Gains, growth and market confidence

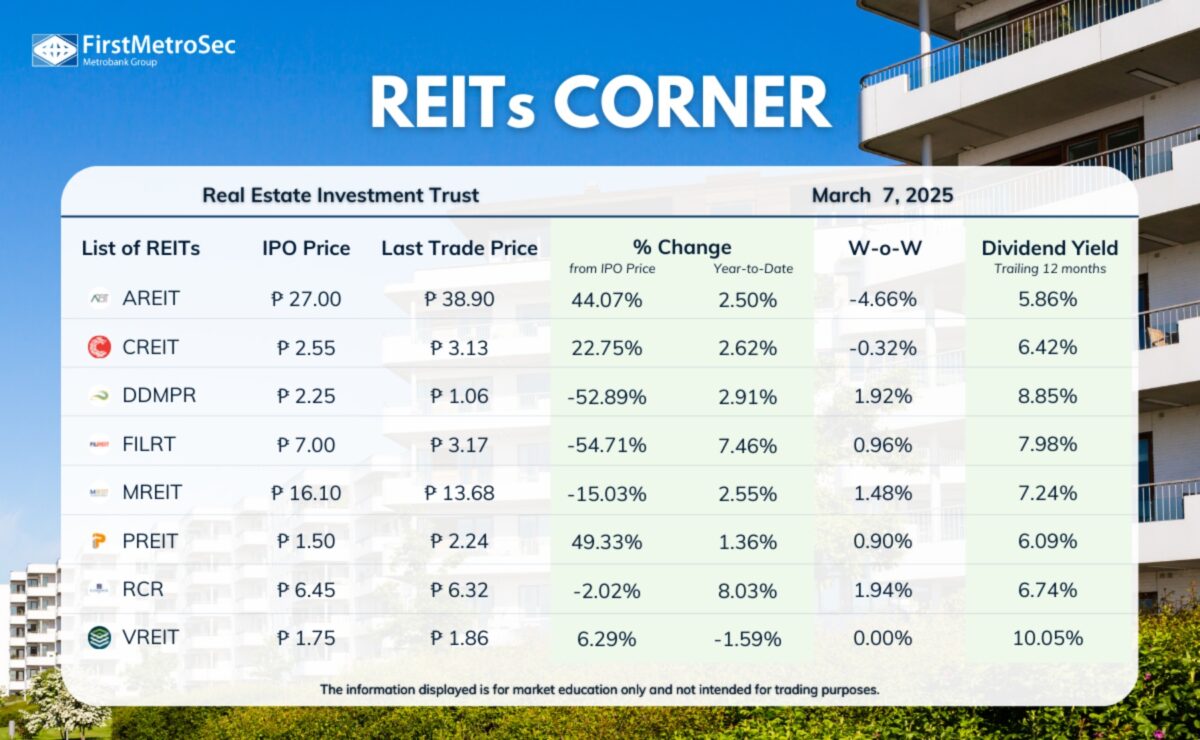

Here’s a recap of last week’s (ending March 7) market activity from First Metro Securities.

(First Metro Securities)

Property news

Robinsons Land Corp., the property development arm of the Gokongwei Group, reported a 10 percent growth in net attributable income to P13.21 billion in 2024, up from P12.06 billion in 2023, driven by the strength of its investment portfolio.

Economic news

Rate cuts. Following a series of interest rate cuts last year, bank lending in the Philippines accelerated in January 2025, posting its fastest growth in over two years with a 12.8 percent year-on-year increase, according to the Bangko Sentral ng Pilipinas (BSP), marking the highest growth rate since December 2022.

Inflation. The easing of inflation to 2.1 percent in February 2025 from 2.9 percent in January gives the BSP more room to resume its rate-cutting cycle in April, according to economists, marking the lowest inflation rate since September 2024.

Fuel price cut. Motorists can expect another round of price relief in the second week of March, with gasoline prices likely to drop by P1.40 to P1.70 per liter and diesel prices expected to decline by 70 centavos to P1.20, based on the four-day trading in Mean of Platts Singapore (MOPS) and the forex average.

(First Metro Securities)

Philippine Stock Exchange index

The main gauge sustained its upward trajectory, adding another +1.26 percent to close at 6,298.29. Sentiment remained upbeat, supported by continued net foreign buying of P158.85 million and selective accumulation in index heavyweights. The rally was broad-based, with nearly all sectors posting gains, led by Services (+4.40 percent) and Financials (+1.05 percent). The strong performance had traders shrugging off the volatility in US markets, instead focusing on bargain-hunting opportunities.