Back-to-school expenses? Here are 4 tipid tips to follow

In case you missed it, the upcoming school year 2024-2025 is already set to start on July 29 this year and end on April 15, 2025, marking the gradual return of the traditional June-March school calendar (from the current August-May) in the country.

With back-to-school season almost here, some families may still not be ready with the costs that it inevitably brings. Tuition fee, school supplies, uniforms, books—the list goes on and on! But don’t fret, here are some ways to make these educational expenses more manageable and well within your budget:

Be on the lookout for back-to-school sales

Year after year, brands and stores hold back-to-school promotions that you should take advantage of especially for school supplies, gadgets, and clothes. Stay updated for promos and discounts by following the social media pages of your favorite office and school supply stores and department stores. Online shopping platforms also have these kinds of sales so don’t miss out on those, too.

Reuse and repair

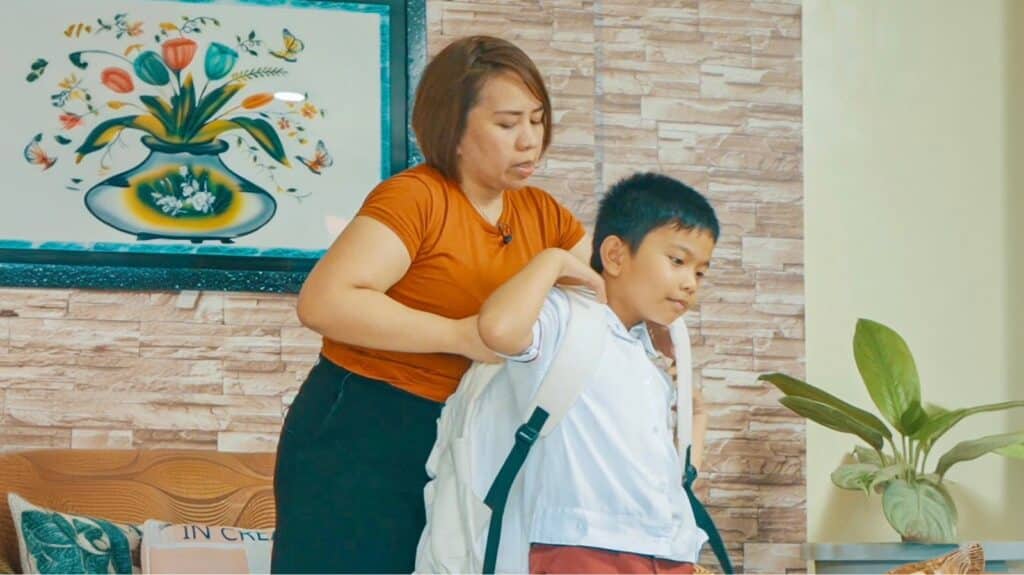

This tip best applies to school bags, lunchboxes, water bottles, uniforms, and school shoes. Oftentimes, these are the most expensive items in the back-to-school shopping list, so before buying brand new, check first if the one your child has is still in good condition or may just need a little repair to be good as new. Otherwise, get the most value out of your money by ensuring that your purchases are of good quality and can be used for a long time.

Check out relevant scholarships

A lot of government offices, private companies, and educational institutions offer scholarships and financial aid for both secondary and tertiary students. Each scholarship program has varying qualifications for eligibility. Research which one is the most suitable for your child and proceed with the application process.

However, since the school year is already starting in a few weeks, applications for a lot of scholarships may already be closed at the moment. Make sure to double check! If that’s the case, you can always apply next semester or academic year.

Consider applying for a short-term loan

The unexpected additional expenses brought by the change in the school calendar may be too much for some families to manage. In this case, there are ways to source more funds in a timely and hassle-free manner. Online lending applications offer short-term personal loans that can be approved and disbursed in a matter of minutes using just your smartphone.

A report by Tala, the world’s first fintech company for the Global Majority, has found that approximately 50% more loans are taken for education purposes during back-to-school months in the Philippines compared to the rest of the year. The average loan size is around Php 5,000, which has increased in recent years, equating to one-quarter of the average monthly income.

Interestingly, 70% of these loans are taken by women, most likely mothers and guardians like Eds, a single mother and long-time Tala user. She discovered Tala when she was searching for extra funds to complete the amount needed for her children’s tuition fees. At first, Eds was doubtful that she would be approved for a loan due to lack of requirements, but she was pleasantly surprised to know that it only took one valid ID and filling out a short questionnaire to apply.

“It’s a good thing that Tala trusted me. It’s like an answered prayer,” she said. Since then, Eds was able to grow her loan limits with on-time repayment, using the money to support her soap-making and kimchi businesses that allowed her to earn additional income for her family.

This back-to-school season, Tala recognizes the determination of parents to provide the schooling needs of their children despite challenging circumstances, anchored in the belief that education is key for a successful future. By offering flexible, convenient online credit, Tala aims to be a partner of Filipino families in reaching their goals and unlocking life’s opportunities.

ADVT.

This article is brought to you by Tala.