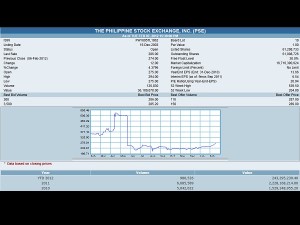

Philippine Stocks Exchange index as of Tuesday, February 07, 2012 15:30:00 PM. Taken from pse.com.ph

MANILA, Philippines—The local stock index fell below the 4,800-mark on Tuesday due to profit-taking and fresh concerns over Greece’s debt.

The main-share Philippine Stock Exchange index shed 60.35 points, or 1.25 percent, to finish at 4,755.98 as all counters ended in negative territory.

The day’s downturn battered the mining/oil index the most as its counter fell by 2.7 percent. The financial, property and services sub-indices likewise dropped by over 1 percent.

Turnover amounted to P7.5 billion.

There were 61 advancers against 118 decliners while 36 stocks were unchanged.

The index was weighed down most by PLDT, BDO, AGI, SMPH, EDC, Metrobank, BPI, JG, Semirara, Megaworld and AC.

SM Investments, Security Bank and ALI bucked the day’s decline. NiHao also outperformed the market, rising by 11.8 percent to P10.06 per share.

As fresh concerns over Greece replaced the euphoria over the upbeat US jobs data, investors found a good excuse to pocket gains from the local market. The PSEi had hit a record intra-day high of 4,855 on Monday.

“Asian markets have been consolidating with focus back on the Greek debt talk, after the excitement surrounding the NFP (non-farm payrolls in the US),” said Frances Cheung, senior strategist for emerging Asia at Credit Agricole CIB.

Investor sentiment across equities markets in the region was weak as Greek political leaders haggled over the details of a cost-cutting package required to be able to tap the $170-billion bailout money from international creditors.

But Asian assets were still finding good support, Cheung said, suggesting that the hit on sentiment had not been severe.