Bank of Japan to decide whether to raise rates next week — Deputy Gov

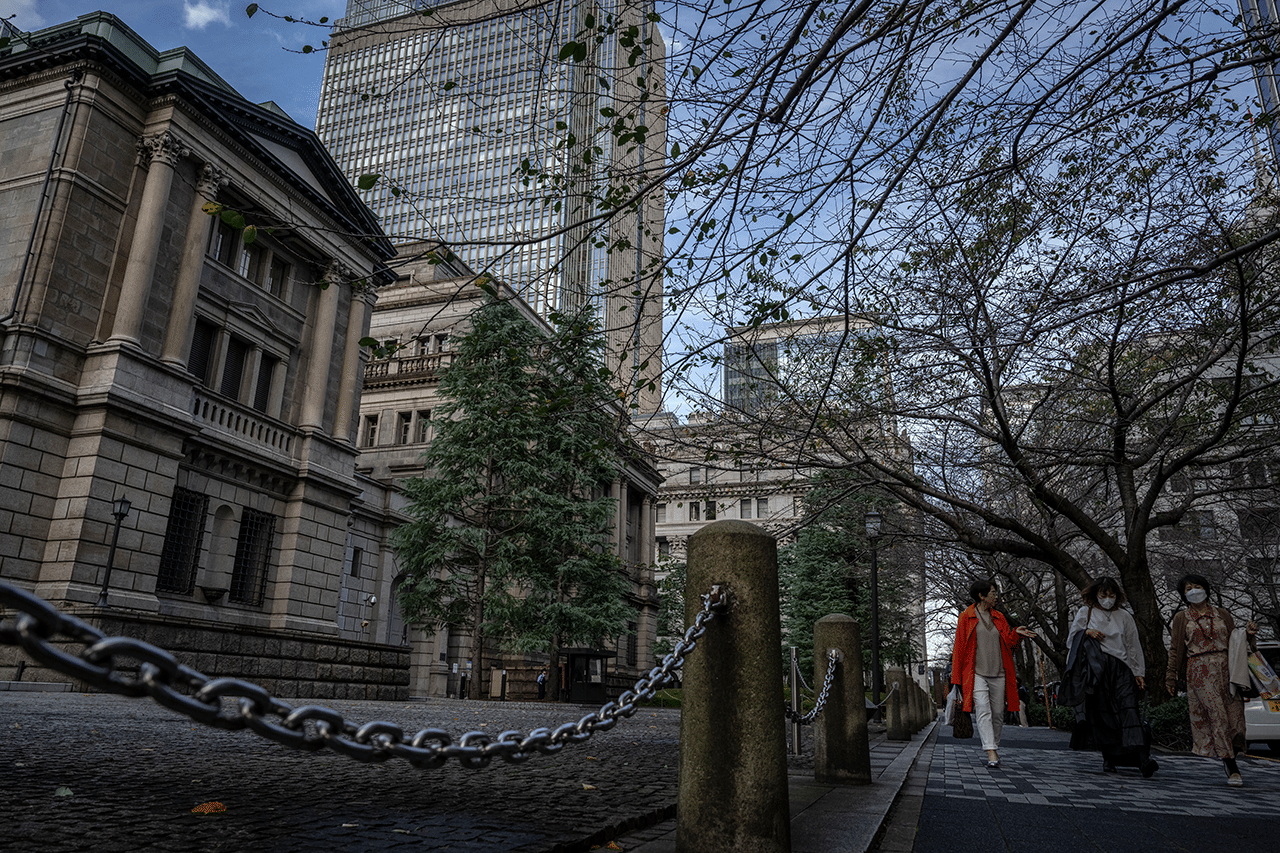

People walk past the Bank of Japan (BoJ) headquarters in Tokyo on October 30, 2024. (Photo by Yuichi YAMAZAKI / AFP)

Yokohama, Japan — Bank of Japan Deputy Governor Ryozo Himino said Tuesday that the central bank will decide whether to raise interest rates at its next policy-setting meeting, scheduled for two days from Jan. 23.

“At the monetary policy meeting to be held next week, the (BOJ policy) board will have (a) discussion to decide whether to raise the policy rate or not,” Himino said in a speech in Yokohama, south of Tokyo.

Noting that the current economic and price trends are broadly in line with the BOJ’s outlook, Himino said, “If this outlook will continue to be realized, the bank will raise the policy interest rate accordingly and adjust the degree of monetary easing.”

READ: PH, Japan central banks maintain swap deal at $12B — BSP

Regarding wage increases in this year’s “shunto” spring labor-management negotiations, which the BOJ is expected to take into account when deciding on rate hikes, Himino said, “I hope to see strong wage hikes in fiscal 2025 as we did in fiscal 2024,” reflecting labor shortages and higher minimum wages.

Article continues after this advertisementMeanwhile, the BOJ deputy chief suggested that the uncertainty surrounding U.S. President-elect Donald Trump’s economic policies could be resolved to some extent after Trump takes office on Monday. “The inaugural address next week will give us an idea on the broad direction of policies the new administration will pursue,” he said.

Article continues after this advertisementOn Japan’s consumer price outlook, Himino said, “The main scenario the Bank of Japan envisages is that the inflation rate for the next two fiscal years will be around 2 pct.”

“But there are various risk factors at home and abroad, both (on the) upside and downside,” he continued, adding that the BOJ should manage its monetary policy “with due attention to them.”