Boeing reports $6.2B loss as it awaits vote on end to strike

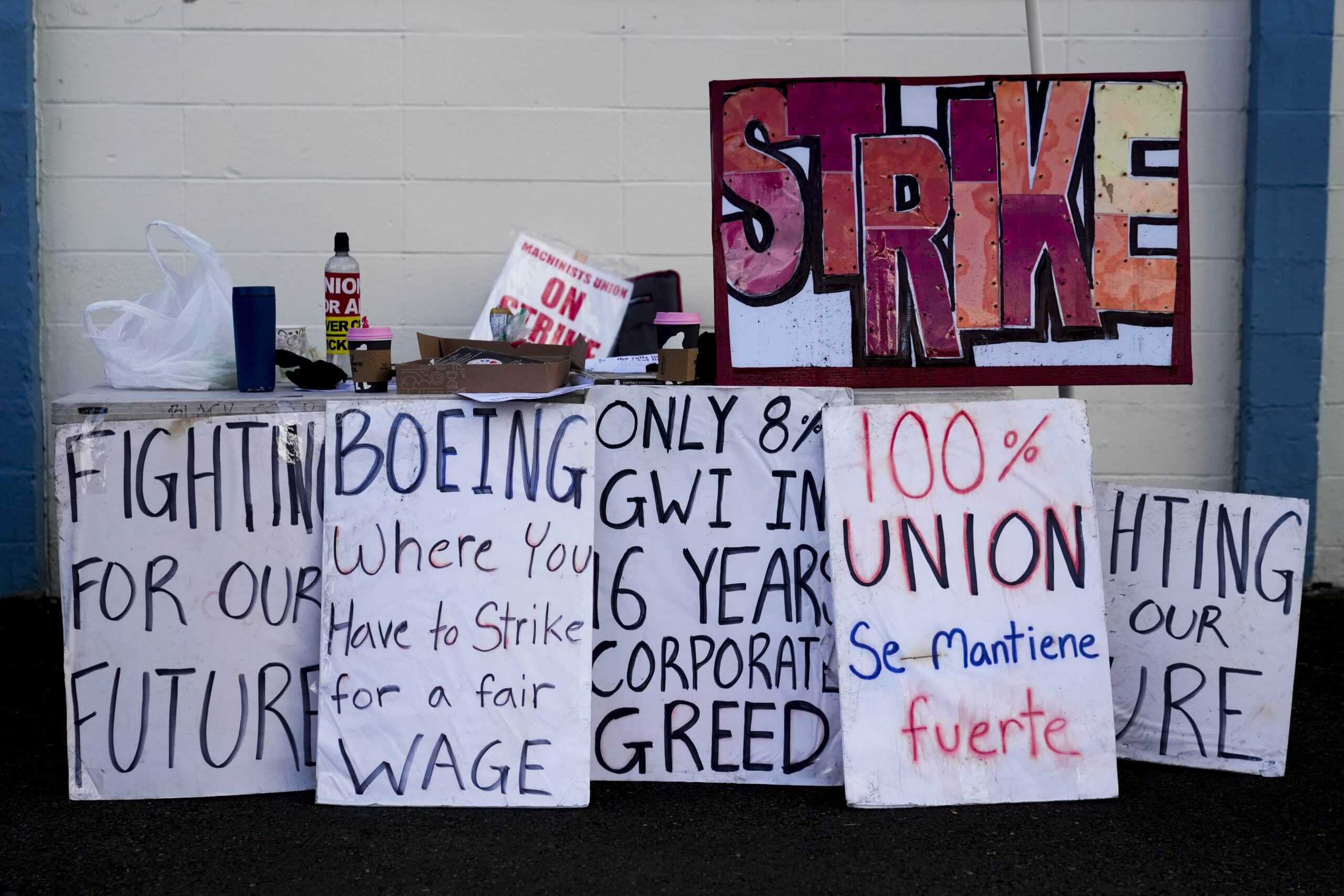

Strike signs line a table outside the Aerospace Machinists Union hall as Boeing employees on strike vote on a new contract offer from the company, Wednesday, Oct. 23, 2024, in Renton, Wash. (AP Photo/Lindsey Wasson)

New York, United States — Boeing reported a whopping $6.2 billion quarterly loss Wednesday as a nearly six-week labor strike weighed on its commercial plane division and costly problems dragged down its defense and space business.

