The Monetary Board (MB) has temporarily allowed extra lending capability for banks as well as reduced the reserve requirement rate on sustainable bonds issued by them, as part of efforts to mainstream sustainable finance.

Through these, banks are allowed to extend loans for eligible green or sustainable projects or activities with a top-up 15 percent single borrower’s limit (SBL).

Eligible projects or activities must meet any of the principles or eligible categories of projects as laid out in the 2022 Strategic Investment Priority Plan on Green Ecosystems, Health and Food Security or in the national government’s Sustainable Finance Framework.

They must also meet such principles as spelled out in the Philippine Sustainable Finance Guiding Principles; Asean (Association of Southeast Asian Nations) Taxonomy for Sustainable Finance; or Philippine Sustainable Finance Taxonomy Guidelines.

Sustainable finance champion

The Bangko Sentral ng Pilipinas (BSP) said in a statement these represented additional temporary measures to encourage banks to extend loans or finance investments for green or sustainable projects or activities, including transition financing for decarbonization.

Also, these measures form part of the suite of initiatives under the BSP’s 11-point Sustainable Central Banking Strategy to support the achievement of the country’s climate commitments and sustainable development goals.

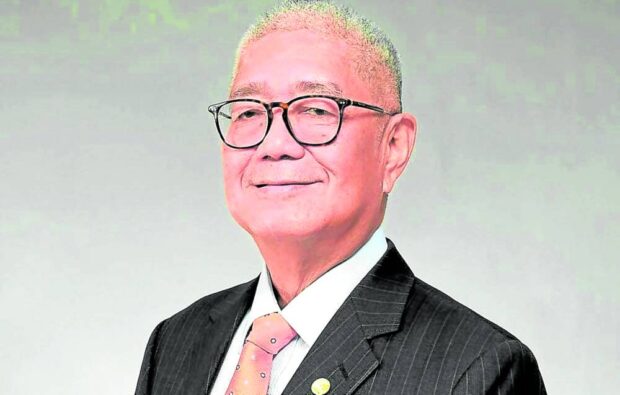

BSP Governor Eli Remolona Jr. said that as a sustainable finance champion, the central bank will continue to play an active, enabling role in fostering the transition toward a sustainable economy.

“We will identify and create appropriate incentives that are within our mandates, empowering the banking system to steer capital flows toward growing green or sustainable investments and accelerate the development of solutions addressing just transition and adaptation-related challenges,” Remolona said.

Risk management

Further, banks are expected to adhere to the credit risk management guidelines, including the management of credit concentration risk, as well as adopt controls to protect their financial interest like the use of insurance or negative pledge covenant.

Meanwhile, the applicable reserve requirement rate for green, social, sustainability or other sustainable bonds issued by banks will be gradually reduced to zero percent from the current 3 percent.

There will be a 2-percentage-point or 200-basis point reduction in the first year from effectivity of the policy, which is 15 days upon publication in the Official Gazette or in a newspaper of general circulation.

Following that is an additional one-percentage-point or 100-basis point reduction in the succeeding year for another 12 months. Both measures — extended lending capacity and reduced reserve requirement — will be available to banks for a period of two years, and may be further reviewed as needed.

The BSP said that based on an ad hoc survey, three in every four respondent universal and commercial banks have financed or approved loans that support green or sustainable projects, totaling at P830 billion and $14 million as of end-June 2022.

This amount represents about 7 percent of the Philippine banking system’s total loan portfolio.

The top five sustainable activities or projects supported by these banks are renewable energy, sustainable water and wastewater management, energy efficiency and green buildings.