How to analyze your industry

Water refill stations are being franchised everywhere. These water stations provide a low-cost alternative to expensive bottled water at the supermarkets. Filipinos have shifted from boiling their drinking water at home to simply buying from these water refill stations. Many provide delivery service even if a suki (loyal customer) orders only a single five-gallon bottle, which is the standard used in these stations.

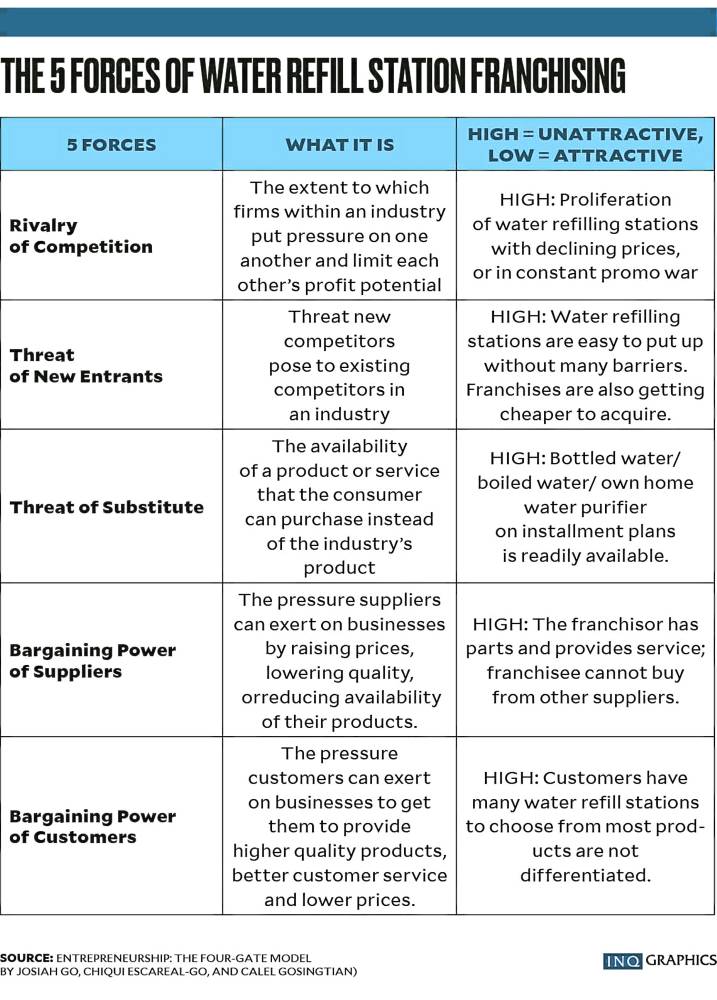

But does one know if franchising a water refill station is attractive or not? The industry analysis framework, introduced by Harvard professor Michael Porter, can give an indicator by analyzing the five forces in an industry—rivalry of competition, bargaining power of suppliers, threat of new entrants, threat of substitutes and bargaining power of customers, as shown in the table on the right. Note that the first three forces are about competition, both direct and indirect.

READ: What you should know about your target market

The five forces enable firms to identify competitive pressures (those with high threat) as well as opportunities in the marketplace. The force that has the most impact in the industry (rated “high”) to where the firm belongs should be watched closely with one’s corporate and marketing strategy formulated to counter the pressure accordingly. The framework is unique because profit is affected not just by competitive activities but also by the extent of bargaining power of suppliers and customers.

In the analysis of the water refill station, the five forces of industry are pointing to an industry generally unattractive to franchisees, unless there are a lot of resources for credit terms, free use of hot/cold dispensers, being a monopoly, or being an early entrant in a geographical area. It is, therefore, important to carefully choose an industry that is attractive to invest in to get a better return on investment.

Favorable backdrop

It is important for aspiring entrepreneurs to choose an industry with friendlier economics. For instance, the pharmaceutical industry has a much higher return and demand versus investing in cable TV that is already affected by strong substitutes like Netflix. However, care should be exercised when using the industry analysis model. It is possible that an industry may not be as good upon initial evaluation, but a firm can introduce innovation and create better profitability for themselves. Some water refill stations sell twin packages with a laundry franchise, since refill stations that use reverse osmosis systems throw out most of the water, with the wastage going to the laundry franchise.

The famous Bounty Fresh chicken case in the Philippines—wherein a dressed chicken integrator decided to expand the business model to include thousands of Chooks-to-Go kiosks—should be a reminder that there is no bad or inferior industry. Entrepreneurs who see opportunities in crisis have the edge, as competitors typically would not invest in (what may seem to be) an unattractive industry. —CONTRIBUTED

Josiah Go is chair and chief innovation strategist of Mansmith and Fielders Inc. Together with Chiqui Escareal-Go and Calel Gosingtian, he co-authored the book “Entrepreneurship: The Four-Gate Model,” which is officially endorsed by Go Negosyo and JCI Manila.