MANILA, Philippines — Expectations that inflation had cooled in March—which would give the Bangko Sentral ng Pilipinas (BSP) room to possibly cut rates—boosted the mood of investors on Wednesday.

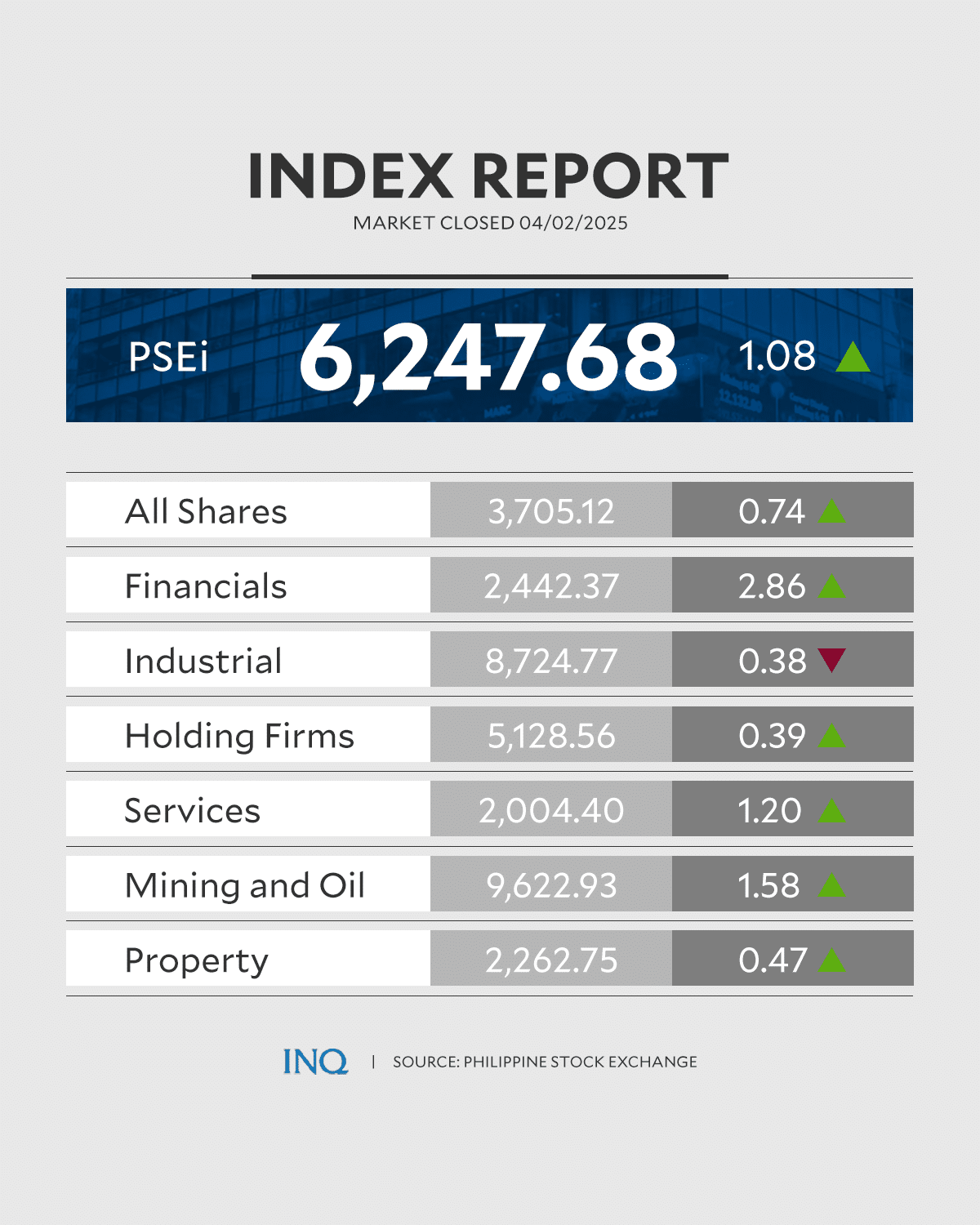

By the end of the session, optimism fueled the 1.08-percent rally of the benchmark Philippine Stock Exchange Index (PSEi), representing a 66.96-point increase, to close at 6,247.68.

Likewise, the broader All Shares Index added 0.74 percent, or 27.24 points, to 3,705.12.

A total of 1.31 billion shares worth P6.1 billion changed hands, stock exchange data showed.

Japhet Tantiangco, research head at Philstocks Financial Inc., said the market’s climb came on the heels of reports that inflation slowed last month.

READ: Positive surprise: Philippine inflation eased to 2.1% in February

This is seen to give the BSP more leeway to cut policy rates during its meeting next week.

Actively traded stocks

Rallies at top-traded stock BDO Unibank Inc. (up 3.07 percent to P158), Bank of the Philippine Islands (up 4.62 percent to P138.10) and Metropolitan Bank and Trust Co. (up 2.19 percent to P74.60) allowed the banking subindex to end with a 2.86-percent climb.

BDO was followed by Ayala Land Inc., up 3.91 percent to P23.90; International Container Terminal Services Inc., up 1.86 percent to P361.60; BPI; and SM Prime Holdings Inc., down 1.46 percent to P23.65 each.

Other actively traded stocks were Manila Electric Co., down 1.45 percent to P542; Metrobank; PLDT Inc., down 0.87 percent to P1,260; Jollibee Foods Corp., down 3.67 percent to P231.20; and SM Investments Corp., up 0.51 percent to P792 per share.