The expansion of the Philippine economy is seen to pick up pace in 2024 after slowing down this year, though still among the fastest-growing Asian markets, amid improving prospects worldwide and in the region.

For this year and next, the Philippines’ performance reflects global and Asian developments.

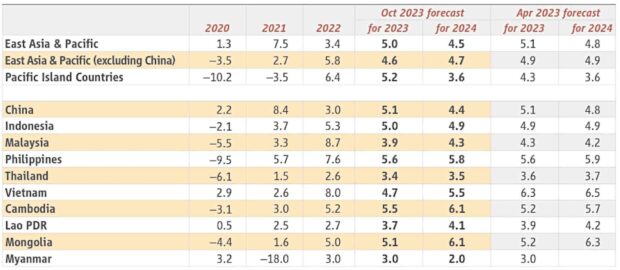

According to the World Bank, growth in East Asia and the Pacific in 2023 will be higher than average growth projected for all other emerging market and developing economies, albeit lower than previously projected.

The multilateral lender’s latest outlook, as of October, put Philippine gross domestic product (GDP) growth at 5.6 percent for 2023. This was lowered from the World Bank’s forecast of 5.9 percent stated last April, and farther down from the government’s target growth of at least 6 percent.

Also, the World Bank expects economic expansion across the region to edge up in 2024, as recovery in global growth and easing of financial conditions offsets the impact of slowing growth in China and trade policy measures in other countries.

On the other hand, an intensification of geopolitical tensions and the possibility of natural disasters, including extreme weather events, are seen as additional downside risks to the region’s economic outlook.

The World Bank penciled in a faster growth of 5.8 percent for the Philippines in 2024, albeit lowered from the April forecast of 5.9 percent.

Manuela Ferro, World Bank vice president for East Asia and the Pacific, said in October that the region remained one of the fastest growing and most dynamic regions in the world, even if growth is moderating.

Ferro said that sustaining high growth will require reforms to maintain industrial competitiveness, diversify trading partners and unleash the productivity-enhancing and job-creating potential of the services sector.

The World Bank noted that the diffusion of digital technologies and services reforms are improving economic performance. In the Philippines, the adoption of software and data analytics among businesses increased the productivity of firms by 1.5 percent on average over the period 2010-2019.

Also, the elimination of such barriers led to a 3.1-percent increase in labor productivity in the manufacturing enterprises that use these services, benefiting small and medium private enterprises most significantly.

Meanwhile, the International Monetary Fund said the global recovery from the COVID-19 pandemic and Russia’s invasion of Ukraine remained slow and uneven.

The IMF said in its own update that global economic activity still falls short of its prepandemic path, especially in emerging market and developing economies.

Some factors that hold back recovery reflect the long-term consequences of the pandemic, the war in Ukraine, and increasing geoeconomic fragmentation.

Other factors are more cyclical in nature, including the effects of monetary policy tightening necessary to reduce inflation, withdrawal of fiscal support amid high debt, and extreme weather events.

Considering these, the IMF downscaled its 2023 forecast for the Philippines to 5.3 percent from 6 percent in April. On the other hand, the forecast for 2024 was raised to 5.9 percent from 5.8 percent.

On the other hand, BofA Securities said in a research note issued on Nov. 9 that it raised their estimate for 2023 to 5.4 percent from 4.8 percent previously.

“We think the surge in government spending seen in [third quarter of 2023] may not extend into [the fourth quarter] given the constraint posed by the budget and the fiscal deficit,” Bofa said.

The American group also raised its forecast for 2024, 5.4 percent from 5 percent, based on “mild adjustments” to consumption, government spending and trade.

According to Finance Secretary Benjamin Diokno, growth in the fourth quarter of 2023 will be supported by the continued acceleration of government spending and the rebound in manufacturing activities given the improved global economic outlook for the year.

Diokno said easing inflation was expected to help domestic demand propel the economy closer to the low end of the growth target, referring to 6 percent.

He added that the continued decline of the unemployment rate and the improvement in the quality of jobs will help drive economic growth.

National government expenditure is also expected to further improve in the last quarter of 2023 as the government continues to accelerate the implementation of programs and projects, particularly on infrastructure.

Further, the better-than-expected global economic growth in the first half of the year and the improved global economic outlook will help boost the growth of the country’s manufacturing and export sectors

“The improving outlook for inflation, strong fiscal position, sound external conditions, and robust labor market, among other positive indicators, should pave the way for the expansion of activities of businesses, households, and the rest of the private sector,” Diokno said.

INQ