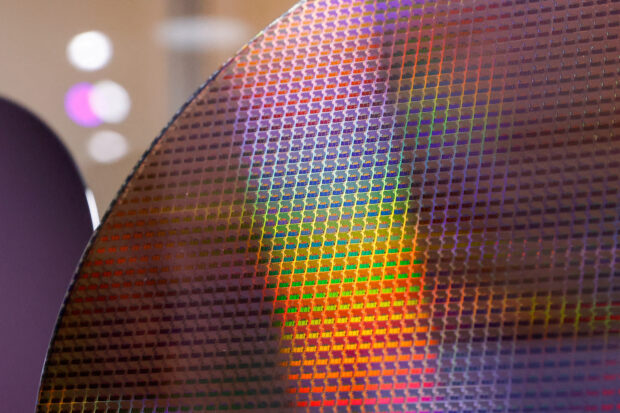

A wafer is pictured at Semicon Taiwan in Taipei, Taiwan Sept 6, 2023. REUTERS/Ann Wang/File photo

WASHINGTON – Last year, a veteran Silicon Valley software executive took the helm of a startup in his native China, company records show. The startup told potential investors it would sell microchip design software that is mostly available from just a handful of large Western companies.

The coveted and highly specialized software tool, known by its initials of OPC, is used in the design of many microchips and is crucial to the design of advanced chips.

The production of advanced chips is one of the most contentious technological struggles now dividing the United States and China as they vie for economic and military supremacy. Washington is trying to curb China’s access to sensitive microchip design tools.

The strategy behind the startup, dubbed Seida, shows why that containment effort is so challenging.

Before becoming chief executive of Seida, Liguo “Recoo” Zhang had lived in the United States long enough to secure permanent residency and purchase a Silicon Valley home, according to people familiar with his career and public records reviewed by Reuters.

He was employed by Siemens EDA, a U.S. unit of German industrial giant Siemens AG that dominates the market in China for the very technology Seida told investors it planned to sell there. At least three other Chinese-born colleagues from Siemens EDA joined Zhang at Seida.

In a 2022 business-plan presentation prepared for investors, Seida called OPC “indispensable technology” and said it would offer the tool by early 2024. A Chinese version of the product, Seida said, would “break through the foreign monopoly,” helping China become self-reliant in chip technology. Seida’s ultimate goal, according to one slide: “Become OPC leader in the world.”

The pitch attracted powerful Chinese investors.

One backer, recent corporate filings reviewed by Reuters show, is an investment arm of Semiconductor Manufacturing International Corp, or SMIC. The state-backed, Shanghai-based company is China’s leading maker of microchips. U.S. companies are restricted by Washington from providing technology to SMIC without a special license because its alleged work with China’s military is considered a threat to American national security.

SMIC didn’t respond to Reuters’ requests for comment about the investment or the U.S. restrictions.

On a recent visit to Seida’s headquarters in Hangzhou, in eastern China, a receptionist told Reuters that Zhang wasn’t available for an interview. In an email after the visit, Peilun “Allen” Chang, Seida’s chief operating officer, said the prospectus reviewed by Reuters is “obsolete.”

Alon Raphael (C), President and CEO of Femtometrix, is pictured with Dr. Tim Wong (R) and Mr. William Galvan at his laboratory in Los Angeles, California, U.S., Dec 15, 2023. REUTERS/Mario Anzuoni

The company’s objectives have evolved, he wrote, adding that its backers are primarily “private institutions and individuals.” Chang declined to specify how much capital Seida has raised or what products it now aims to pursue, saying its business plan remains “under continuous evaluation.”

Siemens EDA, in a statement, confirmed Zhang’s departure and that of three other colleagues. The company said it considers Seida “a potential competitor” but declined to comment further.

Reuters couldn’t determine whether Seida has progressed toward selling OPC, short for optical proximity correction. The software is commonly employed for the design of many microchips and is part of a broader set of technologies known as electronic design automation, or EDA. The tools can help design chips that could advance strategic new technologies like artificial intelligence, quantum computing and hypersonic flight.

