A-list-dominated PH bond market ready to welcome smaller firms

Underwriters and banks must also work to lure business from the “extremely large” universe of micro, small and medium-sized enterprises (MSMEs), apart from the usual A-list corporate names, Philippine Dealing & Exchange Corp. (PDEx) president Antonino Nakpil told reporters in an interview last week.

“There should be space for everybody within the different investment ratings. Just because they are not triple A or not double A does not mean these firms have bad credit. It should mean they are willing to pay higher yields, higher interest rates,” Nakpil said. “That’s why you want the capital market to develop, so capital will be accessible not just to family-owned conglomerates but [smaller] firms,” he added. Nakpil said there was room for smaller bond listings from companies with less than investment-grade ratings. The lowest-rated among these are known as junk bonds since these promise higher returns with more risk as the trade off.

“The underwriters have to be able to show us these names. For our part, there is no barrier put up by the exchange for lower rated firms to come in because we have no minimum credit ratings,” he said, adding that most of their issuers are from the country’s top 50 largest corporations. While the Philippine bond market continued to grow, Nakpil said peers in Southeast Asia were also expanding rapidly, which could push the Philippines to the bottom of the pile.

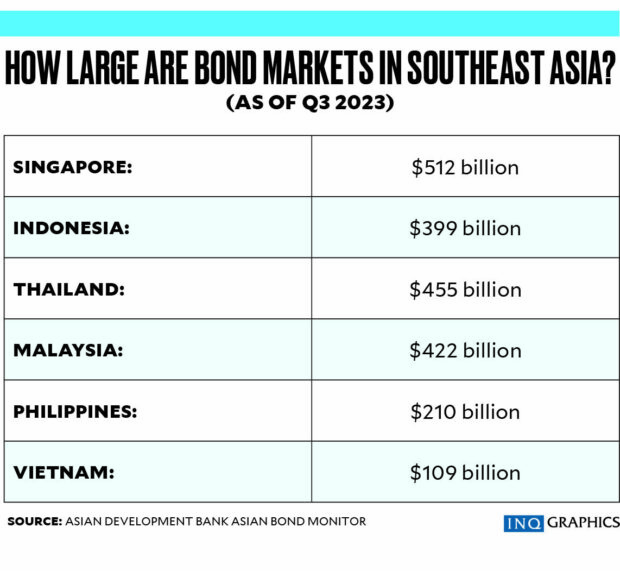

The latest Asian Bond Monitor by the Asian Development Bank showed the Philippines at fifth among six Southeast Asian economies when ranked by the size of their local currency bond markets as of the third quarter of 2023.

“We’re always saying we’re number five out six [countries in Southeast Asia], including Vietnam. But I think pretty soon, we will be number six,” Nakpil said.

Juan Paolo Colet, managing director at investment bank China Bank Capital Corp., said conservative bond investors might find it difficult to accept businesses with lower credit ratings.

“It will be very challenging to bring MSMEs to the bond market based on present realities. Local bond investors are generally conservative and may not feel comfortable with riskier issuers like MSMEs,” Colet told the Inquirer. “In addition, the issue size might be too small relative to the time, effort and cost involved in getting ready for and doing a bond transaction, so there is a question on whether it would make economic sense for both issuers and investment banks,” he added.

PDEx was projected to grow bond issuances this year to about P400 billion from P209 billion in 2023, Nakpil said. He said a large number of the amount would be driven by banks issuing debt for refinancing purposes.

Last month, Sy-led BDO Unibank completed the country’s biggest corporate debt issuance after raising P63.3 billion. This was followed by Gotianun-led Filinvest Development Corp., which raised P10 billion from its first domestic bond sale in a decade. INQ