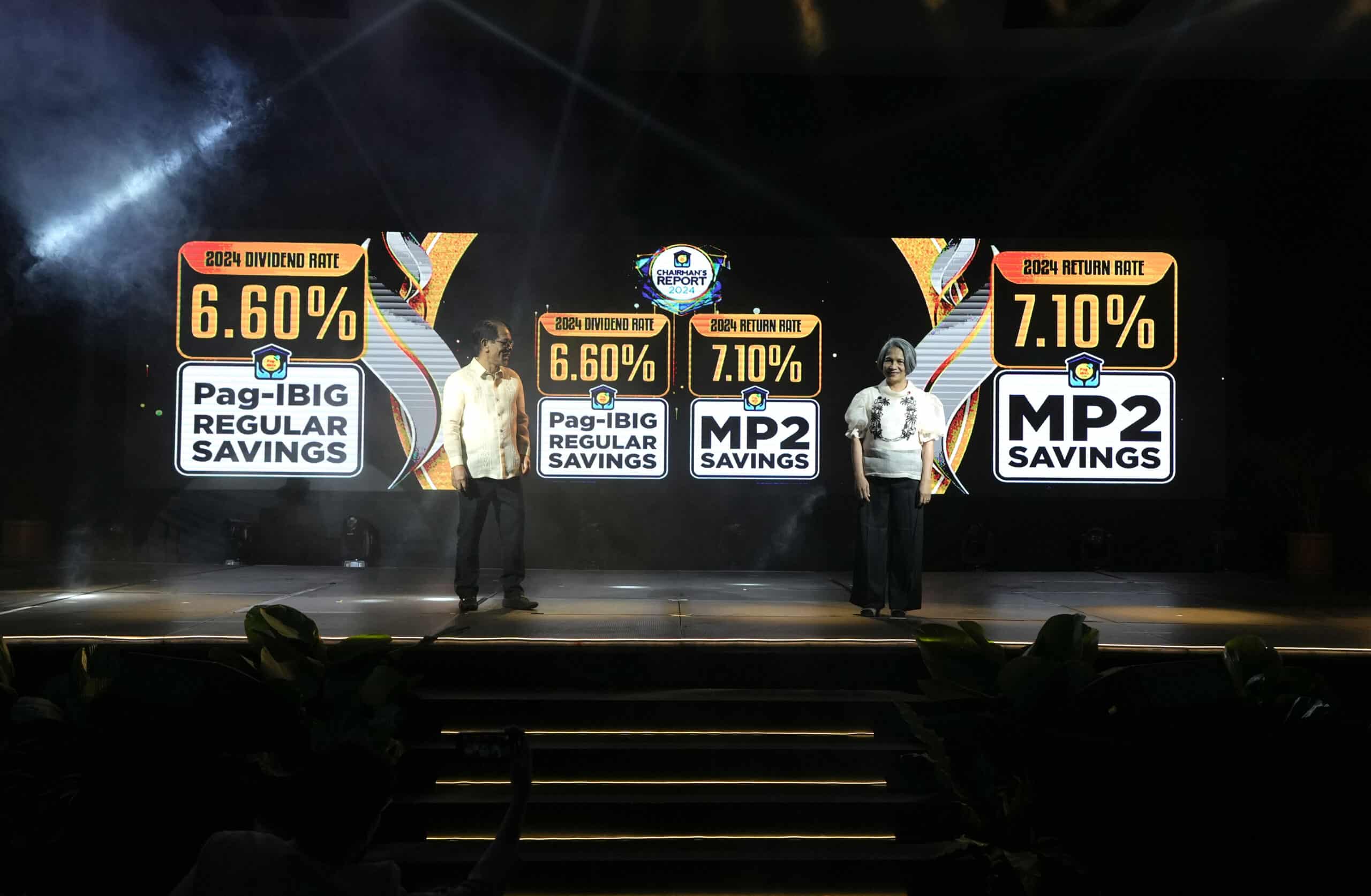

Pag-IBIG Fund announces record ₱55.65-B dividend in 2024; Regular savings earn 6.6%, MP2 yields 7.1%

Pag-IBIG Fund declared the highest-ever amount of dividends for its members’ savings at the Chairman’s Report 2024 held Thursday at the Philippine International Convention Center.

For 2024, Pag-IBIG Fund reported ₱55.65 billion in total dividends, marking the largest payout in the agency’s 44-year history. As a result, the dividend rates for the Regular Savings climbed to 6.6%, while the agency’s popular Modified Pag-IBIG 2 (MP2) Savings rate rose to 7.1%.

“For nearly five decades now, this institution has empowered individuals and families to find, acquire, and build the homes they aspire for—all in a system founded on trust, integrity, and shared opportunity,” President Ferdinand R. Marcos Jr. said in a message. “This Chairman’s Report 2024 stands as proof of how your unwavering commitment has grown the contributions entrusted to your care, enabling every hardworking Filipino to achieve their dream homes. Let us remain steadfast in creating a strong, secure, and inclusive Pag-IBIG Fund that uplifts communities and ensures no Filipino is left behind in this era of Bagong Pilipinas.”

Pag-IBIG Fund recorded another banner year, with its 2024 net income reaching ₱67.52 billion—a 36% increase from ₱49.79 billion in 2023. The agency also surpassed the ₱1-trillion mark in total assets, closing the year at ₱1.069 trillion, another all-time high.

Department of Human Settlements and Urban Development Secretary Jose Rizalino Acuzar, who chairs the 11-member Pag-IBIG Fund Board of Trustees, underscored the agency’s outstanding performance and robust financial standing. “Pag-IBIG Fund has once again marked 2024 as one of its best-performing years, achieving record highs in both total assets and net income. This accomplishment directly benefits our members, as we declared ₱55.65 billion in dividends—equivalent to 82.71% of our net income, exceeding the 70% dividend requirement by law,” Acuzar said. “With our strong performance, sound investments and robust finances, we are well-equipped to continue providing our members with responsive benefits, and advance our efforts under the Pambansang Pabahay para sa Pilipino Program, ensuring that more Filipino workers can access affordable homes.”

Meanwhile, Pag-IBIG Fund Chief Executive Officer Marilene C. Acosta highlighted the agency’s record-setting performance in 2024. She noted that Pag-IBIG released ₱129.73 billion in home loans, helping 90,640 members acquire new or better homes. The agency also collected a total of ₱132.81 billion in membership savings—₱73.74 billion of which were voluntarily saved under Upgraded and MP2 Savings—and disbursed ₱70.33 billion in cash loans to assist more than 3.2 million members.

“Truly, when Pag-IBIG Fund performs well, our members benefit the most,” Acosta said. “We take great pride in our record-high achievements in 2024, which reflect our commitment to helping members achieve their dream of homeownership, find relief in trying times, and save for a brighter future. We remain steadfast in safeguarding our members’ contributions and ensuring they yield the best possible returns—because our members deserve nothing less than the highest level of public service and the most prudent stewardship of their hard-earned savings.”

ADVT.

This article is brought to you by Pag-IBIG Fund.