The embattled aviation giant, which has been under scrutiny from regulators following safety problems, will learn later in the day if Seattle-area employees will accept the company’s latest proposal, ending the bruising work stoppage.

The quarterly results had been telegraphed to the market on October 11, when newly installed Chief Executive Kelly Ortberg announced the company was cutting 10 percent of its workforce.

READ: Boeing and workers reach tentative deal to end strike

In a message to employees, Ortberg said a turnaround would require a “fundamental culture change” as well as steps to stabilize finances, improve operations and devise a future vision for Boeing that allows it to once again be an iconic company and aerospace leader.

The most pressing issue is ending the nearly six-week strike, Ortberg said.

Some 33,000 workers in the Seattle area voted Wednesday on Boeing’s latest proposal, which includes a 35 percent pay rise over four years.

The vote is expected to be “tight,” the head of the Seattle union said Tuesday.

“After the voting ends, the count will occur at each union hall,” said the International Association of Machinists and Aerospace Workers (IAM), which plans to release results late Wednesday.

To strengthen liquidity, Boeing has announced plans to raise up to $15 billion in securities. Analysts have also said the company could divest some assets to raise cash.

READ: Boeing names new CEO as it reports hefty loss

Ortberg told CNBC the company had embarked on a portfolio review that could lead to streamlining some assets.

“I would rather err on the side of doing less and better than doing more and not doing it well,” Ortberg said in his first media interview as CEO.

He said the job cuts were unrelated to the strike, but necessary because the company was “overstaffed” for its business mission in the coming period.

Even before the strike, Boeing had slowed production in its commercial plane division to ensure greater attention to safety protocols after a 737 MAX flown by Alaska Airlines was forced to make an emergency landing in January when a fuselage panel blew out mid-flight.

The near-catastrophe — coming after two fatal 737 MAX crashes in 2018 and 2019 that claimed 346 lives — put Boeing under greater regulatory oversight.

Shares came under pressure after Boeing executives signaled that 2025 financial results would be challenged, but Ortberg also offered a bullish picture of a better potential future.

“The demand is fantastic for our product lines, and if we’re efficient as we deliver those in the market, the sky’s the limit for us,” Ortberg said.

Long road ahead

The company’s latest results were dented by $3 billion in one-time cost hits to its 777X and 767 programs, as well as the drag from the ongoing strike.

In its defense and space business, Boeing’s results were battered by $2 billion in costs for a number of programs, including the KC-46A Pegasus Air Force refueling aircraft.

Boeing reported a one percent decline in revenues to $17.8 billion.

In the memo, Ortberg called for better management of defense, where the company has seen profits repeatedly hit in recent years due to cost overruns on fixed-price contracts.

In September, Boeing defense chief Ted Colbert left the company.

Other key priorities include maintaining Boeing’s investment-grade credit rating and, further down the road, beginning to engineer a new airplane.

“But we have a lot of work to do before then,” he added.

Ortberg expressed optimism about the union vote, but cautioned that restoring production would not be an overnight process, noting stress on the supply chain.

“It is so much more important that we do this right than fast coming out of the chute,” Ortberg said of resuming operations.

Although he didn’t indicate plans to scale back Boeing’s space program, Ortberg pointed to commercial planes and defense as “core” products that “will always stay with the Boeing company.”

Analyst Peter McNally of Third Bridge predicted Boeing’s recovery would not be swift.

“Even if the strike is settled today, Third Bridge experts believe the impact on Boeing will carry through beyond the fourth quarter,” McNally wrote.

Between that and other problems with operations and the Boeing supply chain, “Third Bridge experts see an underwhelming recovery in Boeing deliveries for years to come.”

Shares fell 1.8 percent.