Gatchalian: Did banks, Alice Guo conspire in billions of deposits?

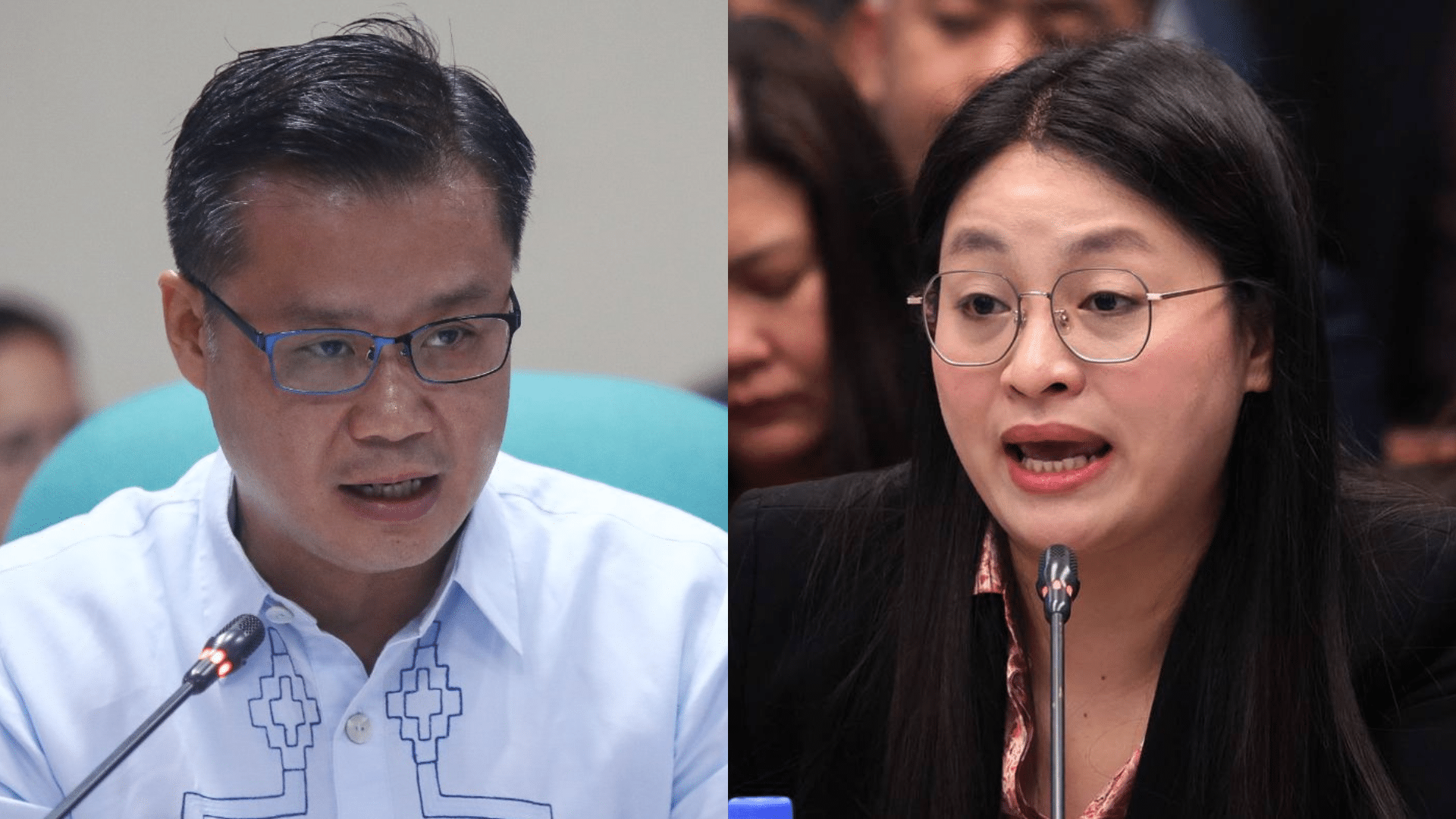

Sen. Sherwin Gatchalian and Bamban Tarlac Mayor Alice Guo. —Photos from Senate Public Relations and Information Bureau and INQUIRER.net

MANILA, Philippines — Noting that billions of suspicious funds entered Alice Guo’s bank accounts from 2019 to 2022, Sen. Sherwin Gatchalian floated on Friday the possibility that local banks have had lapses and are possibly conspiring with the embattled local chief executive in illicit activities.

Speaking to reporters in a virtual presser, Gatchalian said Guo alone has 36 bank accounts with unjustified billions worth of funds — a bulk of which were transferred between 2019 to 2022.

READ: Alice Guo’s assets frozen by CA

“It’s worth noting: Why did this come out only now? If you look at the timeline — there was a big transaction back in 2019. In fact, I’m looking at her transaction. In a span of three years, almost billions entered her accounts. Why didn’t the banks report this? So I suspect the banks also had lapses,” Gatchalian said in Filipino.

“Maybe the banks — especially the branches – also conspired [with Guo] and did not report to the Anti-Money Laundering Council (AMLC). Because it should immediately be reported if a branch gets a big deposit and the depositor can’t justify it. This should immediately be reported,” he added.

READ: Gatchalian says arrest order vs Alice Guo possible

Gatchalian proceeded to question why the banks were not able to report the transaction in 2019 and only now in 2024 that the activities were divulged. He said this alone raises suspicion that banks are conspiring with Guo.

Pursuant to the Anti-Money Laundering Act, a transaction in cash, like a bank deposit or withdrawal, involving more than P500,000 is deemed a “covered transaction” that banks must report to the AMLC within five banking days.

“If you remember, that also happened in the past. The Bangladesh [Bank] illegal transfer to the Philippines. If we remember, that could really happen. That’s why this AMLC was established so that reporting is quicker,” he explained.

Pressed to disclose the liabilities of commercial banks that fail to report suspicious transactions, Gatchalian said that it would be the AMLC that would determine the penalty.

“I’ll leave that to AMLC to determine because it’s still investigating in terms of the reporting and compliance of banks,” he said.

Meanwhile, he maintained that local banks involved in Guo’s case had shortcomings in terms of flagging billions worth of unjustified funds.

“With such big transactions, why didn’t they report it immediately to AMLC so that as early 2019 it could have been investigated?” he said.

The AMLC on Thursday evening said it had successfully secured a freeze order from the Court of Appeals (CA), marking a significant milestone to freeze the assets of individuals allegedly involved to illicit Philippine offshore gaming operators (Pogos) in the country including Guo.

AMLC detailed that the CA’s approval of the freeze order encompassed a wide range of assets, including the following:

- 90 bank accounts across 14 financial institutions

- several real properties and high-value personal properties (such as luxury vehicles and a helicopter)