BSP sees leeway to extend pause at May meet

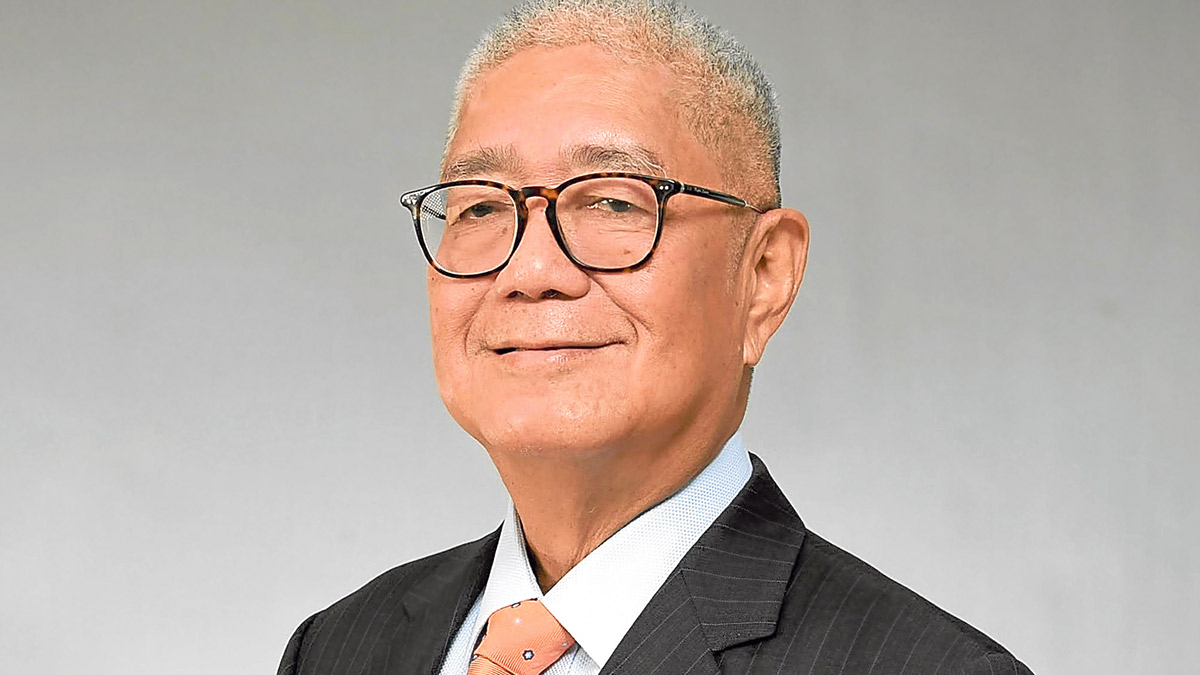

MANILA, Philippines — There’s still “leeway” for the Bangko Sentral ng Pilipinas (BSP) to extend its pause on rate adjustments this month, Governor Eli Remolona Jr. said on Monday, as inflation is widely expected to have breached the government’s target in April.

But Remolona told reporters that while the BSP is staying hawkish, the Monetary Board (MB)—the highest policy-making body of the central bank—would have room for a rate cut either in the fourth quarter of 2024 or first quarter of next year if inflation sustains a 3-percent reading in the next months.

“Tomorrow (May 7) is the release of [April] inflation number. So if the reading will be too high, our easing will be postponed,” the BSP chief said.

READ: March inflation higher at 3.7% but still within gov’t target range

“Yes, there’s still leeway to [keep rates],” he added.

Article continues after this advertisementEarlier, the BSP said it projected inflation in April to have settled between 3.5 and 4.3 percent.

Article continues after this advertisementIf the upper end of the forecast range is realized, price growth last month would be faster than the 3.7 percent recorded in March. At the same time, inflation would overshoot the BSP’s 2 to 4 percent target band after staying within that range for four straight months.

Rice prices

The BSP said rice price gains likely remained a major contributor to inflation last month, with other key commodities like meat and gasoline also expected to have registered faster cost increases.

Remolona also expects unfavorable base effects to magnify the inflation reading in April.

The MB will meet on May 16 to review its policy stance. As Remolona telegraphed to the market, above-target inflation would likely prompt the BSP to delay any rate cuts to avoid upsetting inflation expectations, which “continued to be broadly anchored” based on highlights of the last Monetary Board meeting in April.

READ: BSP tipped to keep interest rates steady

The highlights of the previous meeting also said that growth prospects over the medium term “remained largely intact” even as overall economic activity “continues to gradually respond to tighter financial conditions,” indicating that the economy is still strong despite elevated borrowing costs that can crimp consumption and investments.

The policy rate, which banks use as a guide when charging interest on loans, is currently at 6.5 percent, the highest in 17 years. As it is, the first quarter gross domestic product numbers would be out by the time the MB convenes next week, with Remolona hoping for a 5.5 percent growth at the very least.

Moving forward, Remolona said the MB would likely start easing by 25 basis points (bps), adding that a higher reduction was unlikely for now. INQ