Tax on our Olympians’ winnings, prizes and incentives

Sunday, August 11, was the last day of competition at the Paris Olympics.

The Philippines performed quite well by winning 4 medals, 2 gold medals in gymnastics by Carlos Yulo and bronze medals in boxing by Aira Villegas and Nesthy Petecio.

These athletes have brought immense pride and glory to our country and will deservedly receive cash prizes and other incentives.

Republic Act No. 10699, or the National Athletes and Coaches Benefits and Incentives Act, provides that a gold medalist will receive P10 million, silver medalist P5 million and a bronze medalist P2 million. Carlos Yulo, who won 2 gold medals, will receive P20 million.

Their coaches will also receive an amount equivalent to half awarded to the winning athletes.

READ: House to award Olympic gold medalist Carlos Yulo P3M

Article continues after this advertisementAside from the cash incentives, the law also provides that the athletes and their coaches will also receive other benefits such as 20% discount from all establishments for transportation, hotel and lodging, restaurants, recreation centers, purchase of medicine and sports equipment, on movie, entertainment and leisure tickets, PhilHelath coverage, free medical and dental consultations in government hospitals and establishments, priority in government livelihood and housing programs, and free use of living quarters and training centers set up and maintained by the Philippine Sports Commission for the exclusive use of national athletes while preparing and training for international competitions.

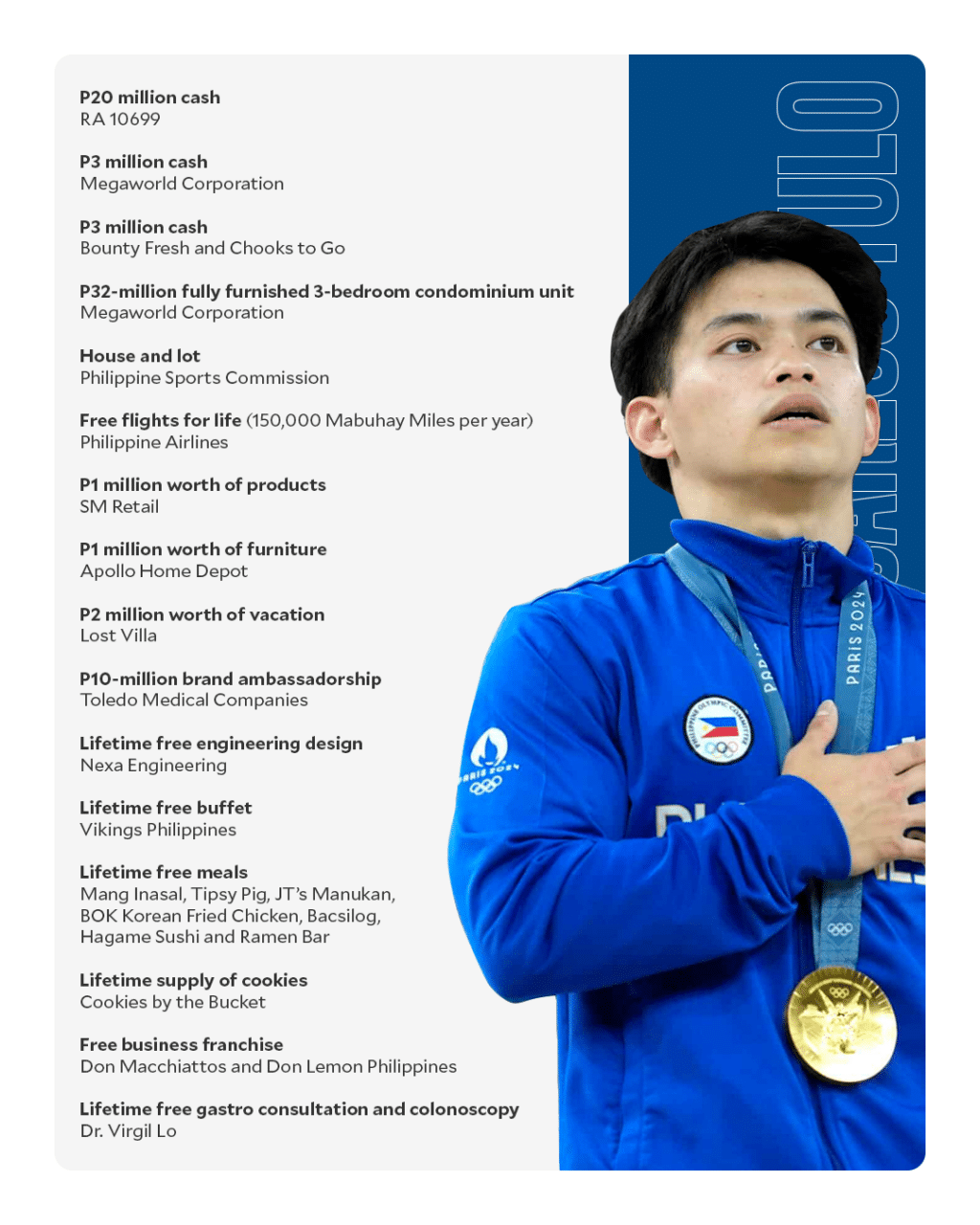

Article continues after this advertisementVarious personalities in the private sector have also supposedly announced or pledged that they will give Carlos Yulo substantial amounts of cash incentives such as a fully furnished 3 bedroom condominium and P3 million cash by Megaworld Corporation and the P3 million from Bounty Fresh. Other pledges include lifetime free meals and cookies and even lifetime free colonoscopy once Carlos Yulo turns 45. There is also the reported offer of a P10 million contract for brand ambassadorship.

