Asian markets edge up but uncertainty rules ahead of Trump tariffs

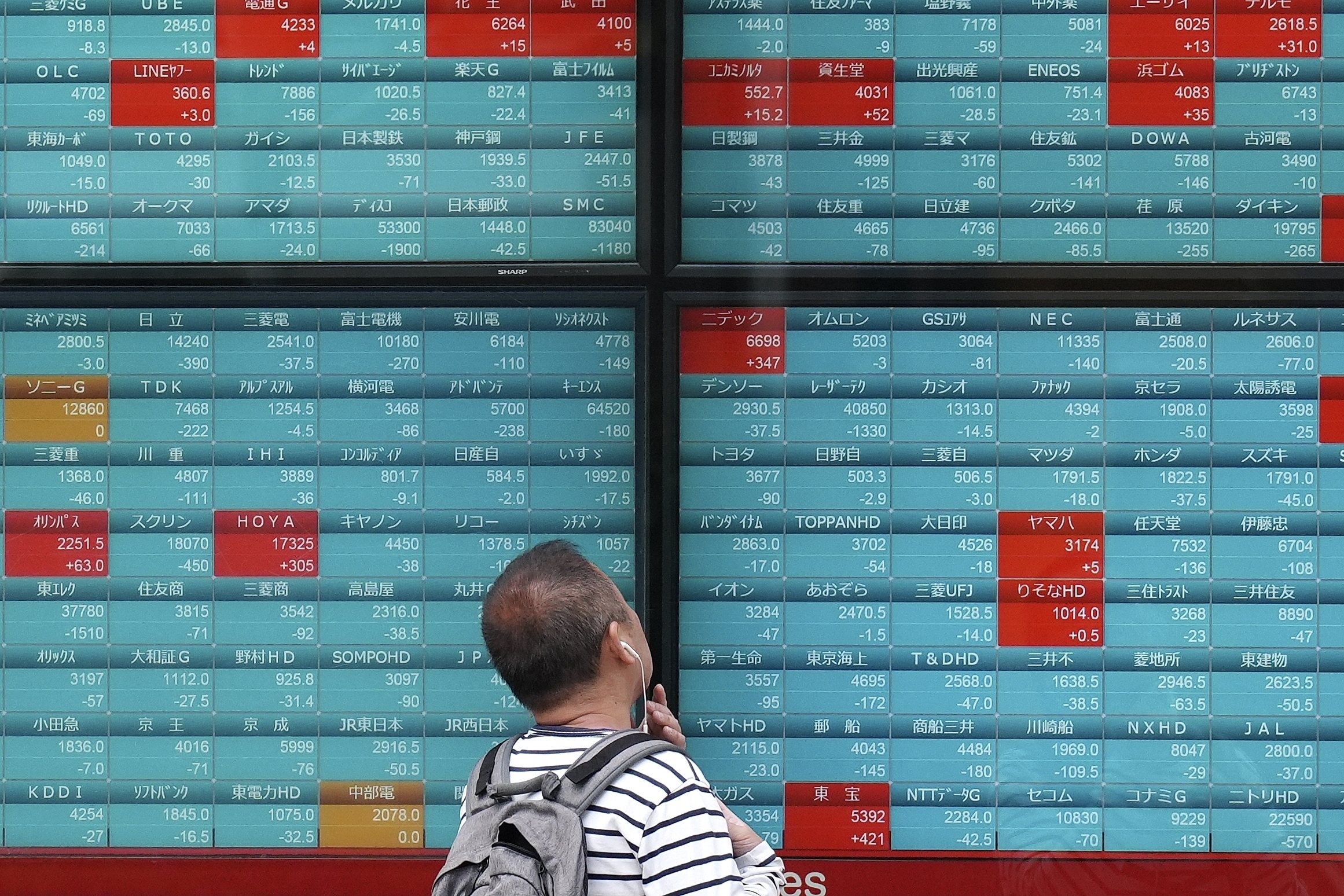

FILE: A person looks at an electronic stock board showing Japan’s Nikkei 225 index at a securities firm Tuesday, April 16, 2024, in Tokyo. (AP Photo/Eugene Hoshiko, File)

HONG KONG, China — Asian markets edged up Wednesday as nervous investors brace for Donald Trump’s wave of tariffs later in the day, though speculation about what he has in store is stoking uncertainty on trading floors.