Since Seida’s launch in October 2021, the U.S. government has increased efforts to curb China’s access to EDA tools, developed and sold mostly by American companies.

Through export controls and other restrictions, Washington aims to prevent China from obtaining know-how that could allow it to match microchip advances by the United States and its allies, including Taiwan, the self-governing island claimed by China and the world’s leading chip manufacturer.

READ: U.S. export ban on some advanced AI chips to hit almost all China tech majors – analysts

In email exchanges with Reuters, Chang said U.S. restrictions were one of the reasons Zhang and his colleagues left Siemens EDA for Seida to begin with. The restrictions, he wrote, limited their business opportunities at Siemens EDA, “diminishing scope for career advancement and involvement in key projects.”

Seida adheres to U.S. and Chinese rules, Chang added.

Neither Seida nor its executives have been accused of wrongdoing. And Reuters has no evidence Seida is using knowledge or technology that could be considered proprietary by Siemens EDA or others. Chang said Seida has “a stringent vetting process…ensuring no infringement upon the intellectual property of others.”

Experts in the sector, and people familiar with efforts by Beijing to outmaneuver U.S. curbs on technology transfer, say Seida’s launch follows a pattern of Chinese companies building upon foreign know-how. Even if the Seida executives didn’t take property from their previous employer, the technologies involved are so complex that only years of experience with existing purveyors would allow them to offer similar products.

READ: China quietly recruits overseas chip talent as US tightens curbs

“Developing OPC from scratch without access to any existing intellectual property would be challenging in this timeframe, to say the least,” said Jan-Peter Kleinhans, director of technology and geopolitics at Stiftung Neue Verantwortung, a Berlin think tank where he has researched China’s market for EDA tools.

The story of Seida, which hasn’t been previously reported, illustrates the challenges the West faces in thwarting Chinese development of advanced microchip technology. Despite Washington’s efforts to slow China’s acquisition of chip technology, Beijing is rushing to foster domestic development, attract expert expatriates to come home and overcome its lag in the sector.

A spokesperson for China’s foreign ministry said in a statement that the United States “abuses export control measures” and “applies illegal unilateral sanctions and long-arm jurisdiction to Chinese companies.”

China, the spokesperson added, has adopted laws to protect intellectual property and “complies with internationally accepted rules.” Technological advances in China, the statement continued, “are not the result of theft, nor of robbery, but are the result of Chinese people’s ingenuity and hard work.”

American officials have repeatedly said that Chinese efforts to secure Western technology pose one of the biggest long-term threats to the economy and security of the United States. They have expressed particular concern about China’s ability to employ advanced chips, and the powerful processors they enable, for its fast-growing military.

“At no point have export controls been more central to our national security,” Matthew Axelrod, assistant U.S. commerce secretary for export enforcement, said at a Congressional hearing in Washington this month.

The Chinese foreign ministry spokesperson said such concerns reflect “a Cold War and hegemonic mentality.”

While export rules may delay Beijing’s progress, industry experts say, they are unlikely to stunt China’s development of chip technology. “The U.S. is lying across the tracks in an effort to stop the Chinese, but it is just going to become a speed bump,” said Michael Bruck, a former general manager in China for chipmaker Intel Corp. “It will push China to be more independent.”

China’s government has made its drive for more sophisticated chips a centerpiece of its strategic plans.

Last year, after Washington announced new restrictions, Beijing said the government would spend $143 billion to spur China’s domestic chip sector. Through a separate program known as “Thousand Talents,” the government offers employment, housing, and other incentives for Chinese experts who return from science and tech jobs abroad.

READ: China plans $143-B push to boost domestic chips, compete with U.S. -sources

The program, in existence for more than a decade, has been criticized by Washington because it is viewed by some as a mechanism for China to illegally obtain intellectual property from abroad.

Last May, the U.S. Federal Bureau of Investigation arrested a California-based software engineer on trade secrets charges. In an FBI affidavit related to the case, investigators said the engineer, Liming Li, had stolen millions of files from two unidentified U.S. employers.

