Wall Street rallies to close out a bloom-filled May

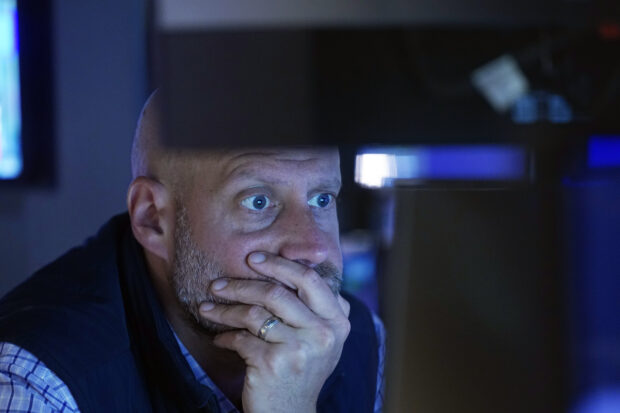

Specialist Meric Greenbaum works at his post on the floor of the New York Stock Exchange, Thursday, May 30, 2024. Most U.S. stocks are rising following mixed profit reports from big companies and signals that the economy may be cooling. (AP Photo/Richard Drew)

NEW YORK — An already verdant May for Wall Street finished with another push higher as stocks rallied Friday after a report showed inflation is at least not worsening.

The S&P 500 rose 0.8 percent to close its sixth winning month in the last seven. The main measure of the U.S. stock market’s health set an all-time high late in the month after clawing back all its losses from a rough April.

The Dow Jones Industrial Average jumped nearly 575 points, or 1.5 percent while sagging prices for some big technology stocks held back the Nasdaq composite. It slipped by less than 0.1 percent.

Gap soared to one of the market’s biggest gains, 28.6 percent, after delivering stronger profit and revenue for the latest quarter than analysts expected. The parent company of Old Navy and Banana Republic reported growth across its brands, reversing earlier declines at most of them. The retailer also raised its forecasts for sales and profitability this year despite saying the outlook for the economy remains uncertain.

Boost from easing Treasury yields

Stocks broadly got a boost from easing Treasury yields in the bond market after the latest reading on inflation came in roughly as expected. That left open the question of when Wall Street will get the lower interest rates that it craves.

The report showed a key measure of inflation remained at 2.7 percent last month, exactly as forecast. Some underlying trends also improved by a touch more than expected. That could bolster confidence at the Federal Reserve that inflation is sustainably heading toward its target of 2 percent, something it says it needs before it will cut its main interest rate.

The Fed has been keeping the federal funds rate at the highest level in more than 20 years in hopes of slowing the economy enough to stifle high inflation. But if it holds rates too high for too long, it could choke off the economy’s growth and cause a recession that throws workers out of their jobs and craters profits for companies.

“The pickle for the Fed is whether growth will slow faster than inflation,” said Brian Jacobsen, chief economist at Annex Wealth Management. “We’ve gone from great growth to slower growth pretty quickly. The road to lower inflation has been like a joyride so far, but the last mile will be more challenging.”

Friday’s report from the U.S. government showed that growth in spending by consumers weakened by more than economists expected. Growth in incomes for Americans also slowed last month.

READ: US economic growth in Q1 revised down from 1.6% to 1.3%

Such numbers show businesses “need to prepare for an environment where consumers are not splurging like they were last year,” according to Jeffrey Roach, chief economist for LPL Financial.

After the report, the yield on the 10-year Treasury fell to 4.5 percent from 4.55 percent late Thursday. It had topped 4.6 percent earlier in the week amid worries about tepid demand following some auctions for Treasurys, a move that had hurt stocks.

The two-year Treasury yield, which more closely tracks expectations for Fed action, slipped to 4.87 percent from 4.93 percent late Thursday.

Virtually no one expects the Federal Reserve to cut interest rates at its next meeting in a week and a half. But traders are betting on a nearly 85 percent probability that the Fed will cut at least once by the end of the year, according to data from CME Group.

READ: Inflation pressures lingering from pandemic keep Fed rate cuts on pause

Stocks in industries that tend to benefit the most from easier interest rates helped lead the market Friday. Real-estate stocks in the S&P 500 jumped 1.9 percent as a group for one of the biggest gains among the 11 sectors that make up the index. Boston Properties rose 4.3 percent.

On the losing end of Wall Street were several tech stocks.

Dell tumbled 17.9 percent even though it matched analysts’ forecasts for profit in the latest quarter. Its stock had already soared 122 percent in 2024 ahead of the report, meaning expectations were very high, and analysts pointed to concerns about how much profit Dell is squeezing out of each $1 in revenue.

Nvidia fell for a second straight day, losing 0.8 percent, as its momentum finally slowed after soaring more than 20 percent since its blowout profit report last week. The chip company was one of the heaviest weights on the S&P 500 Friday. But its soaring profits and ability to keep a frenzy going on Wall Street for the entire artificial intelligence technology industry were also huge reasons for the index’s 4.8 percent gain for May.

READ: Trump Media slumps after former president convicted in hush money trial

Trump Media & Technology Group slumped 5.3 percent in its first trading following the conviction of Donald Trump on felony charges Thursday. The company, which runs the Truth Social platform, had warned earlier in filings with U.S. securities regulators that a conviction of Trump could hurt it.

MongoDB dropped 23.9 percent despite topping forecasts for profit and revenue. The database company for developers gave forecasts for profit in the current quarter and for this full year that fell short of analysts’ expectations.

All told, the S&P 500 rose 42.03 points to 5,277.51. The Dow leaped 574.84 points to 38,686.32, and the Nasdaq slipped 2.06 to 16,735.02.

In stock markets abroad, indexes were mixed across Asia and Europe.