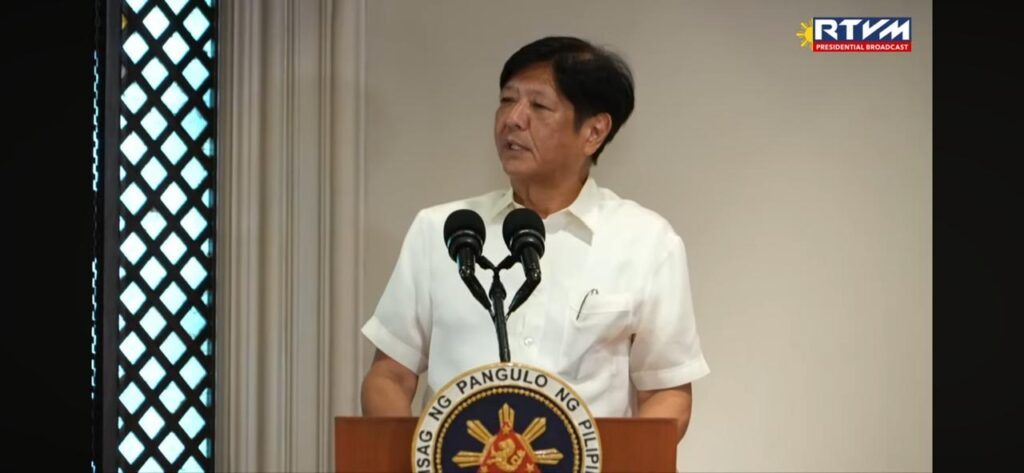

President Ferdinand Marcos Jr. (File photo screengrabbed from RTVM)

MANILA, Philippines — President Ferdinand Marcos Jr. on Wednesday signed into law the Value-added tax (VAT) on Digital Services, which will impose a 12 percent VAT on digital services provided by foreigners.

The event was done in a ceremony in Malacañang.

Subject taxpayers include providers of digital content such as movies, music, images and information; electronic marketplaces; online licensing of software, mobile applications, videos and games; online advertising spaces; search engine services; social networks; as well as webcasts and webinars, among others.

The law titled Republic Act No. 12023 is set to recover revenue lost due to unclear tax laws on e-commerce transactions, particularly from foreign companies that serve Filipino consumers but are not based in the Philippines.

Based on the projection of the Department of Finance, the law is expected to generate between P80 billion and P145 billion from 2025 to 2028, depending on the compliance of subject taxpayers.

It amends certain provisions of the National Internal Revenue Code of 1997 to adapt to the changes in the economy that are driven by technological advances.