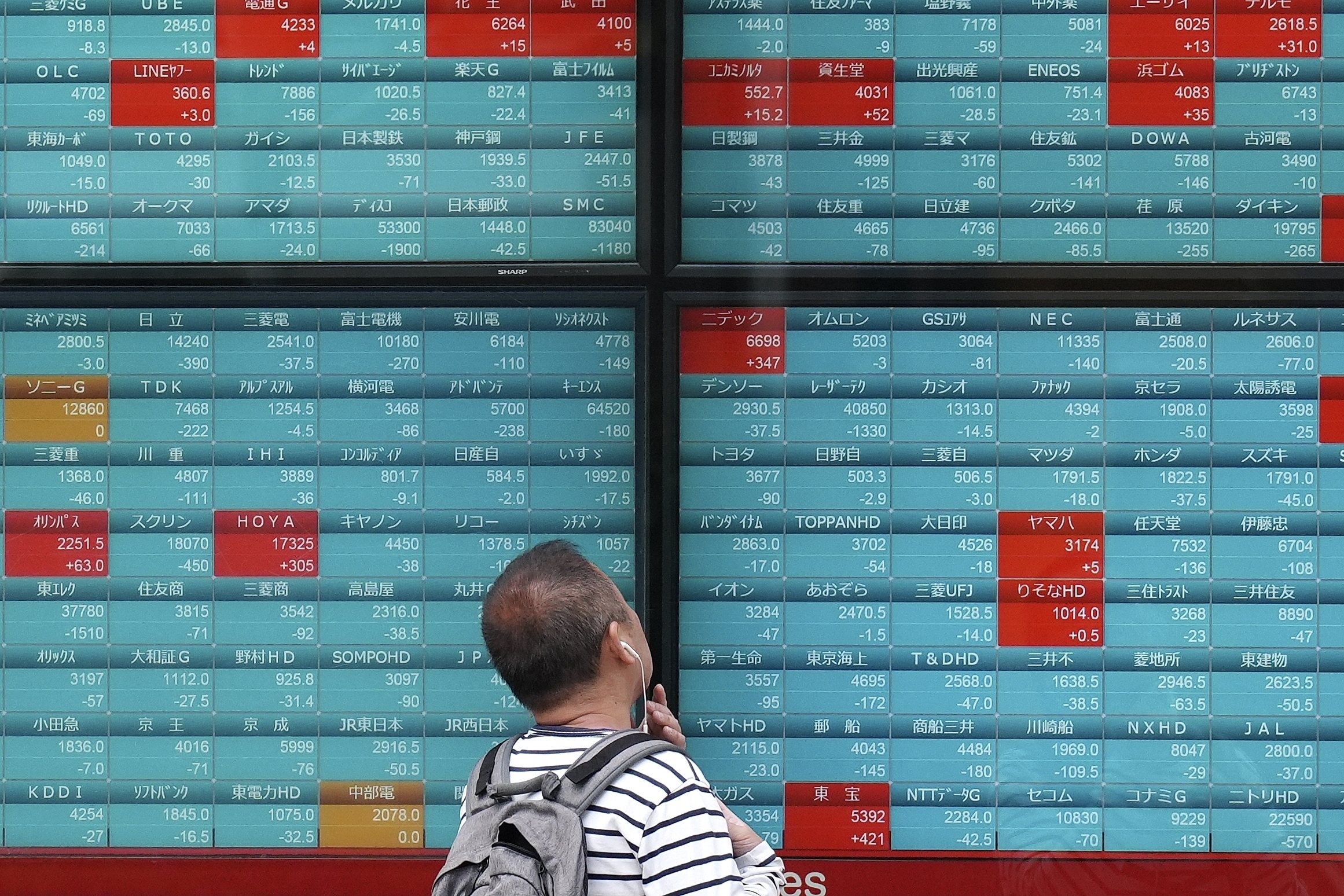

FILE – A person looks at an electronic stock board showing Japan’s Nikkei 225 index at a securities firm Tuesday, April 16, 2024, in Tokyo. Asian shares advanced on Thursday even after sinking technology stocks sent Wall Street lower in the S&P 500’s worse losing streak since the start of the year. (AP Photo/Eugene Hoshiko, File)

Hong Kong, China — Asian markets fluctuated Tuesday as rising expectations that Donald Trump will return to the White House played up against fresh hopes that the Federal Reserve will cut interest rates at least once this year.

Traders struggled to extend gains on Wall Street, where the Dow chalked up its first record since May, while the dollar rose with Treasury yields on speculation that another Trump tariff battle with China and likely tax cuts could push inflation higher.

READ: Recent data adds to Fed confidence on cooling inflation: Powell

Recent polls show the former president’s chances of beating incumbent Joe Biden have surged since the assassination attempt on him at the weekend, while his choice of JD Vance as his running mate suggests a continuation of the America First program.

“Increased market confidence after Saturday’s failed assassination attempt that Donald Trump will be re-elected president in November has been reflected in market movements across US Treasuries, equities and currencies since the weekend,” said Ray Attrill at National Australia Bank.

“The US yield curve is steeper, the dollar modestly higher and energy and banking stocks leading the charge in the S&P500.”

While the Dow led gains in New York, Asia investors were a little more cautious.

Hong Kong dropped more than one percent owing to further losses in the tech sector, while Shanghai was also off with traders awaiting policy measures from China’s leaders as they hold a key economic meeting this week.

READ: US political turmoil seen adding pressure on peso, says analyst

Sydney, Singapore, Wellington and Jakarta also fell, though Tokyo, Seoul, Taipei and Manila edged up.

There was some support after Fed chief Jerome Powell reiterated comments pointing to a possible rate cut following a recent run of positive readings on inflation.

“We didn’t gain any additional confidence in the first quarter, but the three readings in the second quarter, including the one from last week, do add somewhat to confidence,” he said in an interview with David Rubenstein of the Economic Club of Washington DC.

He added: “If we were to see an unexpected weakening in the labour market, then that might also be a reason for reaction by us.”

His remarks came after he told lawmakers last week that Fed officials did not need to wait for inflation to fall to their two percent target before cutting.

Also Monday, San Francisco Fed boss Mary Daly said there was growing optimism that the fight against surging prices was being won, though she did say she wanted to see more data.

The dovish comments over the past week have sent bets on a September rate cut soaring, while some traders are eyeing as many as three by the end of the year.

Despite that, the dollar held its gains as the possibility of a Trump win increases.

“The confluence of political developments, economic data, and central bank actions continues to create a complex landscape for global currencies,” Luca Santos, market analyst at ACY Securities.

Key figures around 0230 GMT

Tokyo – Nikkei 225: UP 0.5 percent at 41,399.72 (break)

Hong Kong – Hang Seng Index: DOWN 1.3 percent at 17,789.39

Shanghai – Composite: DOWN 0.3 percent at 2,965.29

Dollar/yen: UP at 158.59 yen from 158.09 yen on Monday

Euro/dollar: DOWN at $1.0892 from $1.0902

Pound/dollar: DOWN at $1.2965 from $1.2970

Euro/pound: DOWN at 84.01 pence from 84.03 pence

West Texas Intermediate: DOWN 0.3 percent at $81.67 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $84.62 per barrel

New York – Dow: UP 0.5 percent at 40,211.72 (close)

London – FTSE 100: DOWN 0.9 percent at 8,182.96 (close)