Updated on January 7, 2025 at 9:39 a.m.

The Philippines’ appeal as a renewable energy investment hub sparkled in 2024, making a significant jump from 20th to second most attractive market for clean power investments in just three years.

Can it still dream to become the No. 1, or is this too tall an order?

The government’s renewable push is on full steam, and it is seen to further thrive as more funds from abroad are expected to flood the market for clean energy developments.

State officials welcomed the 2024 Climatescope Report by BloombergNEF released earlier this month, where the Philippines overtook mainland China, one of the world’s economic powerhouses.

India claimed the prime spot, while Chile and Brazil completed the top five.

On top of improving the local business climate, the current administration has been strengthening its ties with investors to trigger more development in renewable energy. This, as the government hopes to increase its share in the power generation mix to 35 percent by 2030 from the current 22 percent.

The Department of Energy (DOE) said that currently, local players have been driving the growth of the sector. But it is confident that more foreign investors would cash in on the country’s abundant resources, seeing the Philippines as a bankable destination for expansion.

This optimism is particularly buoyed by recent reforms that allow 100 percent foreign equity in renewable energy projects.

READ: Reasons for the mixed performance of renewable energy stocks

Can the Philippines dethrone India?

An official of Blueleaf Energy Philippines expressed doubts about the country’s capacity to secure the top place, especially when compared to a large country like India

“I think we cannot be No. 1 compared to India [because] it has a sheer volume,” says Christopher Chua, country head at Blueleaf Energy Philippines.

Chua says gaining the second spot was “not bad,” since the Philippines is already the leading nation in Southeast Asia.

He adds that the Philippines has an advantage versus other markets whose government leaders have control over utilities, including power purchase agreements, which could be subject to “a lot of control and corruption.”

“So, here, it’s very open. So that’s why a lot of foreign investors, like Blueleaf, invest in the Philippines because it’s a very open market. Everyone has a fair chance,” Chua says.

READ: Manila Water, MSpectrum seal power deal on using solar energy

But for Jose Layug Jr., president of Developers of Renewable Energy for AdvanceMent Inc., the Philippines has a fighting chance given the current administration’s efforts to entice more investors through “friendly policies” and Filipinos’ increasing demand for electricity.

Layug tells the Inquirer that, aside from tapping onshore wind, solar, hydro, geothermal and biomass, the country can embrace bigger capacities through offshore wind and floating solar projects.

Meanwhile, Alberto Dalusung III, Energy Transition advisor at the Institute for Climate and Sustainable Cities (ICSC), says that the ranking second proved the country’s competence to potentially dominate renewable energy in emerging markets.

“It also underscores the abundance in the country of renewable energy and its capacity to become a hub for investment and collaboration, not just within Asean, but across other regions,” Dalusung tells Inquirer in a separate interview.

“Through its advancement in the deployment and development of RE, the Philippines is demonstrating a model response that climate-vulnerable countries can adopt in facing climate change, promoting economic opportunities, like energy security, energy independence, and employment,” Dalusung adds.

Mylene Capongcol, director of the Renewable Energy Management Bureau of the DOE, also says that all areas in the country were “suitable for renewable energy development.”

