Philippine stocks dip for 2nd straight day

MANILA, Philippines—The local stock index faltered for a second day on Tuesday as investors took a break after last week’s run-up.

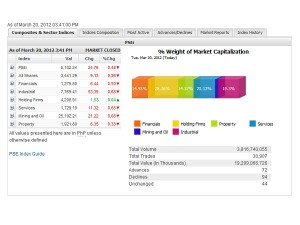

The Philippine Stock Exchange index dipped by 24.76 points, or 0.48 percent, to close at 5,102.24.

All counters were in the red except for holding firms, which narrowly escaped the downturn.

Value turnover was heavy at P19.29 billion, including a P12.86 billion block sale on Alaska Milk Corp. as a 60.8 percent had been sold by the Uytengsu family to Dutch dairy giant Royal Friesland Campina (RFC).

The index stocks that contributed to the day’s decline were PLDT, AGI, EDC, Metrobank, MPI, AEV, AC, DMCI, BDO and Meralco.

On the other hand, Megaworld, SM Investments, URC, ALI, RLC and ICTSI tempered the PSEi’s decline. Security Bank, Dizon, NiHao and FLI also went up in heavy volume.

Ismael Cruz, president of IGC Securities, said last week’s surge was a convincing break. “What’s important now is that we stay above 5,000,” Cruz said.

Manny Cruz, chief strategist at Asiasec Equities, said the next immediate support for the index would be at 5,100 and resistance at the previous record high of about 5,145. “We’re confident that we’ll reach 5,270 within the first half,” he said.

Cruz noted that foreign inflows to the country remained light when compared with Indonesia. “So you could just imagine the increased exposure when we get a (Philippine sovereign) rating upgrade,” he said.

In the near term, Cruz said quarter-end window-dressing might provide some upside toward the end of the month. “But we may see major correction after the traditional window-dressing,” he said.