Equities: Looking better but it’s still not the time to be greedy

Jumping back into stocks on a narrative of looming interest rate cuts might sound like a viable strategy but experts warn that risks abound, and they advise investors to instead go slow and wait for clearer signs that money is rotating back to equites.

“Borrowing a phrase from Lewis Carroll, we anticipate the Philippine equities market to delve deeper ‘down the rabbit hole” in 2024’,” says Mark Angeles, head of research at First Metro Securities.

“We highlight two main uncertainties for the market: when will tight monetary conditions moderate and to what extent/magnitude will the slowdown be? We think concerns on the former will be resolved first before the latter,” he tells the Inquirer.

Angeles says that their “base case” Philippine Stock Exchange Index (PSEi) target for 2024 is 6,700—a modest 4 percent increase from the 2023 year-end close of 6,450.04.

On the high side, First Metro Securities is looking at a year-end target of 7,400 or an increase of 14.7 percent over the previous year.

“Our expectation is for the Philippine equities market to chart a volatile path in the next 12 months. There will be market rallies driven by policy rate cuts,” says Angeles, who expects corporate earnings growth of 5 percent this year and 7 percent in 2025.

“However, history would tell us that these rallies are often short-lived and the market underperforms until a durable recovery takes hold. Therefore, we recommend staying cautious on policy rate cuts for now, and wait for signs of a cyclical recovery. In our view, patience and active/nimble management are key to outperformance,” he adds.

Baby steps

First Metro Securities’ PSEi targets are not far from some of its peers. COL Financial Group chief equity strategist April Lynn Tan sees the PSEi rising to around 7,100 this year, backed by corporate earnings growth of 10 percent.

Jonathan Ravelas, veteran forecaster and senior adviser at Reyes Tacandong & Co., also expects the PSEi to end the year at 7,100.

While more optimistic on the Philippine economy in 2024 and 2025, Ravelas says growth will not be linear and investors should be ready to embrace fear, uncertainty and disruption.

Meanwhile, Nicky Franco, head of research at stock brokerage house Abacus Securities, sees the PSEi reaching 7,800 in 2024.

“We believe this trend is going to continue in 2024 and we don’t think this has been captured in consensus earnings expectations,” Franco says in the recent briefing to clients.

The Philippines also lags emerging markets and regional peers when it comes to valuations, making domestic stocks more attractive when factoring in potential earnings upgrades, he adds.

Franco balances his outlook by advising investors to remain cautions and to approach the market by taking “baby steps.”

Fund flows

For one, he notes that foreign inflows will continue to remain soft while domestic retail investors shift their attention away from the stock market to the recent bitcoin rally.

He also expects a lag between the start of the Bangko Sentra ng Pilipinas monetary easing cycle versus the US Federal Reserve, which announced plans to cut interest rates this year.

Overall market volumes will improve over 2023 but likely remain below 2019, Franco says.

For her part, Tan is wary of external risks that could spoil hopes for what could be a decent year of returns in the stock market.

“The biggest challenge would be the weak economic outlook of developed economies led by the US. There is a significant risk that the US economy would suffer from a recession this year,” Tan says in an email to the Inquirer.

She adds that the risk of a recession has not been priced in after the S&P 500 recently touched a record high on optimistic over looming interest rate cuts.

“If a recession materializes, there is room for the US market to go down, and for it to drag other equity markets including the Philippines,” Tan adds.

Stock picks

While gambling companies and banks were some of the top performing plays in 2023, analysts are favoring more defensive and dividends-focused stocks this year.

For the rest of 2024, Tan favors the real estate investment trust (REIT) sector as well as power and consumer firms focused on non-discretionary or essential products.

Angeles’ top picks are Century Pacific Food Inc. (price target P34.50/ per share), Robinsons Land Corp. (P22.50), MREIT Inc. (P14.20), RL Commercial REIT (P5.70), PLDT Inc. (P1,430), Converge ICT Solutions (P13.3), Jollibee Foods Corp., (P300) and Universal Robina Corp. (P155).

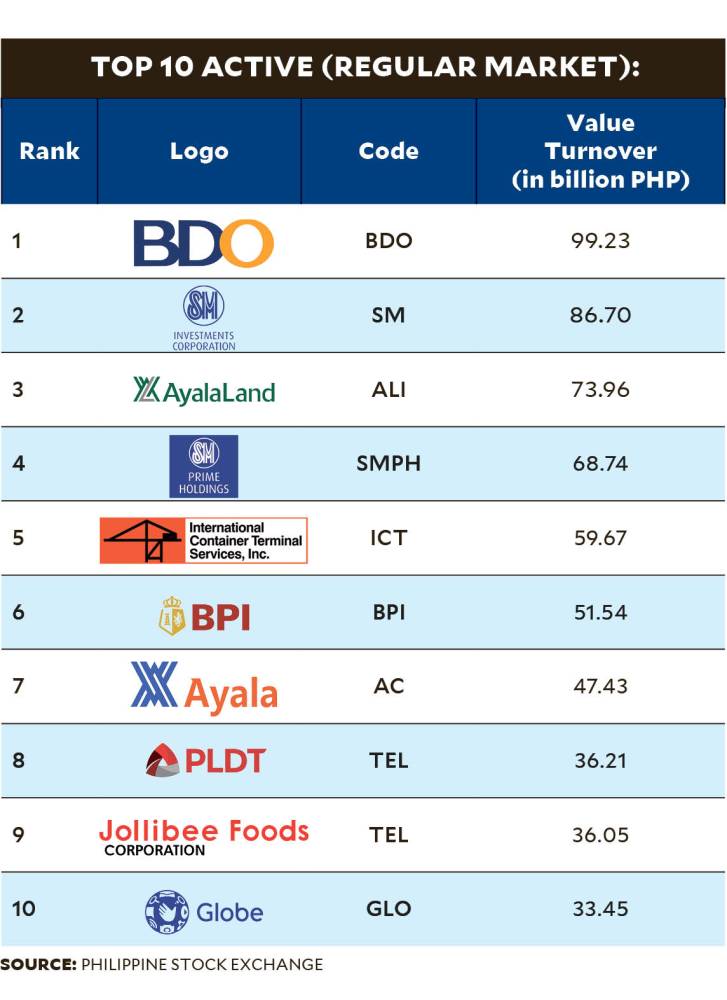

Franco’s top picks are SM Investments Corp., SM Prime Holdings Inc., Aboitiz Equity Ventures Inc., Monde Nissin Corp., GT Capital Holdings, Union Bank of the Philippines, D&L Industries Inc., Manila Water Co., SP New Energy Corp., and DigiPlus Interactive Corp.

The Philippine Stock Exchange (PSE) expects six initial public offerings (IPOs) this year worth around P40 billion versus three firms in 2023 that raised about P13 billion.

The PSE’s overall capital raising target for the year is P175 billion, which is a 24 percent increase over 2023.

Other IPOs candidates were waiting for interest rates to come down with the exception of tycoon Edgar Saavedra’s Citicore Renewable Energy Corp., which filed a P12.9 billion IPO for March this year.

“The ability of companies to raise funding through IPOs will depend on market conditions. If the equity market continues to go up, then it will be easier for companies to raise equity capital through IPOs,” Tan says.