38 Philippine firms make it to Fortune’s first ‘Southeast Asia 500’ list

Thirty-eight of the country’s top revenue-generating firms made it to Fortune Magazine’s inaugural “Southeast Asia 500” list, reflecting economic recovery in the region amid rapidly changing consumer needs.

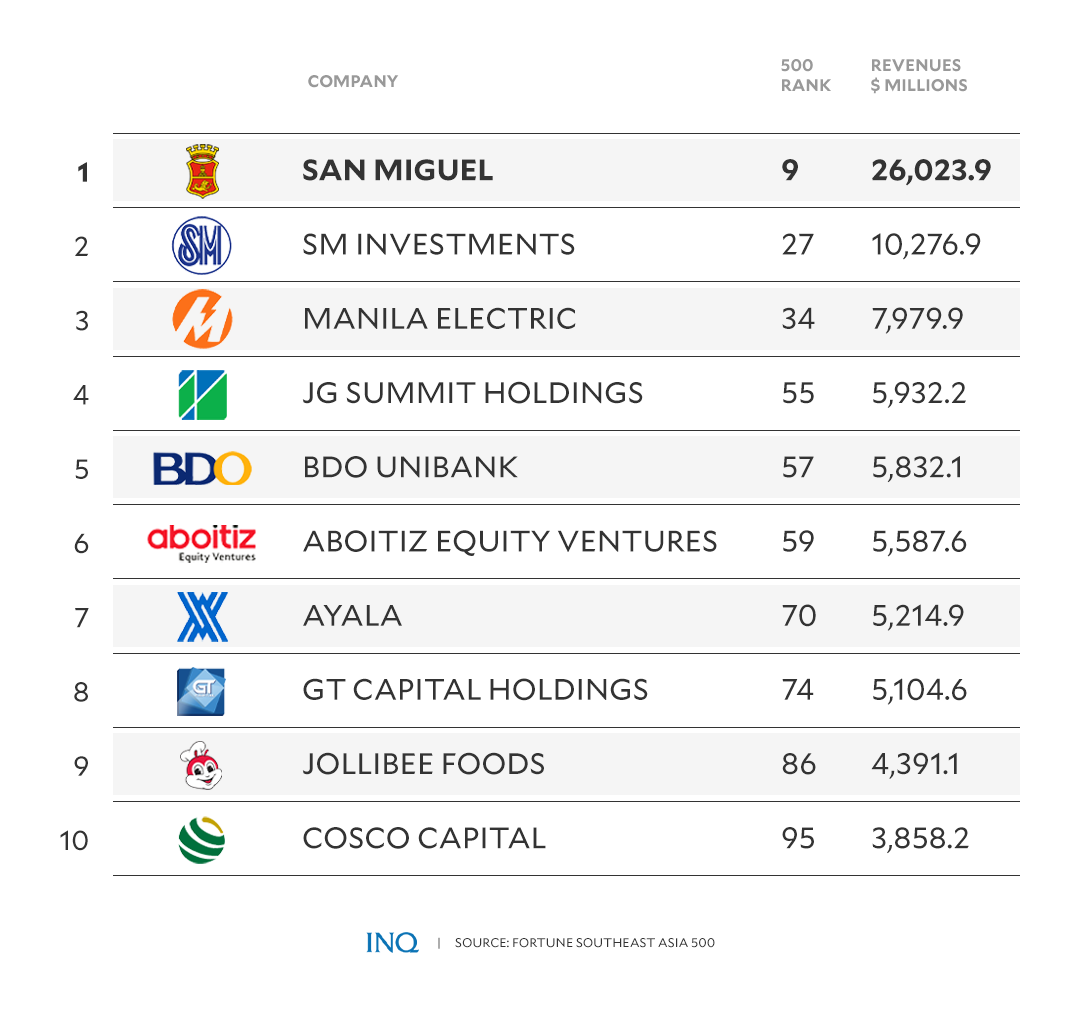

Billionaire Ramon S. Ang’s San Miguel Corp. was the sole Philippine company in the Top 10, ranking 9th

With combined sales of $130.94 billion last year, 38 of the country’s top revenue-generating firms—mostly conglomerates and banks—made it to Fortune Magazine’s first “Southeast Asia 500” list, as more Western companies are looking at the region as a way of diversifying their supply chain.

Billionaire Ramon Ang’s San Miguel Corp. (SMC) was the sole Philippine company in the Top 10, ranking 9th, with last year’s revenues totaling $26.02 billion. It was followed by the Sy family-led conglomerate SM Investments Corp. at No. 27 with $10.3 billion in revenues.

Also on the list which was released on Tuesday morning were the Manila Electric Co. (34th), JG Summit Holdings (55th), BDO Unibank Inc. (57th), Aboitiz Equity Ventures (59th), Ayala Corp. (70th), GT Capital Holdings (74th), Jollibee Foods Corp. (86th), Cosco Capital (95th), PLDT Inc. (97th) and Alliance Global Group (100th).

Clay Chandler, Fortune Asia executive editor, told the Inquirer that technology-focused companies, in particular, saw much supply chain potential in Southeast Asia.

“We’ve definitely seen in the last several months that many of the biggest Fortune 500 companies have started to pay attention to Southeast Asia in an entirely new way,” Chandler said in an interview.

Shift in focus

“People realized that efficiency wasn’t everything, that they needed to diversify a little bit and set up supply lines that were in other areas. Southeast Asia has probably been the biggest beneficiary,” he added.

This shift in preferences was the reason why Fortune added Southeast Asia in its decades-old Fortune 500 franchise, which recognizes the biggest companies globally.

“It’s a real mark of Southeast Asia’s arrival in the global scene, so with that in mind, we decided it was worth taking a hard look at the largest companies in this region,” Chandler said.

In the region, Chandler noted that the minimum revenue requirement to be included in the Top 500 list was $460.8 million.

Firms from seven Southeast Asian countries made the cut, dominated by Indonesia with 110 companies, followed by Thailand with 107. Malaysia had 89 firms; Singapore, 84; Vietnam, 70; and Cambodia, two.

Energy emerged as the largest sector with collective revenues of $590.7 billion, followed by banking with $242 billion, and food, beverages and tobacco with $201.1 billion.

Singapore-based commodities trader Trafigura bested all other companies in the region with 2023 sales totaling $244.28 billion, making up 40 percent of the country’s total revenue of $619.41 billion. Singapore firms also accounted for half of the 10 highest revenue-generating companies in the region.

Chandler said they were optimistic that Southeast Asia would continue to have high potential for growth this year, as they expected more companies to join the broader Fortune Global 500.

“We’re very upbeat about the prospects for the region in general. It would not surprise me at all to see more Southeast Asian companies [in the Global 500],” he added. INQ