Trick or treat: A beginner’s guide to scam- and spook-free investing

If you’re ready to join the ranks of wise investors, just pay a visit to www.firstmetrosec.com and to ensure a swift initiation into the world of invest- ing, don’t forget to use ‘INQUIRER PROPERTY’ as your account opening code.

Investing is like navigating a haunted house—it can be full of twists and turns, and you never quite know what’s lurking in the shadows.

In today’s world, there’s no shortage of options to grow your money—stocks, bonds, mutual funds, UITFs, ETFs, REITs and of course, real property. But beware, for just as in a haunted house, there are those who aim to scare you out of your hard-earned cash with promises of enchanting returns.

So, how can you tell if an investment is a trick or a treat? These four red flags should send shivers down your spine and make you think twice before parting with your money:

Risk-free or a grave mistake?

No matter how conservative the instrument is, all investments carry some form of risk. Even government debt securities like Treasury bonds have risk, because there’s still the possibility (even if the chances are really low) that the government won’t be able to repay its debt for some reason.

That’s a fact which you have to accept if you want to start investing. It’s also why, if you take a risk assessment and find that you’re risk-averse, you won’t be able to start investing—at least, not yet. This is one safety net most investment companies employ to help newbie investors choose the perfect vehicle aligned with their investment experience.

Always remember that if you are being offered an investment product or a business opportunity that claims to be 100 percent free from risk, that’s a definite red flag.

Any legitimate broker or agent would always be upfront about the risks that your money would face if you invested it in that product, because they want you to make informed decisions. That’s also the benefit of seeking guidance from investment professionals—you are ensured that you are going to get a crash course on investing minus the sales talk.

Guaranteed returns, or just smoke and mirrors?

Beware of promises that sound too good to be true. There are investments that can make you money, but remember, even the most successful investors started from scratch and knew what they were doing.

High returns often come with high risks, and some investments are like roller coasters, with no guaranteed safety bar. If it seems too easy, it’s probably a ghostly illusion.

Doubling your money without having to do anything. Growing your money three-folds in a short span of time. Making millions simply by recruiting at least two fellow investors.

These are just some of the many reasons why people end up getting victimized by investment scammers. Because they promise a lot of money and require very little to no activity from you. All you need to do is trust them. Operative word being “trust”.

Of course, there are instruments which can potentially double or triple your money. Some people can really make millions without having to do anything. But you have to understand that in order for them to be able to enjoy those, at some point, they had to start from scratch, and made sure they understood what they’re getting themselves into.

Real estate, considered as a time-tested investment vehicle, can give you hefty returns—but you will have to wait for it to appreciate in value.

Fixed-income securities can get you two sources of income—they can get you capital appreciation and guaranteed periodic coupon payments, making your income predictable but also limiting the amount that you can earn.

Finding bonds with coupons that effectively double your money in a very short time is impossible. After all, this sort of debt would end up being troublesome for the borrowing company or organization, and so none of them offer coupons that big.

There are volatile outlets out there whose value can go up and down fast, and whose returns are never guaranteed.

So if you see an investment that guarantees huge returns without any risk, you can consider this as another red flag.

Invest now, or the investing boogeyman will get you?

While a little nudge to invest can be helpful, being pressured to make quick decisions is like a jump scare in a horror movie.

Having someone, whether an actual person or an app, to help you invest is usually a good thing. However, it can be bad if you start feeling pressured to put your money in right here, right now.

It just makes the investor more vulnerable to making bad decisions because they are not given enough time to contemplate, research, verify or talk to somebody about a milestone as important as investing money.

Making the decision to invest is a big one. After all, you’ll be using your hard-earned money, and you can never be 100 percent sure that it’ll grow as much as you expect it to (or even at all). Putting pressure on you can make you rush the choice that you make, which you may end up regretting later on.

Legitimate brokers give you time to think, research, ask questions and discuss with your family and friends before signing the dotted line. Rushed decisions can lead to financial nightmares, and any investment that pushes you into a hasty choice is another red flag waving in the moonlight.

On the other hand, high-pressure tactics are common among unscrupulous people who just want your money. This is another investing red flag to watch out for.

