Top Fed official backs new rate cuts even if Trump tariffs materialize

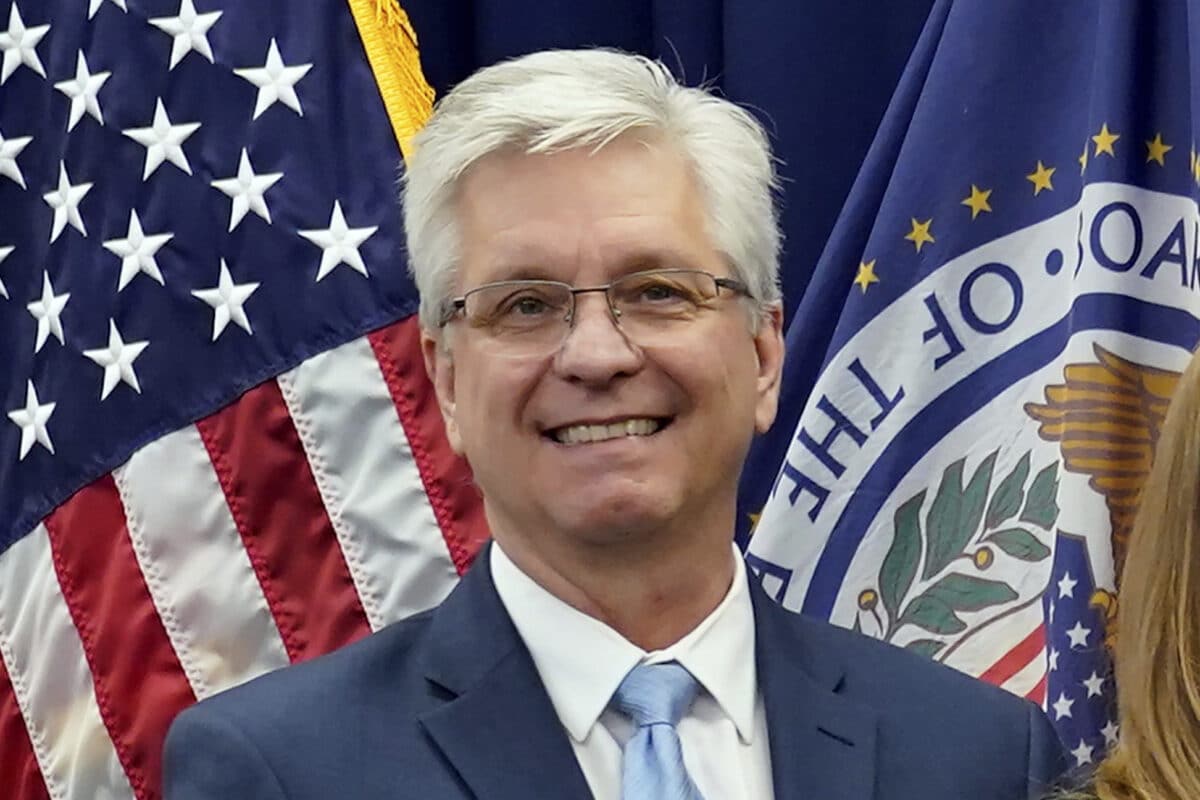

FILE – Federal Reserve Board of Governors member Christopher Waller poses for a photo on May 23, 2022, in Washington. (AP Photo/Patrick Semansky, File)

WASHINGTON — A top policymaker at the U.S. Federal Reserve said Wednesday that he still supports cutting interest rates this year, despite elevated inflation and the prospect of widespread tariffs under the incoming Trump administration.

Christopher Waller, an influential member of the Fed’s board of governors, said he expects inflation will move closer to the Fed’s 2% target in the coming months. And in some of the first comments by a Fed official specifically about tariffs, he said that greater import duties likely won’t push up inflation this year.

“My bottom-line message is that I believe more cuts will be appropriate,” Waller said in Paris at the Organization for Economic Cooperation and Development.

“If, as I expect, tariffs do not have a significant or persistent effect on inflation, they are unlikely to affect my view,” Waller added.

READ: US Fed cuts rate by quarter-point in third straight reduction

His remarks are noteworthy because the impact of tariffs is a wild card this year for the U.S. economy. Financial markets have weighed down in recent months partly on fears that inflation may continue to be an issue, and that tariffs could make it worse. Producers tend to raise prices for customers to offset the increased costs of tariffs on imported materials and goods.

Yet Waller suggested that he is more optimistic about inflation than many Wall Street investors.

“I believe that inflation will continue to make progress toward our 2% goal over the medium term and that further (rate) reductions will be appropriate,” Waller said. While inflation has been persistent in recent months — it ticked up to 2.4% in November, according to the Fed’s preferred measure — Waller argued that outside of housing, which is difficult to measure, prices are cooling.

Waller’s remarks run counter to increasing expectations on Wall Street that the Fed may not cut its key rate much, if at all, this year with high prices lingering. The rate is currently about 4.3% after several reductions last year from a two-decade high of 5.3%. Financial markets are expecting just one rate cut in 2025, according to futures pricing tracked by CME Fedwatch.

Waller did not say how many cuts he specifically supports. Instead he said that Fed officials projected two reductions this year, as a group, in December. But he also noted that policymakers supported a wide range of outcomes, from no cuts to as many as five. The number of reductions will depend on progress towards reducing inflation, he added.

Fed Chair Jerome Powell has said that the impact of tariffs on Fed policy and inflation is difficult to gauge in advance, until it’s clearer which imports are hit with tariffs and whether other nations retaliate with their own.

But at the Fed’s last press conference in December, Powell acknowledged that some of the central bank’s 19 policymakers are starting to incorporate the potential impact of President-elect Donald Trump’s policies on the economy.

“Some people did take a very preliminary step and start to incorporate highly conditional estimates of economic effects of policies into their forecast at this meeting,” Powell said. Other officials did not take such a step, he said, while some didn’t specify whether they did so.

Other Fed officials have recently suggested that the Fed will move more slowly on rate cuts this year, after cutting at each of its last three meetings in 2024.

Lisa Cook, a member of the Fed’s governing board, said Monday that the central bank can “proceed more cautiously” with rate reductions.

Waller, in a question and answer session, said that one reason that longer-term rates have risen is due to concern that the federal government’s budget deficit, already massive, could remain so or even increase. Higher longer-term rates have pushed up the cost of mortgages and other borrowing, putting increased pressure on both businesses and consumers.

“At some point the markets are going to demand a premium to accept the risk of financing” such increased borrowing, he said.

Later Wednesday, the Fed will release minutes from its December meeting and that may shed more light on what policymakers were thinking about inflation and the potential impact of tariffs.