Japan’s finance minister issues strongest warning on yen weakness

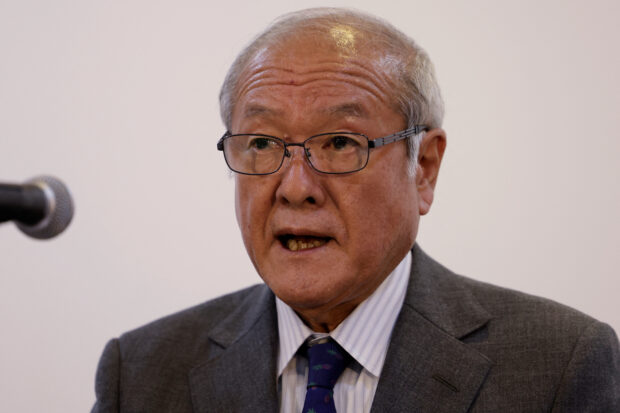

Japanese Finance Minister Shunichi Suzuki arrives for a news conference during the annual meeting of the International Monetary Fund and the World Bank, following last month’s deadly earthquake, in Marrakech, Morocco, Oct 13, 2023. REUTERS/Susana Vera

TOKYO — Japan’s finance minister issued his strongest warning to date about the weakness of the yen as the currency fell to a 34-year low against the dollar, saying authorities could take “decisive steps”, language previously used before intervention.

Shunichi Suzuki previously used the phrase “decisive steps” in autumn 2022 when Japan last intervened in the market to stem weakness in its currency.

Suzuki made the remarks on Wednesday shortly after the dollar spiked on strong U.S. data, nudging the Japanese yen to a 34-year low and into the zone that drew official market intervention in 2022.

The yen traded at 151.97 per dollar in the Asia session, down about 0.2 percent and weaker than 151.94 where Japanese authorities stepped in during October 2022 to buy the currency.

READ: Yen hits 34-year low ahead of key US inflation test

It hit the weakest level since the middle of 1990, around the time Japan’s asset bubble burst.

“Markets are I suppose, gingerly testing to see where’s the line for Tokyo,” said Christopher Wong, a currency strategist at OCBC in Singapore. “I think that the risk of intervention is quite high, because this is a new cycle high. And given the warnings so far, I think that if Tokyo (does) not act, it’s just going to encourage people to push (dollar/yen) a lot higher in the next few days.”

BOJ also closely watching forex moves

Suzuki said the government is closely watching market moves with a high sense of urgency following the yen’s fall.

Bank of Japan Governor Kazuo Ueda said the central bank would also keep a close eye on currency moves and their impact on economic and price developments.

“Currency moves are among factors that have a big impact on the economy and prices,” Ueda told parliament, when asked about the yen’s recent sharp declines.

READ: Japan says it won’t rule out any steps to stem weak yen

The weaker yen makes imports more expensive, fueling inflation, and makes exports from the world’s fourth largest economy cheaper.

The yen’s slide has continued unabated since Japan raised interest rates last week for the first time since 2007, marking a historic shift in monetary policy.

Factors weighing on the yen include its use in carry trades, where investors borrow in a currency with low interest rates and invest the proceeds in a higher-yielding currency. Japanese investors can also get much stronger returns abroad, depriving the yen of support from repatriation flows.

For the current quarter that ends later this week, the yen is the worst-performing major currency, down more than 7 percent on the dollar.