PH targets 6-8% growth till 2028

The Marcos administration adjusted its growth targets for this year until the end of its term in 2028, acknowledging the headwinds from “more uncertain” economic environment at home and abroad.

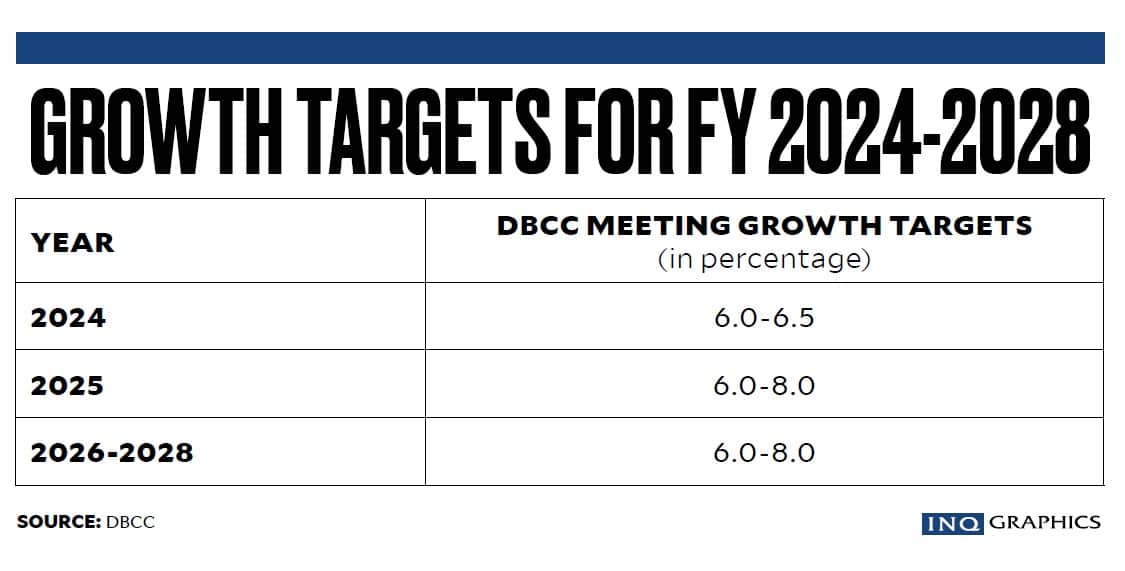

The Interagency Development Budget Coordination Committee (DBCC) narrowed its gross domestic product (GDP) growth goal for this year to 6 to 6.5 percent, from the previous aspiration of 6 to 7 percent.

“In particular, we expect the Philippine economy to bounce back during the last quarter, given the anticipated increase in holiday spending, continued disaster recovery efforts, low inflation and a robust labor market,” the DBCC said.

The 2025 GDP target band, meanwhile, had been widened to 6 to 8 percent, from 6.5 to 7.5 percent before.

From 2026 until the end of President Marcos’ term, the DBCC now expects the economy to also grow between 6 and 8 percent, from the old target of 6.5 to 8 percent.

Secretary Arsenio Balisacan of the National Economic and Development Authority said that the wider growth target range for the medium term had accounted for the possible domestic and external risks that may weigh on the Philippine economy.

“We’re moving in a more uncertain world,” Balisacan said.

“Of course, there are many other disruptions that characterized the global economy in the last 10 years, so we based it on that,” he added.

The Philippine economy grew at an annualized 5.2 percent in the three months through September, the weakest growth in five quarters.

That clip was slower than the 6.4-percent expansion in the second quarter and was below market expectations after weather disturbances had weighed on agriculture output and disrupted government spending, particularly in infrastructure.

GDP growth averaged 5.8 percent in the first nine months. This means the economy would have to grow by at least 6.5 percent in the fourth quarter to meet the low end of the revised growth target for 2024.

Weaker peso

Apart from the growth targets, the DBCC also changed its peso-dollar exchange rate assumption for 2024 to 57-57.5 percent from 56-58 previously, suggesting that the local currency may still appreciate by the end of the year despite revisiting the record-low level of 59 twice last month.

”There’s still a chance that the peso can strengthen, especially because of seasonal factors during the Christmas holiday,” Bangko Sentral ng Pilipinas (BSP) Deputy Governor Francisco Dakila Jr. said.

Meanwhile, the economic team slightly raised its 2024 budget deficit limit to 5.7 percent of GDP, from 5.6 percent before, on the back of higher spending and revenue aspirations. The rest of the fiscal targets had been retained, hoping that such prudence would help the country bag an “A” credit rating.

Finance Secretary Ralph Recto said the current pace of its fiscal consolidation is “as rapid as it can go.”

“For as long as we follow the downward trajectory of the deficit, maybe in two years time, we can get a credit rating upgrade,” Recto said.