Philippine Airlines has also announced that it will give Carlos Yulo 150,000 mabuhay miles per year for life and Aira Villegas 80,000 Mabuhay miles every year for 3 years.

Given the substantial amount of money and gifts to be given and pledged to our winning athletes, the question arises as to what would be the tax they or others would have to pay.

Tax on winnings and incentives

The Bureau of Internal Revenue has clarified that those prizes and awards given under Republic Act No. 10699, which include the P20million to Carlos Yulo and P2 million each to Aira Villegas and Nesthy Petecio do not form part of their income and there is no tax due on them.

Prizes and incentives donated to them by other persons or parties from the private sector also do not form part of their income and they are not under any obligation to pay any tax on these.

The National Internal Revenue Code (Tax Code), specifically Sec. 32(b) and (7)(d) provide that the following items shall not be included in the gross income and shall be exempt from taxation:

a. The value of property acquired by gift, bequest, devise, or descent; and

b. All prizes and awards granted to athletes in local and international sports competitions and tournaments whether held in the Philippines or abroad and sanctioned by their national sports associations.

Donor’s Tax

While the athletes are not liable to pay any taxes on those prizes and incentives donated to them by other persons or parties from the private sector, there is a donor’s tax due on these.

Those other incentives like the 3 bedroom condominium and P3 million in cash pledged by Megaworld Corporation, the P3 million in cash from Bounty Fresh, the free meals, and free services like colonoscopy and engineering services are subject to the donor’s tax of 6% which is based on the prevailing market value of the gifts.

Notably, the winning athletes are not the ones that will pay the donor’s tax as the Tax Code, as amended by the TRAIN Law, provides that any individual, which is the donor, who makes a transfer by gift shall submit a donor’s tax return to the BIR and pay the tax after 30 days from the donation or gift.

The donor’s tax of 6% is due on gifts in excess of P250,000 given in each calendar year.

There is Republic Act No. 7549, which was approved May 22, 1992, which provides that all prizes and awards granted to athletes in local and international sports tournaments and competitions held in the Philippines or abroad and sanctioned by their respective national sports associations shall be exempt from income tax. Provided, that such prizes and awards given to said athletes shall be deductible in full from the gross income of the donor and that the donors of said prizes and awards shall be exempt from the payment of donor’s taxes.

READ: Incentives continue to pour for Carlos Yulo after his double gold feat

However, this does not seem to exempt the donations pledged by the private sector as the money, gifts and things given and/or pledged by them are not the “prizes and awards” granted to athletes in the local and international sports tournaments and competitions as the prizes and awards would properly pertain to those given by the organizers.

Accordingly, the pledges of money, property, services, are “rewards” given by private entities seem not to fall under “prize” or “award” and, are thus subject to the donor’s tax.

After Hidilyn Diaz won her gold medal in weightlifting in the Tokyo Olympics, there was the Hidilyn Diaz Act passed by the House of Representatives of Congress which would have exempted from all taxes incentives, rewards, bonuses, donations and gifts whether from public or private persons. Unfortunately, this was not passed by the Senate. After the medal wins of our athletes in the Paris Olympics there are again moves in Congress to revive this Act and other like bills but these are currently pending.

Income Tax

There are those pledges announced such as the supposed brand ambassadorships of the Toledo Medical Companies, Inc. covered by a five year contract which if the athlete will accept, will form part of their earnings and income subject to income taxes.

The Tax Code provides that gross income means all income derived from whatever source including compensation for services in whatever form paid, including but not limited to fees, salaries, wages, commissions and similar items including those derived from the conduct of trade or business.

Aside from the five year brand ambassadorship contract, if those that have pledged free food, other items and services expect or will require the athlete to endorse their product or perform services, then this would convert the transaction from that of a donation to a contract for services which will render the athlete liable to declare them for income tax purposes with the corresponding obligation to pay income tax on the value of the goods or services received by them.

While our athletes are surely deserving of the prizes, awards, and incentives announced, it is hoped that they do actually receive them. We can recall the experience of Onyok Velasco who won a Silver Medal in the 1996 Atlanta Olympics where years later he lamented that he did not actually or completely receive some of the incentives promised to him.

(The author, Atty. John Philip C. Siao, is a practicing lawyer and founding Partner of Tiongco Siao Bello & Associates Law Offices, an Arbitrator of the Construction Industry Arbitration Commission of the Philippines, and teaches law at the De La Salle University Tañada-Diokno School of Law. He may be contacted at [email protected]. The views expressed in this article belong to the author alone.)