Note: Progress, Roadmap, Accelerators are assessed based on relevant indicators at both country and sector level

Sources: Country NDC; LT-LEDS; Climate Watch; BMI; IRENA; BNEF; FAO; Global Forest Watch; Euromonitor; AVCJ; S&P Capital IQ; Preqin; Pitchbook; Industry participant interviews; Lit. search; Bain analysis

MANILA, Philippines —Over the years, the Philippines has made significant progress in advancing the energy and green transition agenda but there is still much ground to cover.

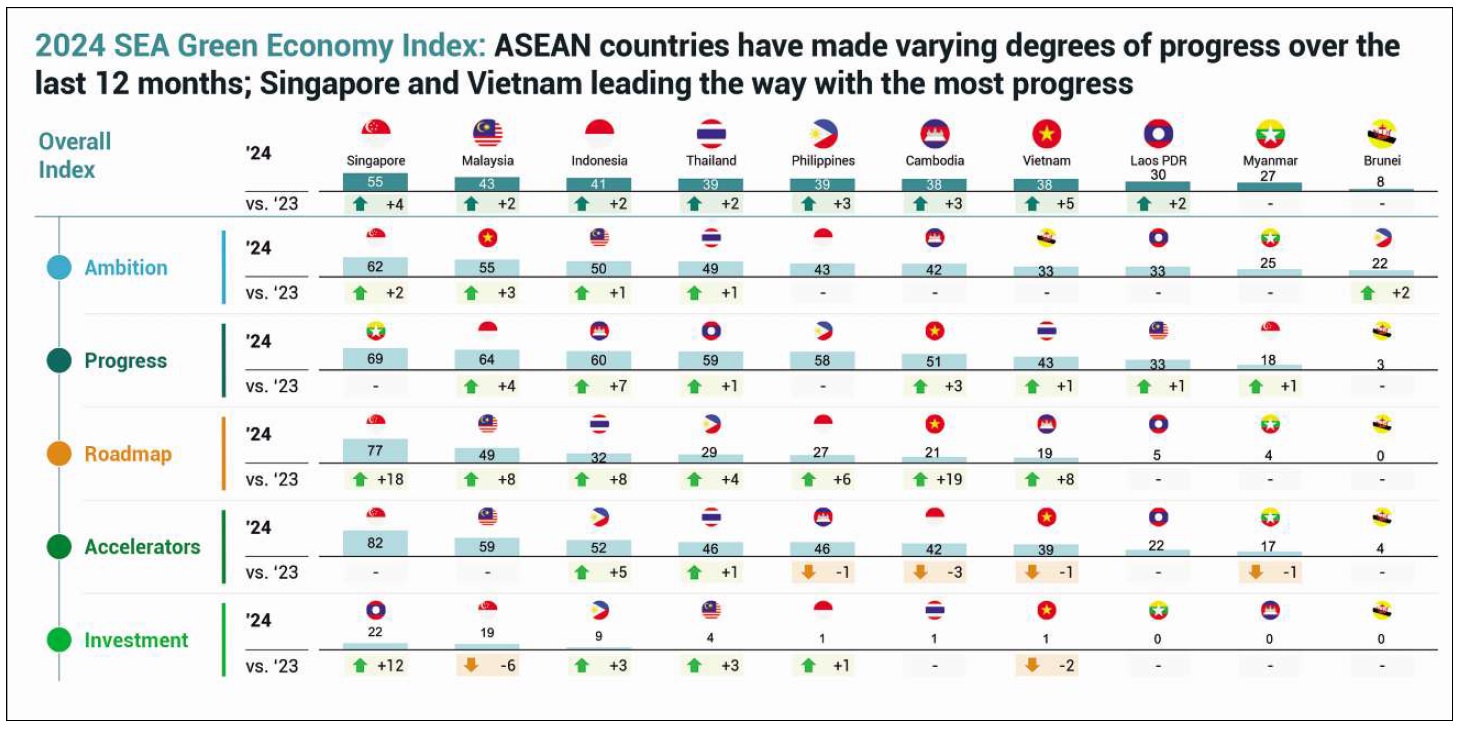

The first-ever Southeast Asia Green Economy Index showed that the country ranked 5th among its regional peers, according to the report entitled “Southeast Asia’s Green Economy 2024–Moving The Needle” jointly published by Bain & Company, GenZero, Standard Chartered, and Temasek.

