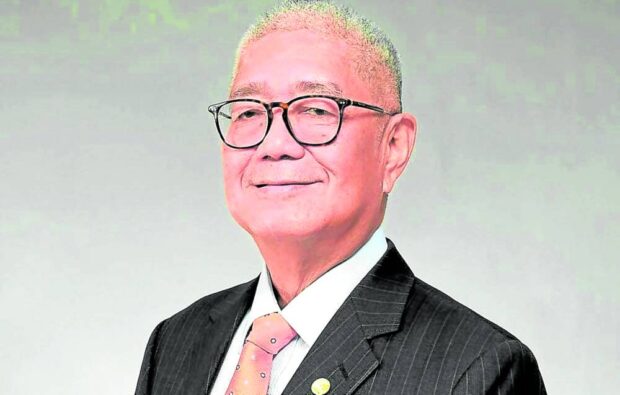

Remolona: PH to have digital currency in 2 years

The Philippines expects to put in place within the next two years a central bank digital currency (CBDC), taking its cue from peer regulators that have developed such digital tokens to compete with volatile cryptocurrencies as an alternative payment system and storer of value.

In a recent chat with business editors, Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. said the decision was to develop wholesale rather than retail CBDC for the local market. Blockchain or distributed ledger technology won’t be used, he added.

“Other central banks have tried blockchain but it didn’t go well,” he explained.

With “wholesale” CBDC, Remolona explained, “banks will be the only counterparties and then, retail will ride on them.”

The BSP believes that wholesale CBDC has the potential to improve the efficiency, safety and robustness of domestic and cross-border payments. It is seen to provide banks with another option, apart from reserves, to deposit money with the BSP for use in real-time interbank payments and settlements system.

Retail CBDC, on the other hand, could provide the general public with a credit risk-free alternative to deposits in private banks, independent back-up solution for electronic payment systems and a suitable legal tender to supplement or replace cash.

Clear limits

However, the BSP acknowledges that retail CBDC could risk disintermediation, accelerate bank runs in times of financial stress and further magnify central bank footprint.

“The decision is to limit it to wholesale—no retail,” Remolona said.

The BSP said wholesale CBDC would definitely happen within his term as governor and replied in the affirmative when asked if it was possible in two years.

“There are others that have done it, which we can replicate,” he said. “It’s [what the central banks will use] to rival cryptocurrencies.”

Cryptocurrencies, which operate outside the control of any government or regulatory authority, have become a new payment system and asset class of their own, especially luring tech-savvy young people around the world.

Remolona said the Philippines could learn from the Swedish experience on CBCD. The Riksbank is testing the use of e-krona as a digital complement to cash.

He noted that China is likewise “almost done” with its own e-CNY, or digital yuan project, mostly for domestic retail payments.

Risk of fraud

Asked what kind of technology the BSP would use for its CBDC if not blockchain, Remolona said it would use Philippine Payment and Settlement System, which is owned and operated by the local central bank.

Based on a study by Basel-based Bank for International Settlements (BIS), wholesale CBDC could help mitigate the risk of fraud and cyberattacks as its technology could improve the irrevocability of digital record-keeping.

Other central banks that have dabbled into wholesale CBDC real-time gross settlement include Bank of Canada, European Central Bank, Bank of Japan, Monetary Authority of Singapore and Bank of Thailand. Their experiments mainly succeeded in replicating existing large value payment systems; however, the results have not been superior to existing infrastructure, according to the BIS. INQ