While emerging brands have made inroads capturing market share from established brands, many established consumer product brands continue to achieve success, according to American management consulting firm Bain & Company.

Bain studied the market share of established (also known as incumbent) consumer product brands in 23 product categories across 11 Asia-Pacific markets over a five-year period from 2018 to 2022.

Among 253 category and market combinations that Bain studied, large incumbent brands have lost market share —defined as losing more than 1-percentage point of market share in aggregate—in 44 percent of cases against emerging or insurgent brands.

Market share held steady in 28 percent of cases and those that won—or gained more than 1-percentage point of market share in aggregate—were seen in 27 percent of the cases.

There was no single category where incumbent brands lost share across every Asia-Pacific market; nor was there a single market where they lost share across all categories.

When looking at markets, Malaysia, the Philippines and India emerge as the top three most favorable markets for incumbents, while South Korea, Singapore and China had the most favorable environments for insurgents.

Insurgents are defined as upstart brands that have become a major thorn in the side of big consumer products by capturing a disproportionate share of growth and, in some cases, radically disrupting profit streams. Some of these brands have outpaced their category growth rates by more than 10 times in the past five years.

Winners, losersIn Malaysia, established incumbents won or maintained share in 74 percent of 23 categories that Bain tracked, whereas for South Korea, incumbent brands lost ground in 70 percent of the categories.

“The trend could be linked to the channel dynamics across markets. For example, the thriving e-commerce sector and well-established networks of third-party suppliers are making countries like South Korea particularly conducive for emerging consumer brands’ growth. On the other hand, the dominance of traditional trade and relatively low penetration of e-commerce make countries like the Philippines more favorable markets for established brands,” said Jichul Kang, head of Bain’s consumer products practice in South Korea.

Personal care sector

From a category perspective, Bain’s analysis revealed that the beauty and personal care sector was the most receptive to insurgent brands overall, in stark contrast to other sectors, including alcoholic and nonalcoholic beverages, food and home care.

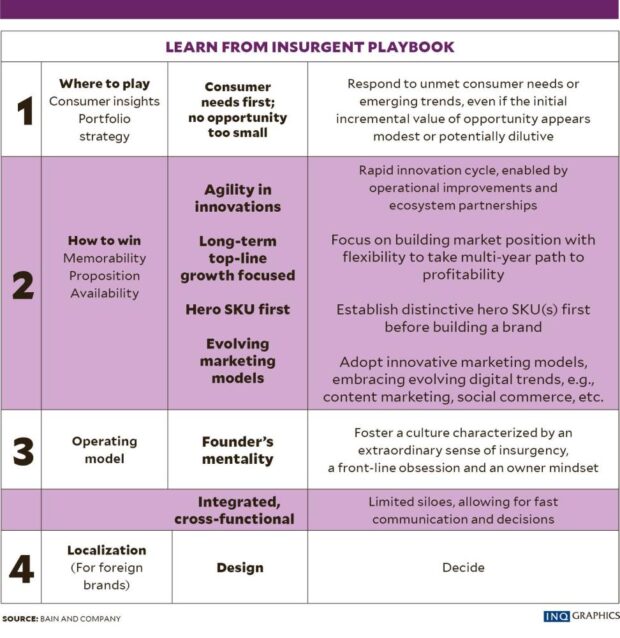

The report indicates that while market, category characteristics and macro situations contribute to the success of incumbents to some extent, what matters most is how they manage their categories and brands. Successful incumbent companies are adept at incorporating the most effective strategies from insurgent competitors while leveraging their inherent strengths. They have harnessed their scale to their advantage. They have skillfully navigated typical pitfalls, such as complexity and inertia that often beset large organizations. Additionally, they have shown a capacity for innovation, investment and execution.

For example, when driving portfolio growth, successful incumbents systematically search for unmet consumer needs and innovate based on emerging trends even when new prospects initially seem minor. Other successful incumbents adopt solutions that insurgents are trying to scale—solutions that resonate with consumers—and use their scale advantage to build distribution and brand awareness, and achieve cost-effectiveness quickly.

“Our study challenges the notion that insurgent brands universally disrupt incumbents. Many incumbents have successfully maintained or grown their market share amid tight competition. The successful incumbents thrived by blending their incumbent strengths and insurgent tactics, allowing them to counter threats and strengthen their market position effectively,” said Sydney-based David Zehner, head of Bain’s Asia-Pacific consumer products practice.