Revving Philippine property for accelerated recovery

The Philippine property sector, especially the Metro Manila residential market continues to experience headwinds.

For one, the sector has been reeling from lengthened remaining inventory life, compelling developers to take a more cautious stance and temper new launches in the capital region. While the Bangko Sentral ng Pilipinas’ (BSP) decision to cut interest rate bodes well for the sector, we do not see the reduction having an immediate impact on mortgage rates, which remain elevated.

The headwinds in the property sector compel developers to continue offering innovative and attractive payment terms and early move in promos. Firms are offering topnotch amenities and after sales service, and these should partly buoy demand in Metro Manila.

Developers continue to pivot to stay afloat. More leisure-themed projects including golf communities continue to be launched from Luzon to Mindanao, injecting much needed optimism into the residential sector still suffering from elevated mortgage rates, high land values, rising prices of construction materials, and exodus of offshore gaming firms from China.

Definitely there are tailwinds, including an economic expansion that is one of the fastest in Southeast Asia and continued implementation of infrastructure projects. We are still optimistic that the traditionally strong fourth quarter will kickstart a much needed rebound for the property sector.

Offering upgraded amenities and facilities should be the norm

Besides carving out of flexible workspaces within residential developments, Colliers believes that developers should continue promoting the upscale amenities and facilities they offer.

As Colliers previously highlighted, proximity to infrastructure and institutional establishments such as schools and hospitals will remain crucial in stoking residential appetite in the market. However, this should be complemented by additional features such as resort-like pools, modern and well-equipped gyms, yoga facilities, garden gazebos, as well as electric vehicle (EV) charging stations.

Developers should also consider integrating green technologies (GreenTech) and sustainable features to differentiate their projects in the market. These include natural lighting, optimized air quality and rainwater catchment facilities, as well as green spaces such as vertical gardens.

Property firms should likewise take a more aggressive stance in introducing artificial intelligence (AI) technologies into their residential projects.

Colliers believes that the launch of more property technology (proptech) features will be the norm moving forward. A number of developers have already incorporated built-in fiber optic internet connection, videoconferencing areas and flexible workspaces suited for work from home (WFH) or hybrid working arrangements.

More attractive promos to complement rate cut

Colliers believes that the BSP’s decision to reduce interest rates is likely to help revive demand in the residential market. So far, the BSP has reduced the policy rate to 6 percent from 6.5 percent in August 2024.

While this may not immediately result in lower mortgage rates, we recommend that developers sustain or even sweeten their current promos to resuscitate the currently tepid take-up in the Metro Manila pre-selling condominium market.

For investors, Colliers encourages them to actively monitor interest and mortgage rates, as these strongly influence the viability of residential investment. Interest rates should guide developers with their promos and payment schemes.

Given the substantial unsold inventory in the secondary market, developers should be proactive in offering leasing and early move-in promos for ready-for-occupancy (RFO) projects.

As it is, some developers are being aggressive in offering early move-in and rent-to-own schemes for their RFO units. A couple of developers even allow buyers to move in with a down payment of as low as 5 percent, and discounts of as much as 25 percent of total contract prices (TCPs).

Launch of leisure-themed projects, golf communities outside Metro Manila

Colliers believes that developers should cash in on the thriving demand for resort or leisure-oriented properties outside Metro Manila.

