Prognosis: Better days ahead for PH real estate

The McKinsey Report released on March 7is a good reference point to assess whether the economy can provide a favorable 2024 to the industry. Using the metrics set forth by the said report, the Philippines may have achieved a soft landing, at the very least, and could yet have another good year in terms of economic growth.

The World Bank meanwhile projects the Philippine economy to grow by 6 percent in 2024 and 6.2 percent in 2025. The Bangko Sentral ng Pilipinas (BSP) also forecasted inflation rate to settle within the range of 3 to 4 percent. The interest rate is meanwhile expected to be maintained at 6.5 percent until Q3 2024, with a possible reduction in the last quarter once inflation is deemed under control. Global conditions remain favorable, with remittances from overseas Filipino workers growing 2.6 percent year-on-year (YOY) as of Q1 2024, on track to reach $40 billion this year.

The employment rate remains remarkably high at 96 percent, the same as 2023 levels. Tourism receipts reached P158 billion as of Q1 2024, which is already 31 percent higher than the pre-pandemic revenues of P121 billion for Q1 2019.

The price volatility of commodities like rice, which puts inflation at the high side, is expected to be partially addressed by the reduction of rice tariff to 15 percent from 35 percent. These economic conditions and interventions are seen to help the real estate market, with the office and residential submarkets expected to significantly benefit from this situation.

Resilience in rates

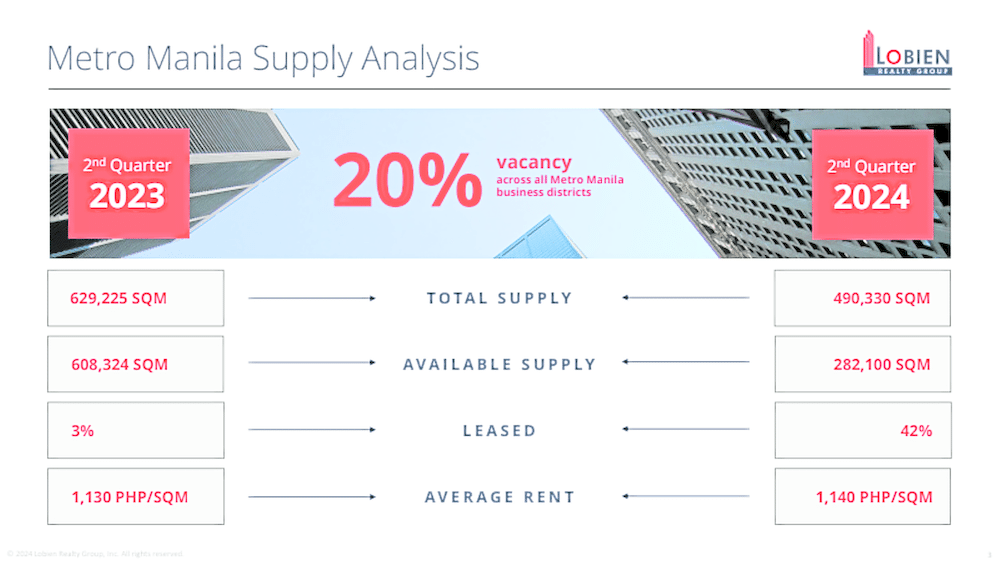

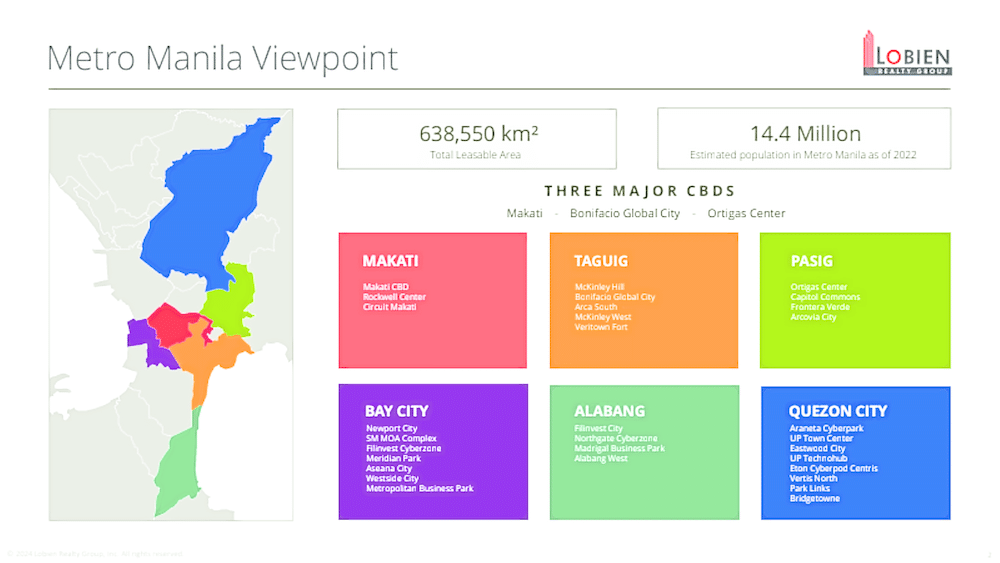

Although Metro Manila office space still has a vacancy rate of close to 20 percent with a net take-up projected to be at around 320,000 sqm for the year, rental rates have not significantly softened as expected.