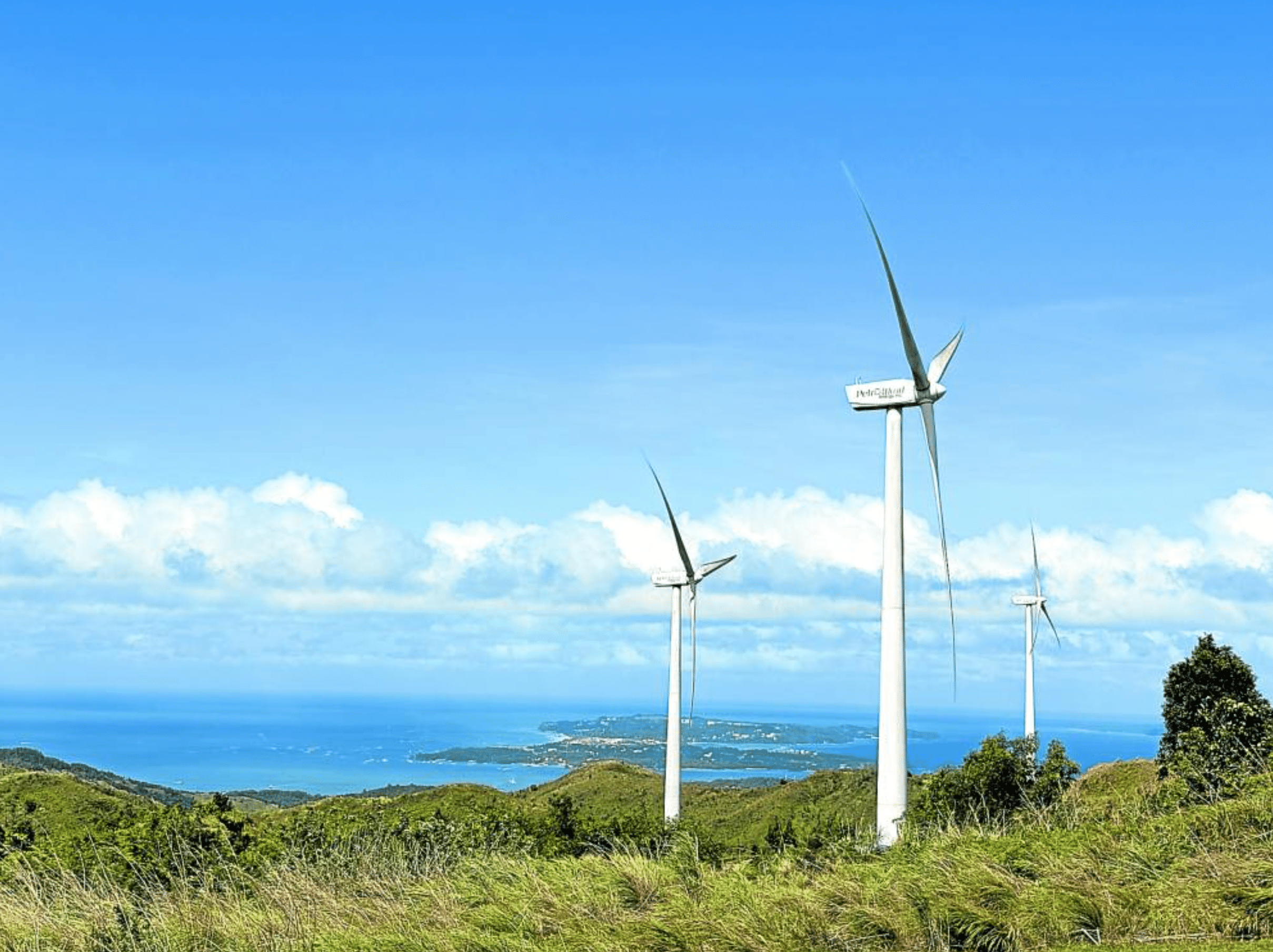

“There are provinces committed to renewable energy development like Iloilo Province, Negros, Ilocos Norte, etc.,” Capongcol said in a message.

PAMPANGA PORTFOLIO Raslag Corp. so far has four solar parks with a total output of about 78 megawatts (MW) —CONTRIBUTED PHOTO

What more can be done

For the government’s part, Capongcol said the DOE would continue enhancing policies and strategies.

Last October, the DOE bared that at least 105 renewable energy projects were facing termination of their contracts as the government has begun training guns on “nonserious” developers.

While some may see this as a big step back from the government’s target, the DOE as well as other business executives said this could actually accelerate the expansion of clean energy capacity.

Defending the rationale behind the move, the DOE says if any contracts were not progressing, they would open these up for new builders who could pursue the projects.

Capongcol likewise notes that the DOE would focus on grid integration, a crucial part of the sector, to ensure the power generated using renewable sources would be transmitted to the grid network.

This was mirrored by ICSC’s Dalusung, as he calls for modernizing the country’s power grid.

“We also need to ensure grid stability, upgrade the current infrastructure, and integrate smart grid technologies to accommodate the variability of renewable energy,” he says, adding that doing so would ensure electricity needs are met.

For the Philippines to bolster its commitment to a clean energy shift, Dalusung also highlighted the need to deploy “targeted efforts,” particularly on curbing small developers’ financial woes in funding expensive renewable projects.

“The playing field between large corporations and smaller companies has to be leveled. Making financing more accessible and equitable will make it possible for smaller enterprises to play a bigger role in advancing the energy transition,” the ICSC executive says.

“We also need the government and multilateral development banks to help derisk renewable energy projects and help come up with innovative financing solutions,” he says.

Dalusung hopes that more local banks could follow suit the example of the Development Bank of the Philippines and Land Bank of the Philippines in improving their portfolio with financing programs intended for renewable energy projects.

“However, innovative financing mechanisms such as green bonds and programs supported by the Climate Investment Funds, and the Green Climate Fund remain underutilized,” he adds.

Dalusung also says the government must pick up the pace of training the local pool of talents and professionals to keep up with the booming sector and adoption of new technologies.

“While renewable projects offer opportunities for more jobs, they require upskilling and reskilling of those currently working in fossil fuel power plants,” he says.