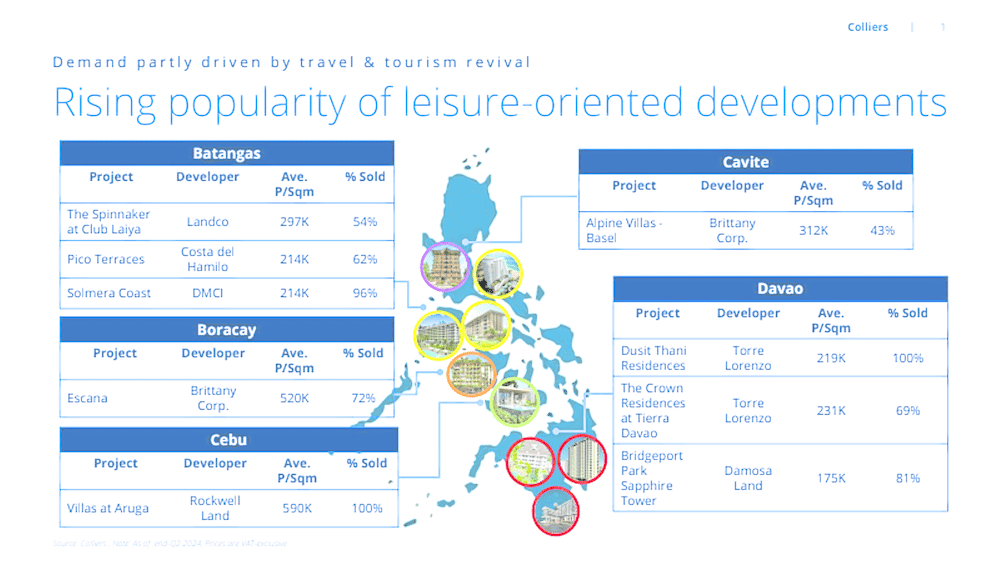

Among the property firms that offer leisure-themed developments outside Metro Manila include Sta. Lucia Land, Brittany, Rockwell, Megaworld, Ayala Land, Robinsons Land, Cebu Landmasters, and Damosa Land, with projects located in Boracay, Cebu, Davao, Bohol, Palawan and Batangas. As of Q3 2024, their projects are priced between P175,000 and P590,000 per sqm with take-up ranging from 43 percent to 100 percent. Recently, Megaworld announced the launch of Ilocandia Coastown in Ilocos and Bellagio Palawan in Puerto Princesa.

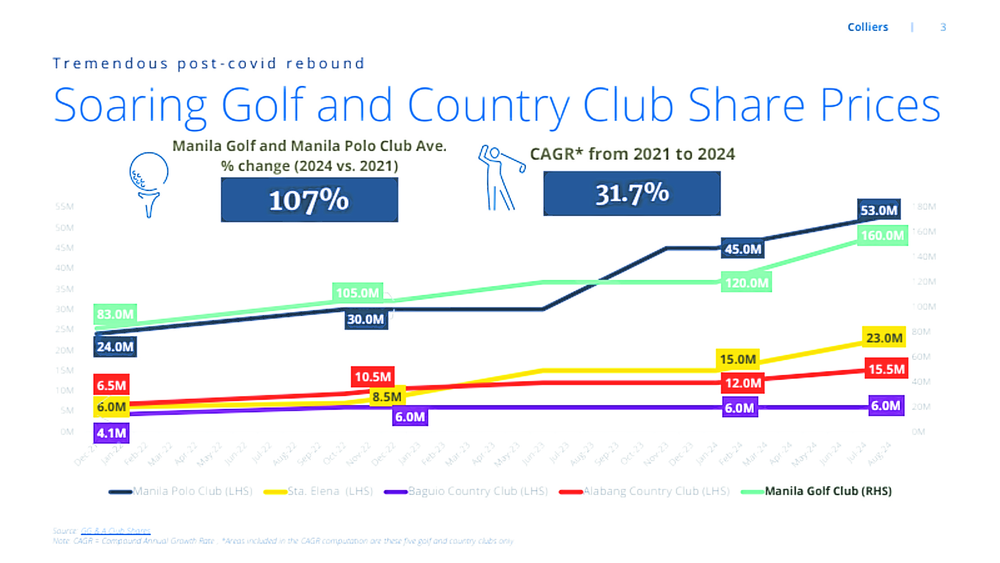

Colliers also sees the revival of demand for golf communities within and outside Metro Manila. Among the developers that launched new golf communities include Vista Land and Megaworld. Sta. Lucia meanwhile remains one of the biggest developers of golf communities across the country.

In our view, golf communities with vertical residential developments are likely to garner interest from local and foreign travelers including retirees, while horizontal projects are likely to corner take-up from domestic travelers and investors.

Opportunities amid uncertainties

While challenges persist, opportunities continue to provide glimmers of hope for the Philippine residential market. It is important that developers now aim for a strong finish in 2024 to start 2025 with renewed confidence and zero in on the growth prospects for Philippine property over the next 12 months.

Email the author at Joey.bondoc@colliers.com