For perspective, rents declined by double digits (as high as 30 percent) during the 1997 Asian and 2008 global financial crises. The provincial office market has a higher vacancy rate at 27 percent, but rental rates have also remained steady at P600 per sqm so far.

Expectations of a significant rent reduction to push excess supply in the market were very logical at the start of the year due to the projected 3.6 million sqm of unrented office space.

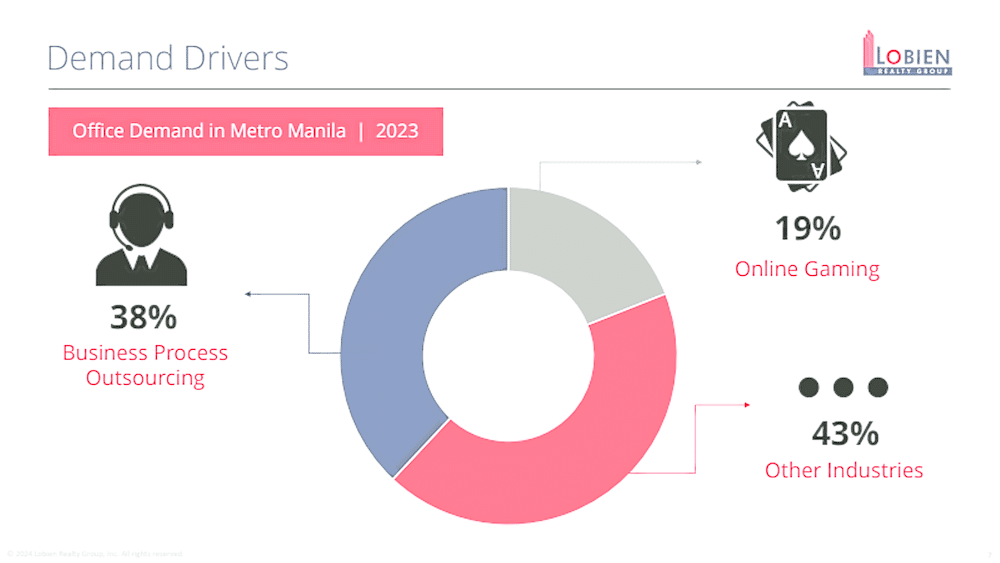

The resilience in rental rates can be attributed to the ability of landlords to maintain their posture in terms of waiting for the market to recover, the recognition that the pandemic-induced recession was not as serious as the financial crisis in terms of its impact on office space demand, and that the structural impact of work from home arrangements would soon be addressed by the need for physical working space in response to business owners’ demand for productivity, data security, and company culture.

The noted YOY recovery in take-up, as shown by the lease rates of 37 percent in Metro Manila as of Q1 2024 versus 4 percent in Q2 2023, can partially provide credence to these arguments.

Rising housing prices

For the residential submarket, the BSP Residential Real Estate Price Index (RREPI) shows that YOY housing prices in the country increased by 6.1 percent, with those of duplex and condominium units growing by 36.2 percent and 10.2 percent, respectively.

Surprisingly, despite the higher borrowing rates, the number of residential real estate loans (RRELs) for all types of new housing units grew by 8.9 percent YOY, signifying the continued confidence of the market on residential price appreciation, which may have outweighed the costs due to the prevailing high interest environment.

This opportunistic purchase on credit by residential buyers may be justified by the increase in average appraised price per sqm of new residential units in the country, which reached P82,260 in Q1 2024, an 11.6 percent increase YOY. New housing units in NCR have an average appraised price of P132,743 (7.9 percent increase) for the same period. There’s also the benefit of interest repricing once borrowing costs fall within the year.

Better prospects

In conclusion, better economic prospects for the country in the second half of the year will be favorable to real estate players.

For the office market, take-up has slowly recovered and the expectations of reduction in interest rates within the year due to inflation staying within the target bandwidth of the BSP augur well for landlords and developers. Office locators may need to start seeking the best available space for their operations at the best possible price while the vacancy rates are elevated.

For residential buyers, the BSP’s RREPI reflects the market’s recognition that the sustained price appreciation of housing units outweighs the current high borrowing costs, and the impending interest rate reduction will benefit them in the long term as their loans are repriced at lower rates.