Market recap: Real estate and equities

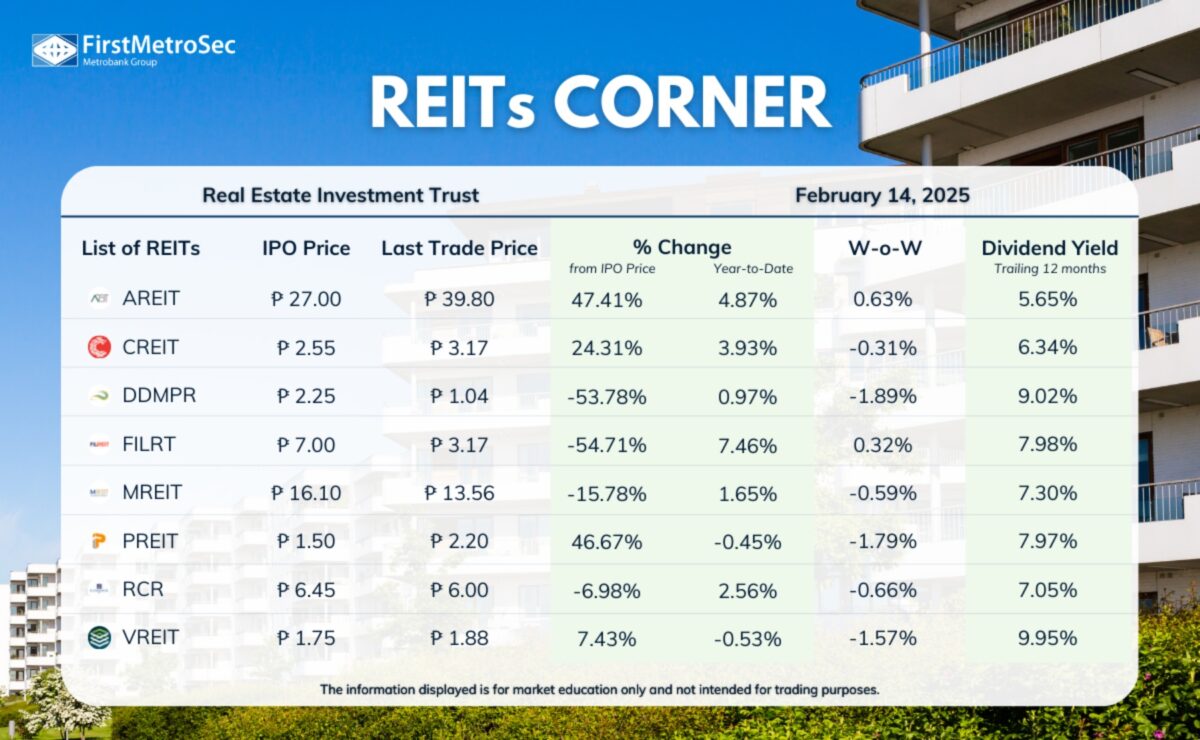

Here’s a recap of last week’s (ending February 14) market activity from First Metro Securities.

(First Metro Securities)

Property news

REIT: Real estate investment trust (REIT) listings from Lucio Co’s Cosco Capital and the Sy family’s SM Prime Holdings are not likely to take place this year.

Ayala Land Inc.: Ayala Land Premier (ALP) saw a surge in sales, raking in P4.7 billion during the first week of February, with P2 billion from its Chinese New Year open house, driven by strong demand for lots in Enara in Nuvali, and an additional P2.7 billion from the launch of Virendo, its first subdivision in Davao.

Sta. Lucia Land Inc.: SLI is confident it finished 2024 strong, driven by the brisk sale of its developments primarily located in second- and third-tier cities. It also announced that it would allocate up to P5 billion this year for land acquisitions, property development and refinancing.

Megaworld Corp.: Uptown Bonifacio, Megaworld’s 15.4-ha flagship township in Bonifacio Global City, has rapidly emerged as a prime destination for global companies, drawing pioneering international brands making their debut in the Philippines.

(First Metro Securities)

Market wrap

PSEi 6,061.33 (-51.86 pts; -0.8500 percent); Val T/O: P4.777 Bn; $82.553 Mn; (ex-block)

The main gauge of the Philippine stock market, the PSE index (PSEi) ended at 6,601.33 (-0.85 percent) as investors reassessed positions and strategies after the Bangko Sentral ng Pilipinas’ (BSP) decision to keep policy rates unchanged.

The index spent most of Valentine’s Day in negative territory before ending at session lows, at an unremarkable value turnover of P4.777 billion. Foreign investors continued to offload positions, recording a net outflow of P578.52 million, adding to the market’s weakness.

Sector performance was mixed but mostly lower. Property (-1.89 percent) and Services (-1.14 percent) led the decline, while Mining & Oil (+1.49 percent) was the sole gainer. Among the top performers were CNVRG (+2.07 percent), URC (+1.86 percent), and PGOLD (+1.78 percent). ACEN (-4.86 percent), ALI (-3.73 percent), and JGS (-3.40 percent) posted the steepest losses. Despite the index’s decline, market breadth was practically neutral, with 82 advancers against 81 decliners.