match the US trade balance — or imbalance — with a specific country, divided by imports from that country, “and that, divided by two, gives us the reciprocal tariff” imposed by the US.

“This is not standard economics,” Spies told reporters by video to a UN briefing in Geneva.

The US calculation included countries’ tariffs on American exports plus other regulations and policies in those countries, like currency manipulation, sanitary measures, and technical barriers to trade, and “all of that led to this—what they call ‘tariffs’.”

The ITC, based in Geneva, is a joint agency of the United Nations and the World Trade Organization that aims to help small businesses in the developing world to trade.

China strikes back with 34%

China announced Friday that it will impose a 34-percent tariff on imports of all US products beginning April 10, part of a flurry of retaliatory measures following Trump’s “Liberation Day” slate of double-digit tariffs.

The new tariff matches the rate of the US “reciprocal” tariff of 34 percent on Chinese exports Trump ordered this week.

The Commerce Ministry in Beijing also said in a notice that it will impose more export controls on rare earths. These are materials used in high-tech products such as computer chips and electric vehicle batteries.

Included in the list of minerals subject to controls was samarium and its compounds. These are used in aerospace manufacturing and the defense sector.

Another element called gadolinium is used in MRI scans.

China’s customs administration said it had suspended imports of chicken from two US suppliers, Mountaire Farms of Delaware and Coastal Processing.

The agency said Chinese customs had repeatedly detected furazolidone, a drug banned in China, in shipments from those companies.

Additionally, the Chinese government said it has added 27 firms to lists of companies subject to trade sanctions or export controls.

Among them, 16 are subject to a ban on the export of “dual-use” goods.

High Point Aerotechnologies, a defense tech company, and Universal Logistics Holding, a publicly traded transportation and logistics company, were among those listed.

Beijing also announced it filed a lawsuit with the World Trade Organization over the tariffs issue.

Asian and European shares slide further

In European trading, Germany’s DAX lost 2 percent to 21,289.53. This, after the country reported factory orders were unchanged in February as manufacturers prepared for steeper duties on their exports.

The CAC 40 in Paris slipped 1.6 percent to 7,478.17 while Britain’s FTSE 100 gave up 1.7 percent to 8,331.44.

Markets in Shanghai, Taiwan, Hong Kong and Indonesia were closed for holidays, limiting the scope of Friday’s sell-offs in Asia.

Tokyo’s Nikkei 225 lost 2.8 percent to 33,780.58, while South Korea’s Kospi sank 0.9 percent to 2,465.42.

The two US allies said they were focused on negotiating lower tariffs with Trump’s administration.

Australia’s S&P/ASX 200 dropped 2.4 percent, closing at 7,667.80.

In other trading early Friday, the US dollar rose to 146.46 Japanese yen from 146.06.

The yen is often used as a refuge in uncertain times, while Trump’s policies are meant in part to weaken the dollar to make goods made in the US more price competitive overseas.

The euro edged lower to $1.0976 from $1.1055.