Calabarzon remains top choice of value-seeking homebuyers

The Bangko Sentral ng Pilipinas’ Residential Real Estate Price Index (BSP RREPI) released in June showed a 2.7 percent increase in housing prices despite the continuing economic headwinds of elevated inflation and interest rates during the first half of the year.

By geographical area, year-on-year prices in the National Capital Region (NCR) fell by 1 percent, but those outside the capital region rose by 4.2 percent.

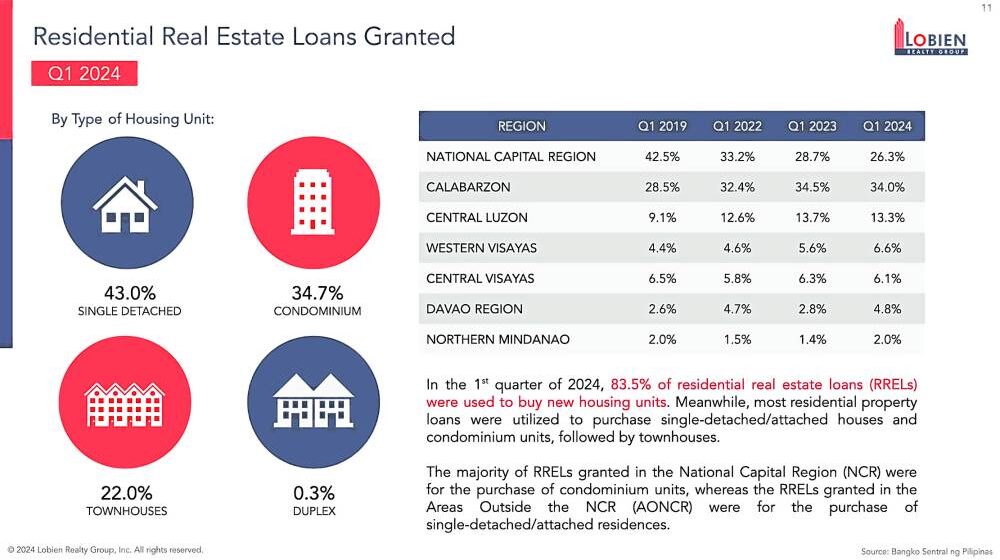

As of Q1 2024, residential real estate loans also showed the same decreasing trend for NCR, to 26.3 percent down from a share of 42 percent in Q1 2019. Huge increases, however, were noted for the Calabarzon Region (to 34 percent from 28.5 percent) and Central Luzon (to 13.3 percent from 9.1 percent) for the same period.

Going outside NCR

The preference of homebuyers to go outside NCR—as reflected in the softening of residential prices and the decrease of residential loans in terms of percentage share—can be attributed to three reasons.

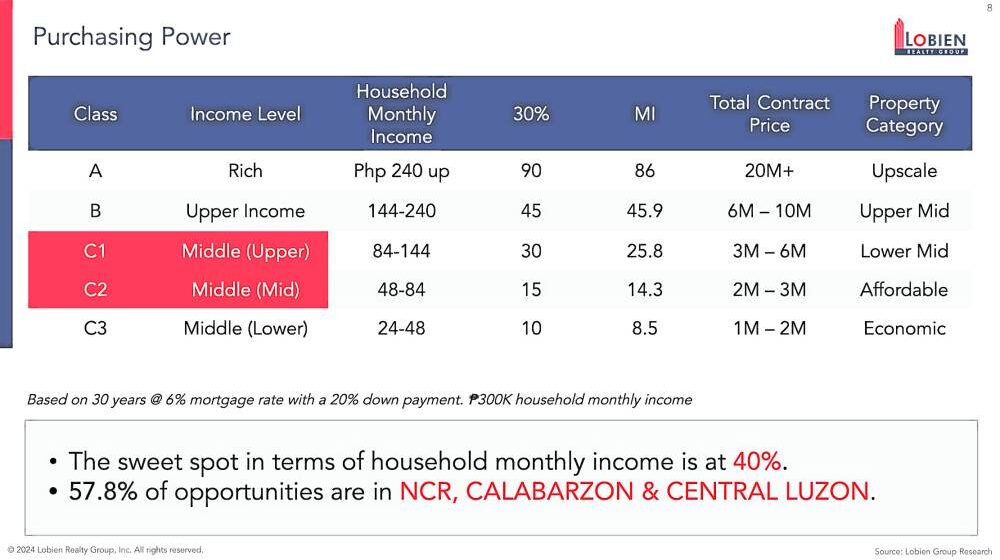

First is the value-seeking activity of homebuyers, who are looking to buy bigger spaces outside NCR for the same price that could fetch them smaller areas in the capital region.