Based on the report, the Philippines achieved the highest score in terms of investment as many companies poured in more money to help attain a green economy for future generations. But the country recorded the lowest score in ambition, meaning that the government has yet to present a blueprint to realize its decarbonization goals.

To date, the country has neither presented a concrete plan nor professed commitment to reach a “net zero” target although certain entities, particularly large corporations, took the initiative to reduce their respective carbon emissions.

The report says that amid the absence of sector-specific emissions targets, four major emitting companies spelled out their net-zero and emissions targets.

‘Unconditional and conditional’ targets

Further, the report noted that the government outlined “unconditional and conditional” targets. The first is to slash economy-wide greenhouse gas emissions by 75 percent for the period 2020 to 2030 under its updated Nationally Determined Contribution target. The other target is to increase renewable energy’s share in the energy mix to 35 percent by 2030 and raise it further to 50 percent by 2050.

READ: Solar investment outstrips all other power forms: IEA

As of last year, coal-fired power plants remain the leading source of energy across the archipelago, accounting for 43.9 percent of the power generation mix while renewables came second with a share of 29.7 percent.

Even without sector-specific emissions targets or the slow uptick of renewables, the report recognized the strides made by the Philippine government to allow more foreign companies to invest in the local renewable space.

In 2022, the Department of Energy issued the revised implementing rules and regulations of the Renewable Energy Act that effectively removed the foreign ownership restriction on projects aimed at harnessing cleaner sources of energy. Before this, a foreign firm’s ownership stake was capped at 40 percent.

A year later, in 2023, President Marcos issued Executive Order No. 18 to create “green lanes” for strategic investments. Essentially, the directive is aimed at expediting the processing of permits, licenses, certifications and/or authorizations required by a business enterprise to undertake critical investment projects.

The Department of Energy said earlier the moratorium on the development of greenfield or new coal-fired power projects remains in effect. The agency first announced the ban in 2020 as part of efforts to promote the use of non-conventional sources of energy. The directive excludes coal facilities with firm expansion plans or indicative projects with substantial accomplishments.

‘Green investments’ up 57%

The report also took note of the 57-percent rise in private green investments, reaching $1.5 billion in the previous year because of the “increase in domestic investments in infrastructure.” However, it represents a small fraction of the required capital investment of $16.6 billion to advance the push for a green economy.

READ: Significant increase in renewable energy investments seen

“Significant increase in waste management investment, while investment momentum continues in [the] solar sector in 2023,” the report says. “Positive efforts have been seen in blended finance and new regional collaboration efforts towards coal phase-out.”

On a regional level, the report acknowledged the “varying degrees of progress” of the Southeast Asian region in pushing the decarbonization plan in the last 12 months, with Singapore and Vietnam “leading the way.”

“Eight out of 10 countries have net zero targets, and while they have remained the same as the previous year, more than half of the region’s top emitting corporates have set net zero or emission reduction targets, 15 more compared to 2023,” a press release on the report says.

“In addition, seven countries have shown progress in adopting renewable energy and electric vehicles, preserving forestland, and enhancing [the] health of cropland soil,” it adds.

Finding the balance

To veer away from fossil fuels, the report says Southeast Asia as a growing economy needs to find the balance between economic growth and transition to renewable energy. Kimberly Tan, Head of Investments at GenZero, says an investment of $1.5 trillion is needed to reach emissions targets by 2030.

The green economy index assessed the 10 Southeast Asian countries based on the following—ambition (20 percent), progress (25 percent), road map (20 percent), accelerator (25 percent) and investment (10 percent).

The index covered Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

“The index helps provide an objective snapshot of how each country is performing year-on-year and relative to peers. It shows an overview of areas they are doing well and recognizes where progress is being made,” says Dale Hardcastle, director of Global Sustainability Innovation Center at Bain & Company.