SB Finance and TrueMoney partner to empower small businesses with accessible financing solutions

SB Finance, Inc., an affiliate of Security Bank, has partnered with TrueMoney Philippines, Inc. (TMPI), a trusted non-bank financial institution, to bring accessible and convenient financing solutions to its own merchant network, and dealers partners of its affiliate company Charoen Pokphand Foods Philippines Corporation (CPF). Both companies are subsidiaries of Charoen Pokphand Group, one of the leading integrated conglomerates in the world.

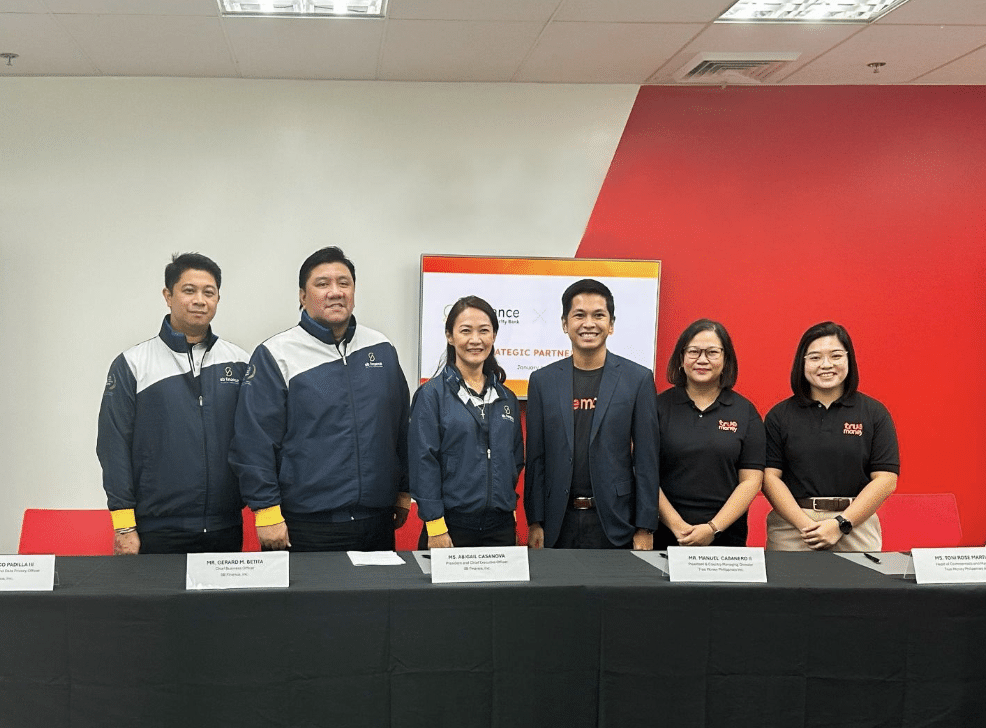

SB Finance Head of Compliance & Data Protection Officer Francisco Padilla III, Chief Business Officer Gerard Betita, and President and CEO Abigail Dans-Casanova signed a partnership with TrueMoney Philippines President and Country Managing Director Manuel Cabañero II, Head of Commercials and Marketing Toni Rose Martinez, and Senior Business Development Manager for New Ventures Patricia Valencia to provide financing solutions to small business owners and dealers.

This partnership is designed to boost small businesses’ growth by enabling them to secure credit lines seamlessly through TrueMoney’s digital platform.

Under this collaboration, TMPI & CPF’s network of business owners can now access SB Finance’s loan products, particularly Personal Loans (PL) and OR/CR for Cash. Approved loans will be disbursed on TrueMoney’s app-based ecosystem, and will be utilized to increase their cash flow to buy goods or avail other financial services through the same app. This initiative aims to streamline the lending process for interested partners of TMPI & CPF, providing them with a faster and more reliable way to access funds, enhance operations, and increase their purchasing capacity.

“At SB Finance, we believe in empowering small businesses by providing them with the financial tools they need to grow and thrive. Our partnership with TrueMoney opens up new avenues for CPF-affiliated dealers to secure the support they need to expand their operations, ultimately driving growth for their businesses and their communities,” SB Finance President and CEO Abbie Dans-Casanova said.

Through TMPI’s application and product, borrowers can manage loan disbursements and repayments conveniently, ensuring a seamless experience. By integrating technology and financial expertise, this partnership bridges the gap between traditional financing and the evolving needs of modern livestock and agribusinesses.

“Small businesses are the backbone of our economy, and by joining forces with SB Finance, we are strengthening their ability to grow and succeed. This collaboration not only simplifies access to financing, but also provides small business owners with the resources to invest in their future,” TrueMoney President and Country Managing Director Manuel S. Cabañero II said.

The partnership leverages both companies’ strengths — SB Finance’s trusted financial solutions, and TMPI’s robust network — to create a sustainable and scalable financing program. The integration ensures that borrowers undergo a secure and efficient approval process, while gaining access to loans tailored to their unique needs. It underscores the shared commitment of SB Finance and TrueMoney to foster economic growth by empowering small businesses to reach new heights.

ADVT.

This article is brought to you by SB Finance.