Consumer loyalty builds brand identity

THOUGHT-PROVOKING Campus Talks is designed to be an engaging speaker series to ignite intellectual conversations and inspire students. —Photos by Eugene Araneta

Technology may be changing a lot of things, but for GoTyme and Grab, human interaction is still the way to grow and sustain their brands and build client loyalty.

Albert Tinio, co-CEO of GoTyme Bank, and Arvi Persan Pernia Lopez, country communications head of Grab Philippines, say they are using technology advances to improve and enhance—rather than replace—human interactions with customers.

Tinio and Lopez discussed “Building and Managing Brand Identity” in the first in a series of the Inquirer’s Campus Talks, organized in collaboration with the University of the Philippines Junior Marketing Association.

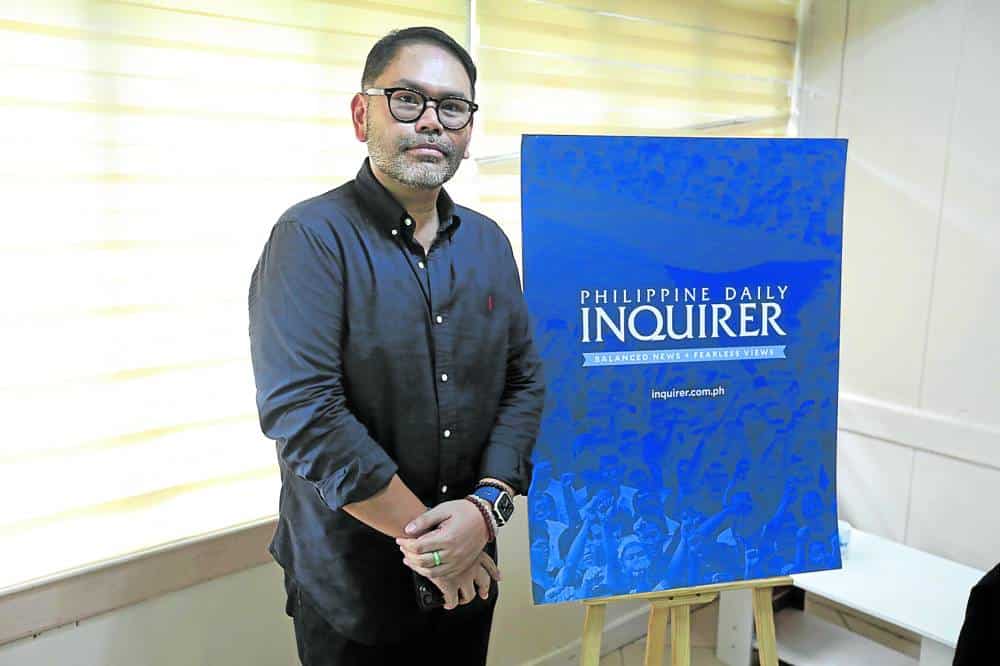

Rudyard Arbolado, president and CEO of the Philippine Daily Inquirer, says Campus Talks aims to provide a venue for students to engage personally with professionals and experts in their fields of interest.

“Campus Talks recognizes the significance of real world exposure in shaping students’ aspirations,” he says. The series, he adds, bridges the gap between academe and industry.

Article continues after this advertisementCampus Talks is designed to be an engaging speaker series to ignite intellectual conversations and inspire students. It invites accomplished CEOs, thought leaders and experts from various fields to share their insights, experience and wisdom.

Article continues after this advertisementCampus Talks offers an intimate and interactive setting for students to interact with influential speakers, ask questions and gain valuable and practical knowledge to fuel their personal and professional growth.

Through thought-provoking sessions, Campus Talks aims to expose students to a diverse range of perspectives, innovative ideas and success stories. It provides a platform where students can expand their horizons and explore new possibilities.

In the maiden session of Campus Talks moderated by Raphael Layosa, both Tinio and Lopez stress that brand loyalty is not earned simply by offering the best product or service in the market. Consumers not only have to recognize quality but also believe that the brand is responsive to their needs.

Addressing an audience consisting primarily of business students and potential marketing professionals, as well as a handful of Inquirer scholars at the College of Mass Communication, Tinio and Lopez say, whether their companies are rolling out new products or launching new services, the goal is always to meet the demand or need expressed by their clients.

Tinio says GoTyme is a “phygital” bank as it harnesses technological advances while ensuring clients that there is always a human person to attend to their needs or handle their complaints.

He adds, “In a world that has become more digital, the more human GoTyme Bank needs to be.”

Even the GoTyme debit card design, Tinio says, takes into account real life situations where people usually carry several cards. It is easier and faster to pick the GoTyme card from a bunch of other cards.

Lopez says Grab does not just rely on data gathered through customer feedback to respond to consumer needs. “We have to engage customers, not just respond to their complaints.”

Grab has added or restored some services to meet customer needs.

“We have to adapt to market changes—real-time adaptation,” Lopez says. “We have to get in front of a potential need before it arises.”

Tinio says, although the Bangko Sentral ng Pilipinas, has licensed six digital banks, the market is big enough for more players. GoTyme, which now has about 4.3 million clients, hopes to hit 5 million before the end of the year with its monthly activation of 250,000 to 280,000.

GoTyme aims to become the Philippines’ largest retail bank in five years.

It helps the brand, he acknowledges, to be associated with already established names—the Gokongwei group of companies. In fact, withdrawals and deposits can be made through the group’s retail outlets, like the supermarket and drug store.

Grab will focus on protecting and promoting its brand as an affordable, reliable and quicker booking option alongside safe commute.

A recent story about a driver committing crimes against his passenger was, instead of being covered up, an opportunity to review Grab’s security and safety measures to better protect riders. “We have to prevent similar incidents in the future,” Lopez says.

“Feedback from clients and partners is very important,” he says.

Tinio says the bank engages with customers on social media and responds to their needs. GoTyme, for instance, has just allowed check deposits to be done digitally. Although he himself does not use checks anymore, Tinio says some clients still do. By allowing digital check deposits, clients do not have to go to a bank.

Lopez says Grab strives to make its services constantly relevant to customers and chooses partners that share its goals.

The key message of both companies to their young audience is: the way to build, grow and sustain a brand means keeping abreast of customers’ actual needs and anticipating future demands.

And customers have to see proof that their feedback, the problems they raise, their suggestions are heard and acted on. —Contributed