Written by: Vaughn Alviar

Filipinos increasingly prefer virtual banking, a development that could foster greater financial inclusion in the Philippines.

That was among the major findings of the latest Consumer Payment Attitudes (CPA) Study of Visa.

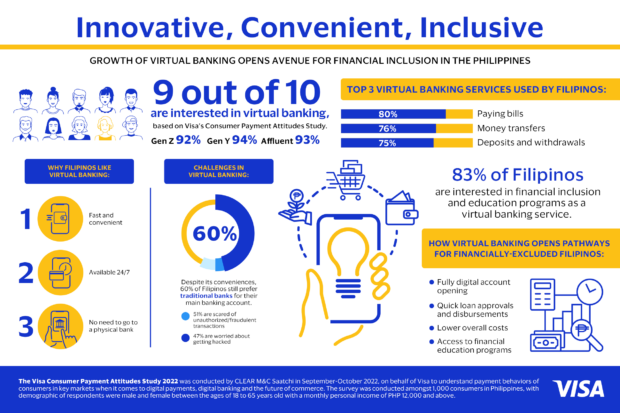

Virtual banking, also called digital, “Web-only” or neo banking, is a new form of banking in which services are provided online. According to the study, which surveyed 1,000 Filipinos, consumers would use it for services such as paying bills (80 percent), money transfers (76 percent), deposits and withdrawals (75 percent), and making payments for purchases at retail locations (63 percent), among others.

This mode of banking became popular during the pandemic riding on an already growing interest in and the practicality of cashless and contactless transactions amid the lockdowns and safety protocols.

The latest CPA Study, which interviewed Filipino consumers aged 18 to 65 years old from September to October in 2022, found that 91 percent were interested in virtual banking. In contrast, the numbers for 2020 and 2021 were at 81 and 88 percent, respectively.

“We anticipate that with the ongoing rally toward the digitalization of the banking industry, virtual banking will consistently gain prevalence in terms of awareness, interest, and usage,” said Jeff Navarro, country manager for the Philippines at Visa.

Visa, a recognized name and world leader in digital payments, conducts the CPA Study annually to understand payment behaviors of consumers relating to digital payments, digital banking and the future of commerce.

Virtual banking and the road to financial inclusion

Consumers acknowledged virtual banking as a safer and more convenient way of banking. They didn’t need to head over to a physical bank, and banking hours and days no longer apply.

With their financial information available in the digital space within their mobile gadgets, Filipino consumers were able to monitor and manage their finances better and were immediately notified of transactions. Finally, virtual banking was perceived as one of the most eco-friendly payment solutions.

The increasing preference for virtual banking “is a testament to the growing preference among Filipinos for safe and convenient transactions. As consumers realize the benefits of cashless options such as mobile wallets and cards, we are witnessing a progressive shift towards a cash-lite society in the Philippines,” said Navarro.

Filipinos also see digital banks as one of the top five sources of financial advice. In fact, 83 percent of Filipinos would be interested to look at financial inclusion and education programs as one type of virtual banking service.

This only goes to show that higher adoption of virtual banking methods could contribute to better financial inclusion among Filipinos. Aside from its capability to serve as an effective financial education platform, it offers consumers, especially the unbanked, the convenience of opening an account digitally. Overall costs are also lower, and loan applications can be easily filed and approved.

Financial inclusion, according to the World Bank, “means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.”

“…Our goal is to convert 50 percent of the total volume of retail payments into digital form and to onboard 70 percent of Filipino adults to the formal financial system,” said Bangko Sentral ng Pilipinas Governor Eli. M. Remolona Jr. in a message at the Second Digital Financial Inclusion Awards on Oct. 24, 2023.

In the same speech, he revealed that account ownership among Filipinos was at 65% in 2022, just 5 points short of the 2023 target.

The rapid growth of financial technology innovations, including digital banking, has helped raise these numbers. Ensuring that trends would remain positive, the government has ensured that those new tools would benefit the people, introducing new digital banking licenses, setting up a real-time payments system and establishing a standardized QR network, among others.

Challenges in virtual banking

There remain obstacles, however, at least two of which were captured by the study.

Some 60 percent of Filipinos still preferred traditional banks as their main banking channel largely because they perceived their money would be safer there. Furthermore, traditional banks could offer good customer service and a more pleasant overall experience.

Up to 51 percent of Filipinos were concerned that virtual banking might lead to unauthorized or fraudulent transactions. Some 47 percent fear the possibility of hacking.

BSP added that some Filipinos still had no access to mobile phones and even signal coverage, prerequisites of mobile banking. As such, stakeholders are ensuring that these hurdles are addressed, and mobile banking services are maximized for inclusive financial education in the country.

BSP is taking a careful approach to consumer protection from fraud, among these the enforcement of the SIM Registration Act and the massive cybersecurity education.

Continuing the call for financial inclusion

Visa is also taking part in that goal, in the name of greater financial inclusion.

Actively contributing to the growth of virtual banking in the country and raising confidence in it, Visa has continuously expanded its partnerships with institutions with prominent virtual banking facilities, the most recent ones being with GCash, CIMB Bank, UnionBank, EastWest Bank, and Maya.

Navarro added: “Visa is committed to continue educating and ensuring with all stakeholders that Filipinos have secure, seamless and convenient digital payment solutions readily on hand.”

To know more about Visa, please visit www.visa.com.ph.

ADVT.