One of the employers, the affidavit shows, found a folder on Li’s laptop containing documents related to “Thousand Talents.” The pilfered company files, the FBI alleged, included unspecified materials related to “national security, nuclear nonproliferation and anti-terrorism.”

Li has pleaded not guilty. His attorney, Daniel Olmos, declined to comment.

Reuters this year has chronicled the race between the West and China for dominance in sectors ranging from killer robots to undersea cables to encryption of digital communications. The struggle for primacy in chipmaking will help determine who triumphs in these technologies and others that will become available once faster processors are developed to enable them.

“The limits of physics”

Since the 1950s, America’s pioneering of chip technology played a major role in the country’s creation of the world’s largest economy, powerful high-tech and financial sectors, and a thus-far unparalleled military. But China’s fast economic growth, and its stated ambition to assert its place as a global power, is now challenging that dominance.

In the Cold War, Washington blocked exports of some raw materials that Eastern Bloc countries could have used to develop weaponry. At the time, such measures succeeded because countries behind the Iron Curtain were already economically isolated.

Now, though, globalization has made most industries far more interconnected. Semiconductors, an approximately $600 billion a year business, are no exception. From raw materials to design to assembly, chips are a global industry.

“The United States is not going to be able to cut the Chinese off like we did the Soviets,” said James Andrew Lewis, director of the strategic technologies program at the Center for Strategic & International Studies, or CSIS, a Washington think tank.

An ambition both countries share is self-reliance in the manufacture of advanced microchips.

Although the United States still leads in many of the technologies needed to design chips, most of the actual printing and assembly happens in Asia. The United States relies heavily on South Korea for memory chips and Taiwan for logic chips. Memory chips store and retrieve information and logic chips process data and execute instructions.

Last year, the United States approved nearly $53 billion for “CHIPS for America,” a program, administered by the Commerce Department, that offers financial incentives to companies that can increase domestic production. Recipients of the incentives are restricted from sharing sensitive technologies with China and other countries not allied with the United States.

Among the challenges for China to create more advanced chips is access to EDA tools, such as the OPC software touted by Seida in early marketing.

Producing the fastest, most capable chips and circuit boards involves designing and printing them with billions of ever-smaller transistors. To achieve such microscopic connections, EDA helps lay out and verify the design of these circuits and simulate how they’ll perform under real-world conditions.

But EDA tools require intense processing power.

So specialized is the technology that some advances are marketed as scientific breakthroughs. NVIDIA Corp, the California-based company that is the leading supplier of chips for artificial intelligence, in March said recent advances in OPC technology would help it push the semiconductor industry “to the limits of physics.”

Despite U.S. export controls, China is making advances.

In 2019, the Commerce Department placed Huawei Technologies Co, the Chinese telecommunications giant, on its list of companies that can’t buy U.S. technologies unless the vendor obtains a special license. As with SMIC, blacklisted by the department a year later, the U.S. cited national security concerns.

“Our export controls on China are designed to massively slow down technology acquisition,” Thea D. Rozman Kendler, assistant commerce secretary for export administration, said at the recent Congressional hearing.

READ: US chip curbs give Huawei a chance to fill the Nvidia void in China

Still, Huawei in August introduced a new 5G smartphone with a sophisticated, seven-nanometer chip manufactured by SMIC. The phone, unveiled while U.S. Commerce Secretary Gina Raimondo was visiting China, was announced to great fanfare. The Commerce Department later said it is investigating whether the two companies relied on restricted U.S. technologies to develop the chip.

Huawei declined to comment.

Proving the source of some technologies can be challenging.

Many semiconductor advances build upon existing intellectual property. And the turnover of personnel within the industry, especially across international borders, can make it difficult to investigate export violations or pursue claims of intellectual property theft. “You can’t really control what’s in people’s brains with any export controls,” said Lewis of CSIS.

Alon Raphael, chief executive of a California company that sells a tool to detect semiconductor defects, said he learned that lesson the hard way. Until 2020, he said, FemtoMetrix Inc, was the sole supplier of the technology, which it spent a decade developing.

But late that year, Raphael said, Chongji Huang, a key employee, resigned and emerged later in China with a Shanghai-based startup that offers a similar product. “I had heard these kinds of stories,” Raphael told Reuters, “but I said to myself, ‘No, not that guy, he’s my friend.'”

