GCash scales up financial literacy efforts nationwide with “Pera Talks”

![]()

GCash, the Philippines’ leading finance super app and largest cashless ecosystem, has expanded the reach of its community-based financial literacy program, Pera Talks, in its unrelenting pursuit to advance financial literacy in the Philippines.

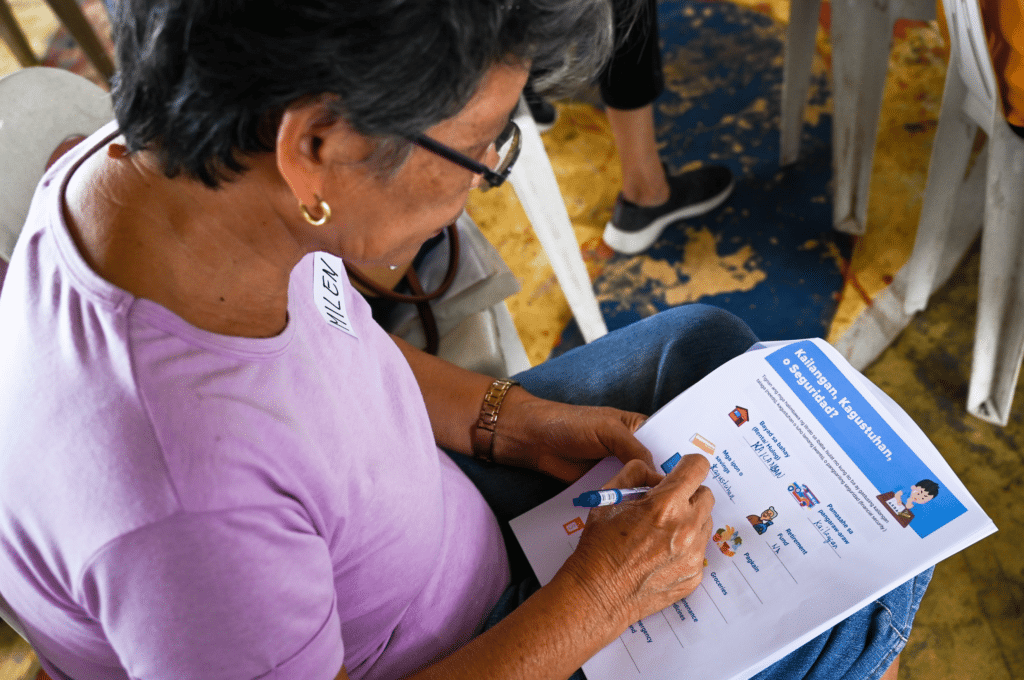

The company launched the pioneering program in 2024 to introduce essential financial concepts to unserved and underserved Filipinos, equipping them with the tools and information to manage their finances digitally. Taking a grassroots approach has allowed GCash to bring the Philippines a step closer to achieving “Finance for All,” where local communities across Luzon, Visayas, and Mindanao learn the fundamentals of financial management, such as saving, budgeting, debt management, cybersecurity, and more, all enabled by the digital financial services offered by GCash.

GCash takes a grassroots approach to bring the Philippines a step closer to achieving “Finance for All.”

“Through Pera Talks, GCash aims to break down the barriers toward financial literacy and inclusion, addressing head-on the lack of awareness, education, and resources so that we can empower consumers both on an individual and community level,” says Cathlyn Pavia, Head of Strategy of GCash for Business. “To make this a nationwide endeavor is a major undertaking, but one that is possible thanks to strong public-private partnerships—the collaboration between the government, communities, nongovernmental organizations (NGOs), and businesses.”

Guided by the framework set by the Bangko Sentral ng Pilipinas (BSP) focused on building synergies and networks to advance financial literacy and financial education, GCash has crafted learning modules and trained teachers to conduct in-person workshops across different communities. Pavia adds: “The goal is not only to expand our reach but to offer a comprehensive guide to financial education, ensuring that this adapts to the communities we are trying to connect with.”

