In the Philippine archipelago, geographical areas can make a big difference in the level of credit perception among Filipinos.

Many low-income families already know the concept of utang that they do to borrow money from friends, relatives and sometimes from loan sharks that can potentially saddle them with unpaid debts. This is why the Bangko Sentral ng Pilipinas (BSP) wants to reduce the proportion of unbanked Filipino adults so they can have access to—and knowledge of—formal and legitimate credit products.

But one of the big stumbling blocks to that goal is the limited presence of some banks in remote areas. And according to the 2024 Credit Perception Index (CPI) of TransUnion, a global credit reference agency, Filipinos in rural areas tend to have lower awareness of the formal loan products compared with people in urban communities.

Notable disparity

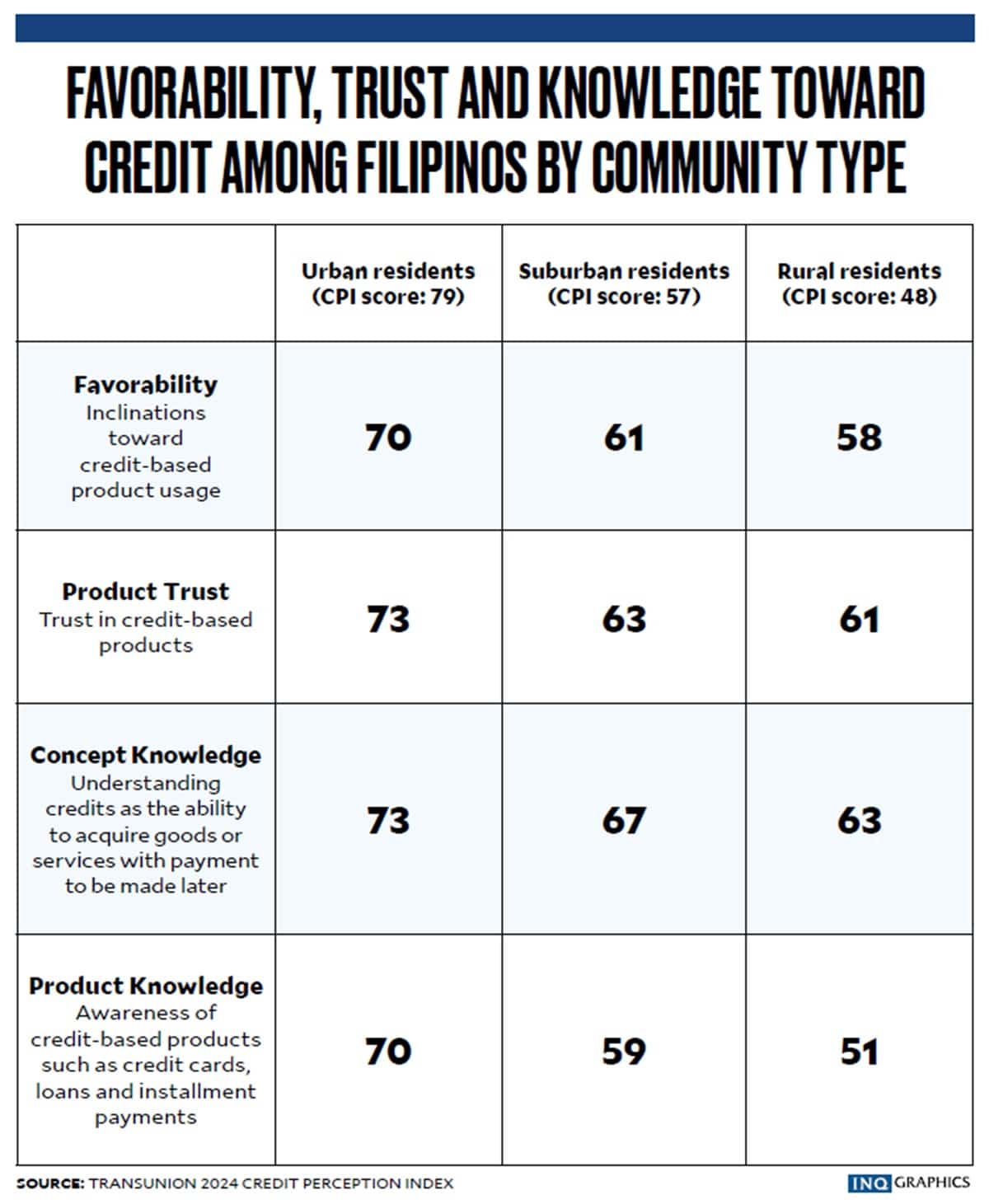

Results of a nationwide TransUnion survey of 1,000 consumers conducted between March and April this year show that the CPI score of Filipinos living in urbanized areas stands at 79.

That is 22 points higher than the 57 CPI score of suburban dwellers. At the same time, it is 31 points above the credit perception score of 48 for those living in rural areas.

Among these three groups of respondents, TransUnion says “notable” gaps were also observed in terms of their knowledge about the concept of credit and awareness of various credit products. The study also brings attention to the uneven level of trust and favorability that urban, suburban and rural dwellers have for credit-based offerings.

The biggest difference is seen in credit product knowledge. In this area, respondents living in urban communities have received a CPI score of 70, 11 points higher than suburban residents’ score of 59, and 19 points more than rural Filipinos’ CPI of 51.

What the results show, TransUnion explains, is that the gaps in credit perception become more pronounced the more rural the area is. And such a discrepancy might stem from the different sources of credit information of Filipinos.

TransUnion reports that the majority of urban residents (65 percent) have cited social media as their most preferred source for information on credit, followed by banks or financial institutions (59 percent).

Meanwhile, the preference for financial institutions as a source of credit information is lower among suburban residents (51 percent) and rural residents (44 percent).

In contrast, family and friends are the most popular source of credit information among the respondents in both suburban (63 percent) and rural (60 percent) areas. These findings, TransUnion says, show that Filipinos in rural parts of the archipelago mostly get their knowledge about credit products from alternative sources such as personal networks, and not so much from professional organizations.

“Given that suburban and rural residents rely more on their personal networks for credit information, this may limit their exposure to the latest credit trends and professional insights,” says Weihan Sun, principal of research and consulting for Asia- Pacific at TransUnion.

Progress

But this does not mean that there is no significant progress in the Philippines’ financial inclusion and awareness goals.

Latest data from the BSP show that the share of digital payments to total retail payment transactions in the country has grown to 52.8 percent in 2023, from 42.1 percent in 2022. That means out of the 5 billion total monthly transactions recorded last year, more than 2.6 billion of them have been successfully converted to digital form.

It is a feat that has exceeded the expectations of the central bank, which had hoped to digitalize 50 percent of retail payments in the country by 2023. The growth in digital payments also bodes well for the BSP’s goal to onboard 70 percent of adult Filipinos to the formal financial system by 2023.

According to the Bank of International Settlements, a one-percentage-point increase in digital payment use is associated with a 0.10-percentage point growth in gross domestic product per capita, and a 0.06-percentage point decline in informal employment. A wider adoption of digital payments can also translate to greater access to credit, BIS says.

If anything, the findings of TransUnion have increased the urgency to intensify efforts to initiate more Filipinos into the formal financial system if the government wants to achieve its goal of lifting the Philippines to the upper-middle income group before the end of President Marcos’ term.

“With regional economies heading in a positive direction, through education and collaboration, we can help ensure no Filipino gets left behind in the progress toward a more financially inclusive nation where everyone is empowered to build better lives,” TransUnion’s Sun says.