Late last year, FemtoMetrix filed suit in California against the startup. Robert Shwarts, an attorney representing Huang and his startup, Weichong Semiconductor Group, told Reuters that neither Huang nor the startup took anything from FemtoMetrix, nor did they violate any trade secrets.

“Enable chip success” NABLE CHIP SUCCESS”

Seida, the startup managed by Siemens EDA veterans, is one of many Chinese tech startups founded in recent years to meet Beijing’s call for a stronger domestic semiconductor industry.

The proliferation can be hard to track.

Recent changes to Chinese regulations restrict access to company registries. Reuters couldn’t determine whether China’s government had any role in Seida’s launch or whether Zhang, the chief executive, or his colleagues received any state incentives to leave Siemens EDA and work there.

Reporters reviewed some of Seida’s corporate filings with the help of two companies that collect and analyze Chinese business records – Datenna, of the Netherlands, and Global Data Risk, based in New York. Combined with interviews and public records, the filings, dating back to October 2021, enabled Reuters to piece together some of Seida’s history so far.

Seida, the filings show, is majority-owned by partnerships now controlled by Zhang and some of the former Siemens EDA colleagues who joined him. It isn’t clear when those partnerships were established or by whom. Records show the partnerships invested in Seida in November 2021 – weeks after the startup’s launch and before Zhang left Siemens EDA.

Zhang’s path toward Seida began at Mentor Graphics Corp, the predecessor company to Siemens EDA, acquired by Munich-based Siemens in 2017. Mentor, started in Oregon in 1981, was an early innovator of EDA and eventually became one of three U.S. companies that sell most of the software worldwide. By the time of its acquisition, Mentor boasted annual revenues of $1.2 billion.

With a masters degree in microelectronics from a Shanghai university, Zhang worked for more than a decade at Mentor and Siemens EDA, according to Seida’s 2022 presentation to investors. Before joining the startup, he was a Siemens EDA product director.

Zhang is now 44 years old, according to U.S. and Chinese records. He became chief executive of SEIDA in July 2022, according to the Seida filings.

Reuters found that at least three other Chinese-born colleagues who joined Zhang were also longtime employees of Siemens EDA. Two of them, Zhitang “Tim” Yu and Yun Fei “Jack” Deng, earned doctorates from U.S. universities, academic records show. Born in China, Yu is also an American citizen, according to U.S. records. Deng, also born in China, obtained legal permanent resident status in the United States.

Seida declined to make Deng or Yu available for interviews.

Under the new export restrictions, U.S. citizens and permanent residents can face penalties if they help Chinese companies develop or manufacture advanced chips without a license. Those penalties can include citations, fines or prison time, depending on the violation.

Chang, the chief operating officer, said by email: “We continuously monitor both emerging and existing regulations to ensure our operations align with applicable legal standards.”

As they sought investors last year, Seida executives aimed high. In the 2022 slideshow, they projected the company could be worth as much as 700 million yuan, or $99 million, by the end of last year. By 2026, they said, Seida hoped to sell shares to the public.

Their efforts attracted at least one important backer.

In June 2023, Seida received undisclosed funding from China Fortune-Tech Capital Co, or CFTC, an investment vehicle owned by chipmaker SMIC, according to records compiled by Datenna and PitchBook Data Inc, a U.S.-based corporate research company. CFTC didn’t respond to requests for comment.

Seida continues to secure investors. This month, according to its corporate filings, five more investors, including four Chinese venture capital firms, acquired stakes in the company.

Chang wouldn’t say if the ongoing review of Seida’s business plan means a departure from its early marketing of OPC. “Due to the confidential nature of our business strategies, specific details of our current and future plans cannot be disclosed,” Chang wrote.

During Reuters’ visit to Seida headquarters, the reception desk bore the same branding as the early fundraising presentation.

The Seida name, according to the slideshow, is an acronym for “Semiconductor Intelligent Design Automation.” Its slogan, in the branding and on Seida’s website, translates to “enable chip success.”