LIVING THE HIGH LIFE Looking ahead to 2030, solid economic fundamentals are poised to continue to drive the growth of the luxury market, despite possible bumps along the route. —BAIN & COMPANY WITH ALTAGAMMA

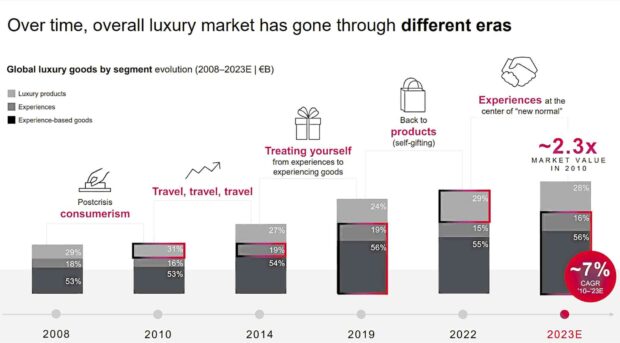

Amid global economic challenges, political unrest and armed conflicts, consumers have shown that their desire to live the high life has not waned and is actually stronger than ever, with the luxury sector projected to grow 8 percent to 10 percent this year to reach 1.5 trillion euros.

This is the key finding of “Long Live Luxury: Converge to Expand through Turbulence,” the latest worldwide market study by Bain & Company with Altagamma, an association of Italian luxury goods manufacturers. The insights are based on Bain’s triangulation of information and sources, as of November 10, which include macroeconomic data (e.g., gross domestic product, consumer confidence index) and the latest forecasts; current trading performance from relevant luxury industry players; annual reports, quarterly results, and analyst reports; and over 100 expert interviews.

Luxury experiences are driving the growth, the report states, with spending reaching “historical highs” this year, driven by “a sense of urgency for social life and travels.”

Growth is projected to be at 13 percent to 15 percent for luxury hospitality and cruises, above prepandemic levels of 3 percent to 5 percent. Moreover, consumers are seeking “unique, personalized, and transformative” experiences, to disconnect from the everyday mundane. Comfort, service, and privacy are also top on consumers’ travel wish list.

Fine wine and fine dining are also experiencing mild and strong growth, respectively, especially among today’s younger generation, the report states.

From a regional perspective, the study shows that Europe has enjoyed a progressive pickup in tourism, driving growth across countries, with long-haul resort locations attracting high spenders alongside key luxury cities. Even if local aspirational customers were impacted by macroeconomic instability, stable top-customer pools maintained positive momentum contributing to market growth.

Alternatively, the Americas have seen a deceleration throughout the year, posting an 8-percent drop from 2022, as widespread uncertainty continues to impact aspirational customers’ spending. Top customers remain confident but have maintained their spending abroad, as the US dollar remains strong against the euro and price differentials favor overseas purchases.

Saudi Arabia, meanwhile, is accelerating, attracting investments of major luxury brands; and Australia has provided fertile ground for growth.

Mainland China posted a strong performance after its first quarter reopening but slowed progressively as new macroeconomic topics arose. Hainan is poised to grow as a bright luxury hub, set to become an entire duty-free island by 2025. Japan is booming, thanks to sound local customers and the weak yen, favoring touristic inflows.

Conversely, South Korea is facing a challenging year, with unfavorable macroeconomic headwinds impacting local consumption and strong currency leading tourists to buy elsewhere.

Southeast Asian countries experienced positive momentum amid strong intraregional tourism and growing interest from local consumers, especially in Thailand.

The quest for ‘monobrand’ stores

The study also shows all other luxury categories achieving growth, favored by continued price elevation.

Fueled by an investment mindset, jewelry is set to reach 30 billion euros in market value in 2023, with fine jewelry affirming itself as a bright spot for investments amid uncertainty. Ready-to-wear is showing positive growth, favored by top spenders on the ultra-high offer, with unfolding demand for excellence and durability.

Beauty, driven by make-up and fragrances, is enjoying positive momentum, favored by the emerging lipstick effect in the Americas and Europe. Watches continue to thrive, despite a rising polarization around few industry winners.

And after overperformance in recent years, growth in leather goods is slowing.

Monobrand retailers, or stores that exclusively sell products of a specific brand, are leading in the distribution ecosystem, favored by consumers’ quest for physical experiences and the increasing role of “clienteling,” or establishing long-term relationships with customers, in sales.

Physical and digital experiences are also increasingly blending, requiring brands to deliver excellence in the experience across the whole consumer journey. Conversely, multibrand environments suffered sharp slowdown in both department and specialty stores. They now have to face questions on how to evolve their value proposition to best serve consumers’ needs.

CHANGING TASTES From a generational standpoint, luxury brands must navigate through rising multigenerational complexity to serve different needs across the consumer base. Also, brands will have to focus on providing differentiation and meaningful experiences across the whole customer journey.

“This is a defining moment for brands, and the winners will separate themselves through resilience, relevance, and renewal—the basics of the new value-centered luxury equation,” said Claudia D’Arpizio, a Bain & Company partner and leader of Bain’s global Luxury Goods and Fashion practice, the lead author of the study. “The luxury market is generating positive growth for 65 percent to 70 percent of brands in 2023, compared to 95 percent in 2022. To stay in the game, it will be crucial for brands to take bold decisions on behalf of their customers.”

Luxury in 2030

Looking ahead to 2030, solid fundamentals are poised to continue to drive market growth, despite possible bumps along the route.

Chinese customers will account for 35 percent to 40 percent of the personal luxury goods market, while Europeans and Americans together will represent 40 percent. From a generational standpoint, brands must navigate through rising multigenerational complexity to serve different needs across the consumer base. Generation X and Y are in their peak income years, representing the bulk of luxury purchases and the key pool of income growth in the near future. However, Generation Z is positioned at the forefront of social and cultural change, inspiring other generations’ value systems, with a strong desire for lived experiences and quest for meaning.

By 2030, Gen Z will account for 25 percent to 30 percent of luxury market purchases, while millennials will account for 50 percent to 55 percent.

Finally, online and monobrand channels are expected to account for two-thirds of the entire market by 2030. In this context, brands will have to focus on providing differentiation and meaningful experiences across the whole customer journey, regardless of the touchpoint of interaction. Leading on sustainability and embracing tech will be key.

“The market is set for long-term growth, rooted on strong fundamentals,” says Federica Levato, partner at Bain & Company and leader of the firm’s EMEA Luxury Goods and Fashion practice, co-author of the report.

“Capturing and amplifying the market potential will be key, as the clear convergence among luxury markets allows for further expansion. Players have the opportunity, but also the responsibility, to reinforce their meaning, while leveraging strategic [mergers and acquisitions] to redefine the boundaries of the industry. These will be foundational drivers for growth in the future.”