The Securities and Exchange Commission (SEC) is giving non-compliant, delinquent, suspended and revoked corporations until the end of the year to avail of lower fines and penalties for the late and non-filing of their reportorial requirements.

The Commission on November 28 issued SEC Memorandum Circular (MC) No. 17, Series of 2024, providing for the Extension of Enhanced Compliance Incentive Plan (ECIP) Applications until December 31, 2024.

ECIP allows non-compliant and delinquent, as well as suspended or revoked corporations, a chance to settle their fines and penalties over failure to submit their annual financial statements (AFS), general information sheet (GIS), and official contact details at significantly lower rates.

In either instance, corporations may apply for ECIP by submitting the Expression of Interest, integrated in their accounts on the Electronic Filing and Submission Tool (eFAST).

Applicant corporations are required to submit their latest due AFS and GIS by December 31, 2024.

- Non-Compliant and Delinquent Corporations

Non-compliant corporations and those placed under the delinquent status may settle their fines and penalties for only P20,000.

- Suspended or Revoked Corporations

Those with suspended and revoked registrations need to pay only 50% of their assessed fines and penalties, plus P3,060 to process their petition to lift order of suspension or revocation.

In addition to the AFS and GIS, corporations whose Certificates of Incorporation have been suspended or revoked need to submit the Petition to Lift Order of Suspension or Revocation, along with other supporting documents such as Directors’ or Trustees’ Certificate, proof of ongoing operations, Secretary’s Certificate of No Intra Corporate Controversy, and MC 28 compliance, among others.

Such documents should be submitted to the designated SEC email addresses. Corporations based outside of Metro Manila must submit the requirements to the concerned SEC Extension Office.

As of November 28, more than 3,200 corporations have already applied and paid the corresponding ECIP fees. Companies who have yet to complete their applications by submitting their latest AFS and GIS, PLO and its supporting documentary requirements, as the case may be, are also given until December 31 for the issuance of Confirmation of Payment for ECIP.

Forfeiture of ECIP Fees

Failure to submit the complete set of requirements by December 31, 2024 shall forfeit the ECIP fee of P20,000.00 for non-compliant corporations and 50% of the total assessed penalties, as well as the initial petition fee of P3,060 for suspended/revoked corporations, in favor of the Commission.