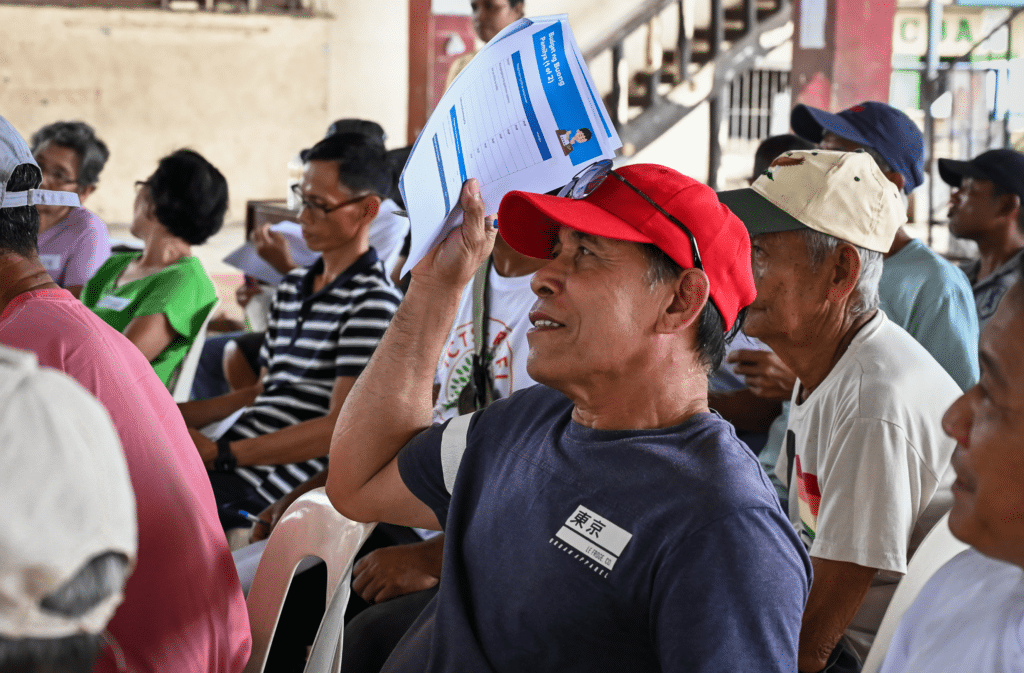

GCash has ventured into strategic partnerships with various non-government organizations to bring Pera Talks to unbanked and financially underserved populations, including rural communities, fisherfolk and farmers, empowering them with essential financial knowledge.

Local communities across Luzon, Visayas, and Mindanao learn the fundamentals of financial management, such as saving, budgeting, debt management, cybersecurity, and more, all enabled by the digital financial services offered by GCash.

Pera Talks also fits seamlessly into GCash’s DigiCities Program. A collaborative effort between GCash and local government units nationwide, the DigiCities Program aims to equip local communities with a wide range of digital financial solutions to facilitate their transition into a digital-ready ecosystem. In 2024, GCash Pera Talks made its way to all 27 DigiCities across the Philippines, providing financial literacy training to LGU employees in different partner cities.

In Luzon, the program reached coffee farmers in Benguet, sugarcane farmers in Batangas, and LGU employees in Cabanatuan and San Fernando, Pampanga, equipping them with essential financial management skills.

Pera Talks, GCash’s AgriBrgy and DigiCities programs empowered farmers and market vendors in the Visayas with essential financial skills. Through NGO partnerships, mangrove farmers in Cebu and Dumaguete received financial literacy training as part of GForest’s mangrove farming initiative. In Negros, attendees from several barangays in Kabankalan participated in financial literacy workshops under the AgriBrgy program. Market vendors in Brgy Valladolid, Carcar, and Lapu-Lapu, as well as vendors in Tagbilaran City, also benefited from financial literacy sessions, enhancing their financial management skills and business practices.

Meanwhile, in Mindanao, Pera Talks and the DigiCities program brought financial literacy training to local communities. LGU employees in Cagayan de Oro participated in a session aimed at enhancing their financial management skills, while market vendors in General Santos City also gained valuable financial knowledge to improve their businesses.

As GCash continues to play a pivotal role in driving financial literacy in the Philippines, it is set on expanding and extending its Pera Talks initiative in 2025, tailoring the programs to meet the needs of more unserved and underserved sectors. Pavia concludes, “While financial inclusion is about access to essential financial services, at GCash, we believe it is also about empowering the Filipino people and ensuring no one is left behind.”

Read more stories here:

Smart makes history with first-ever 5G Max-powered concert

Elevate your sleep experience like a star

Local governments play a critical role in achieving cervical cancer elimination goals