Equities have been battered leading up to the US president’s announcement — which he has dubbed “Liberation Day” — with warnings that friend and foe are in the crosshairs after what he says is years of “ripping off” the United States.

He has trailed the measures for weeks, initially suggesting they would match whatever levies other countries impose.

But US media reported he has also considered either blanket 20 percent levies or another plan where some countries get preferential treatment.

Sweeping auto tariffs of 25 percent announced last week are also due to come into effect on Thursday.

The White House has said Trump will unveil his decision at 4pm in Washington (2000 GMT), after Wall Street markets close, with the Republican promising a new “golden age” of US industry.

READ: Trump set to unleash ‘Liberation Day’ tariffs

However, officials admitted he was still ironing out the details late Tuesday.

Analysts said the ongoing uncertainty was spooking markets.

Jittery markets

“Investors and company management dislike uncertainty, and the piecemeal, unreliable way in which tariff announcements are being delivered is creating plenty of it,” said Oliver Blackbourn and Adam Hetts at Janus Henderson Investments in a commentary.

“Estimates on what the average tariff rate will look like range from a few percentage points in moderate outcomes to double-digit levels in more forceful scenarios,” they added.

READ: US stocks close mixed before Trump tariff announcement

“What does seem less uncertain is that tariffs are, without much exception, likely to be bad for economic growth, consumers, and markets.”

Pepperstone Group’s Chris Weston said the suggestion that the tariffs would be effective immediately would provide some sort of certainty, even if it limited the scope for talks.

“This scenario — while hardly a positive for economics or earnings assumptions — would increase the conviction behind how we respond to the ‘facts’,” he explained.

“That said, life is never straightforward, and we will still need to consider the counter response from other countries.”

The planned duties have ramped up fears of a global trade war after several countries warned they were lining up their responses.

With that in mind, economists have warned that economic growth could take a hit and inflation reignite, dealing a blow to hopes that central banks would continue cutting interest rates.

Across the region

In early trade, Asian markets mostly rose, though they were fluctuating between gains and losses after a recent selloff.

Hong Kong, Shanghai, Sydney, Wellington, Taipei and Manila were all up, Tokyo was flat and Singapore and Seoul slipped.

Safe haven gold held just below its record high $3,149.00 touched Tuesday.

And HSBC strategists led by Max Kettner warned Wednesday might not mark the end of the tariff uncertainty.

“We’d argue the potential is in fact higher for the 2 April deadline to introduce even more uncertainty — and hence prolonged broad-based weakness in leading indicators,” they said.

Chinese tech giant Xiaomi swung slightly higher in Hong Kong to claw back some of Tuesday’s fall of more than five percent that came after it confirmed one of its electric vehicles was involved in an accident in China that reportedly left three people dead.

Key figures around 0230 GMT

Tokyo – Nikkei 225: FLAT at 35,639.81 (break)

Hong Kong – Hang Seng Index: UP 0.6 percent at 23,347.27

Shanghai – Composite: UP 0.2 percent at 3,355.60

Euro/dollar: UP at $1.0797 from $1.0793 on Tuesday

Pound/dollar: UP at $1.2924 from $1.2920

Dollar/yen: UP at 149.81 yen from 149.53 yen

Euro/pound: UP at 83.54 pence from 83.51 pence

West Texas Intermediate: UP 0.1 percent at $71.28 per barrel

Brent North Sea Crude: UP 0.1 percent at $74.53 per barrel

New York – Dow: FLAT at 41,989.96 (close)

London – FTSE 100: UP 0.6 percent at 8,634.80 (close)