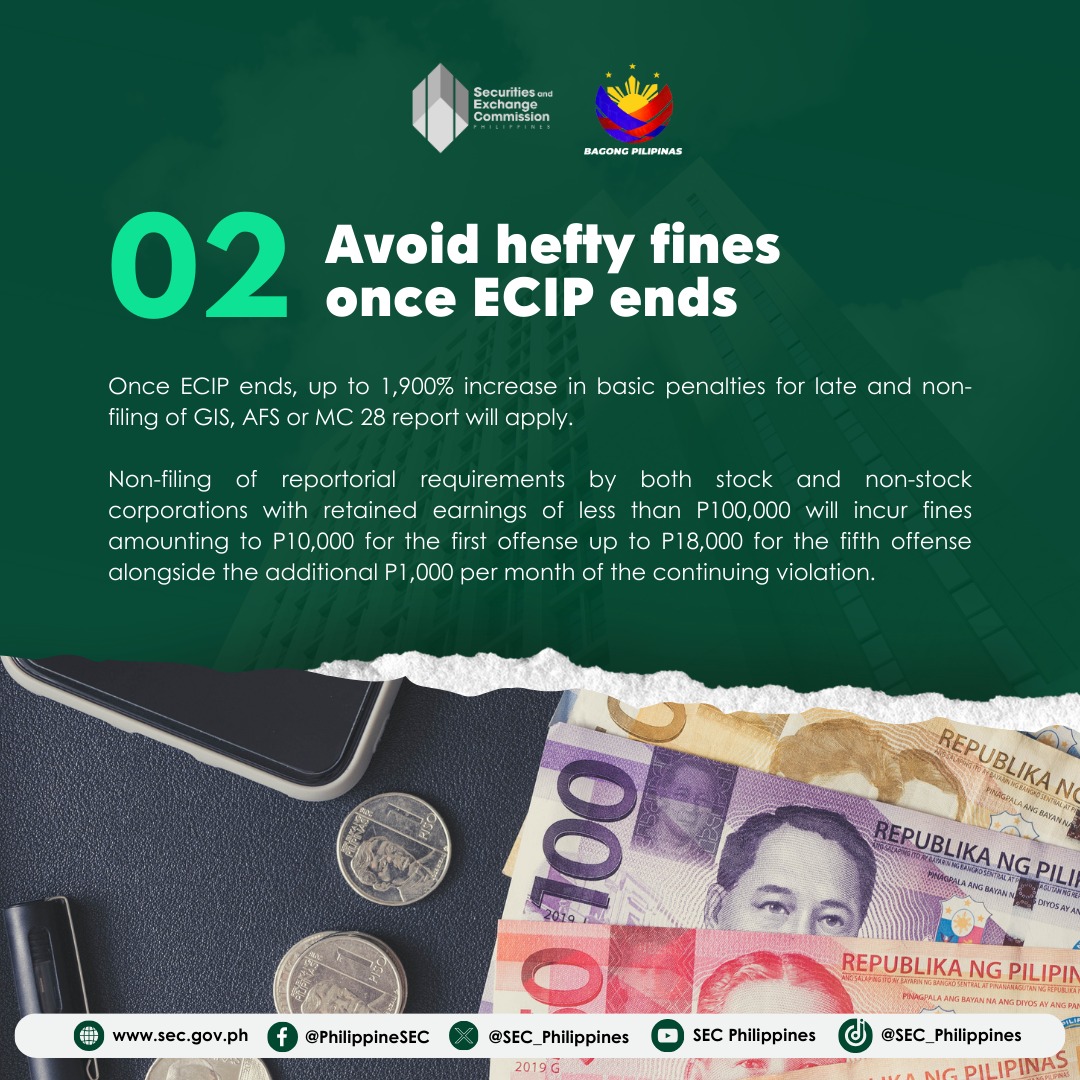

At the end of ECIP, non-compliant and suspended/revoked corporations will be subject to the updated scale of fines and penalties that the SEC implemented in April through Memorandum Circular No. 6, Series of 2024. The new rates are around 900% to 1,900% higher compared to the previous rates that had been in place for more than two decades. Below is an example of comparative computations of fines between the old and new monitoring rate:

A. Late Filing of AFS & GIS: A stock corporation with retained earnings of up to P100,000 which filed its AFS & GIS late but within the year after the prescribed deadline.

Old Monitoring Rate

Base Rate: P500.00 per report

Total Penalty Due: P1,000.00

New Monitoring Rate

Scenario: Filed its AFS & GIS 5 months after the deadline

Base Rate: P5,000 per report, plus P1,000 for every month of delay capped at 12 months

Base Penalty: P5,000.00 per report

Per month of Delay: P1,000.00 x 5 = P5,000.00 per report Total Penalty Due: P20,000.00

B. Non-Filing of AFS & GIS: A stock corporation with retained earnings of up to P100,000 which did not file its AFS & GIS for the year.

1Based on Item IIA of SEC Memorandum Circular No. 6, s. 2024

Old Monitoring Rate

Base Rate: P1,000.00 per report

Total Penalty Due: P2,000.00

New Monitoring Rate

Base Rate: P10,000 per report, plus P1,000 for every

month of delay capped at 12 months

Total Penalty Due: P44,000.00

Eligible corporations are enjoined to apply for ECIP to avoid getting their corporate registration revoked, pursuant to Republic Act No. 11232, or the Revised Corporation Code (RCC).

Under the RCC, the SEC may place a corporation under delinquent status in case of failure to submit reportorial requirements three times, consecutively or intermittently, within a period of five years.

Corporations placed under delinquent status have two years to resume operations, otherwise their registration shall be revoked.

ADVT.

This article is brought to you by Securities and Exchange Commission.