MANILA, Philippines—The local stock index climbed back to the 5,000 level on Tuesday as investor sentiment was boosted by growing certainty of the European Union’s second bailout package for Greece.

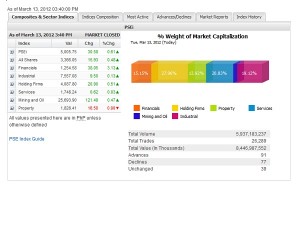

The main-share Philippine Stock Exchange index clawed back 30.58 points, or 0.61 percent, to close at 5,005.75, led by local banking giants.

The financial counter surged by 3.13 percent, outpacing the modest gains posted by other counters. Metrobank (+4.8 percent), BPI (+4.37 percent) and BDO (+2.2 percent) were the main index gainers while other banks that are not part of the PSEi like Security Bank (2.1 percent) and Union Bank (+2.2 percent) also surged.

Only the property counter ended in the red.

“There seems to be a migration back to blue chips as investors chose to take profits on previously high-flying penny stocks,” said PNB Securities deputy chief Manny Lisbona.

“It’s likely that we are still in consolidation for the week,” he said.

Value turnover increased to P8.45 billion from Monday’s P5.7 billion. There were 91 advancers that edged out 77 decliners while 39 stocks were unchanged.

Other stocks that boosted the PSEi were PLDT, AGI, URC and EDC. Meanwhile, investors also snapped up shares of mining stocks ORE, Nickel Asia and NiHao.

On the other hand, the PSEi’s gains were tempered by the decline of AEV, AP, AC, MPI, SMC and Philex. Petron likewise traded with caution.