Second, the intense lockdowns suffered by families during the pandemic highlighted the need for more residential space that will cater to different activities of the family such as online schooling and work-from-home arrangements, among others.

Lastly, there is a conscious effort in the government to tone down the overcrowding of NCR and address traffic congestion by building key transportation infrastructure that will conveniently link NCR to Bulacan and Pampanga in the north and Calabarzon in the south.

Huge demand

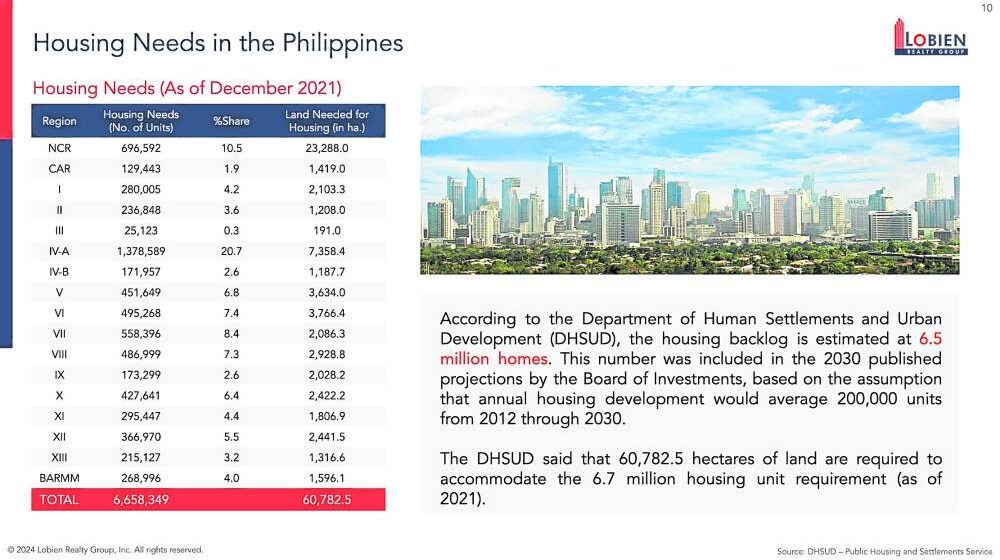

Government housing data showed that 25,000 housing units are needed for Central Luzon while Calabarzon currently needs 1.4 million units, which is 20.7 percent of the country’s 6.5 million housing requirements.

This huge demand in Calabarzon is not lost to major property developers as several high quality townships and residential developments have been built or are planned to be built in this region.

Vibrant economy

We see this trend of commercial and residential developments to continue for Calabarzon as the region has a vibrant economy which grew 5.2 percent in 2023, equivalent to P3.10 trillion or 14.7 percent of Philippine GDP.

Calabarzon is considered as the country’s industrial powerhouse because of its 31 world-class industrial estates and economic zones. Most of the automotive assemblers in the country are in this region, along with big names in the semi-conductor industry. The region’s GDP per capita of $3,455 as of 2021 is also comparable to the country’s GDP per capita of $3,331 in the same year.

Expected to likewise help sustain demand for real estate is the region’s significant population of 17 million, whereas its natural recreational areas, such as Tagaytay with its cool weather and Batangas with its scenic beaches, make the region even more attractive to commercial and residential developments.

Major road infrastructure such as South Luzon Expressway (SLEx), Manila-Cavite Expressway (Cavitex), Cavite-Laguna Expressway (Calax), Muntinlupa-Cavite Expressway (MCX), SLEx Toll Road 4 and planned railway for the region further justify its place as a top-of-mind residential location.

Finally, the possible creation of another financial and economic center in the south, such as the creation of another global city using the National Penitentiary land in Muntinlupa, will unlock greater economic and real estate opportunities in the region.

Key takeaway

Overall, the conscious effort to build a well-linked road infrastructure to connect NCR to nearby provinces and to promote these provinces as alternative residential and work destinations will result in a more sustainable capital region. This will also have a far-reaching positive impact on the economic growth of these regions, such as Calabarzon.

We see such developments to positively impact real estate as well.

The author is the CEO of Lobien Realty Group Inc.