The disappearing license: unregistered investment companies

The financial world is like a well-regulated Halloween party, overseen by the likes of the Bangko Sentral ng Pilipinas (BSP), Securities and Exchange Commission (SEC), the Insurance Commission (IC), the Philippine Stock Exchange (PSE) and Housing and Land Use Regulatory Board (HLURB). These regulatory bodies ensure that investment companies play by the rules and don’t haunt your finances.

Banks, investment companies, and stock brokerages are among the businesses in the financial services industry that offer investment products. This means that they have to follow strict guidelines which are meant to keep customers safe.

Only invest through companies that are licensed to operate and to offer such products. That way, you’ll be confident that your money will be looked after, and that you’ll have a regulator to run for help in case you really need it.

Unregistered investment companies are like uninvited guests at the party; they’re best avoided.

That’s why in order for you to be one step ahead of perpetrators, I am sharing with you the top 5 investment scams here in the Philippines today.Ponzi scheme. This scheme got its name from the person who, on record, devised such a scheme back in the 20th century. It’s an investment scheme promising high returns to attract investors. But what it does is to use the capital from new investors to make the old investors believe that they are legitimately making money.

These pioneers, who are now able to recover a good amount of their initial capital, will now have extra motivation to invest a larger amount of money. The scheme relies on a continuous influx of new investments to maintain the illusion of profitability. Ultimately, when new investments dry up, or too many investors try to cash out, the scheme collapses, and most investors lose their money.

Pyramid scheme. A pyramid scheme is a form of investment scam where investors are promised high returns simply by recruiting others to invest in the business, rather than through legitimate operational activities or product sales.

Participants are often required to make an upfront payment to join. The scheme typically takes the shape of a pyramid, with the original recruiter at the top (Upline), a few people below them (Downlines), and a growing number of participants as you move down the levels.

As the scheme expands, it becomes unsustainable because it requires an ever-increasing number of recruits to pay off those above them.

Ultimately, only the few at the top benefit, and most participants lose their money when the scheme collapses. Pyramid schemes are illegal in many countries due to their exploitative and unsustainable nature.

Advanced fee scam. This is also known as a 419 scam or upfront fee fraud. This fraudulent activity was said to have originated from Nigeria and is the reason why it goes by the nickname “419 scam” which was taken from Section 419 of the Nigerian Criminal Code.

This is a type of fraud in which a scammer requests an upfront payment or fee from a victim with the promise of a much larger payout or benefit in return.

These scams often involve a variety of stories or ruses, such as lottery winnings, inheritance claims, or business opportunities. The victim is asked to send money or provide personal information to cover supposed fees, taxes, or legal expenses.

However, the promised benefit is a fiction, and the scammer disappears with the victim’s money or uses the provided personal information for identity theft or further scams. Advanced fee scams are fraudulent and designed to exploit victims by preying on their willingness to invest money upfront for a larger, non-existent reward.

Pump-and-dump scheme. This is a type of fraud that involves artificially inflating the price of a cryptocurrency or other assets (pump) and then selling it off at the elevated price (dump). Perpetrators of these schemes often disseminate false or misleading information to create a buzz around the asset, enticing unsuspecting investors to buy in.

Once the price is pumped up, the fraudsters sell their holdings, profiting from the inflated prices, while other investors who bought in too late or believed the false information end up losing money as the price crashes. It’s a manipulative and illegal tactic that harms investors and undermines the integrity of financial markets.

Offshore investment scam. Another fraudulent scheme in which scammers lure investors to put their money in offshore accounts or investment opportunities, often in foreign countries. They promise high returns and claim the offshore nature of the investment will provide tax advantages or privacy.

In reality, these schemes are designed to steal investors’ money, and the promised investments or accounts often don’t exist. Offshore investment scams can involve a range of tactics, from fake companies and non-existent assets to complex financial structures aimed at hiding the fraudulent nature of the scheme. They prey on the allure of offshore financial centers and can lead to significant financial losses for victims.

TRUSTWORTHY PARTNER

But if you happen to be on the lookout for a trustworthy, legitimate, and widely-recognized investments solutions partner, FirstMetroSec can help.Get a wide array of investment options—from stocks, corporate bonds, government bonds, mutual funds, UITFs, ETFs and Real Estate Investment Trusts all with just one powerful account.

And the best part? You can summon your investments automatically through our Voluntary Investment Program (VIP) for as little as P1,500 a month—no broomstick required!

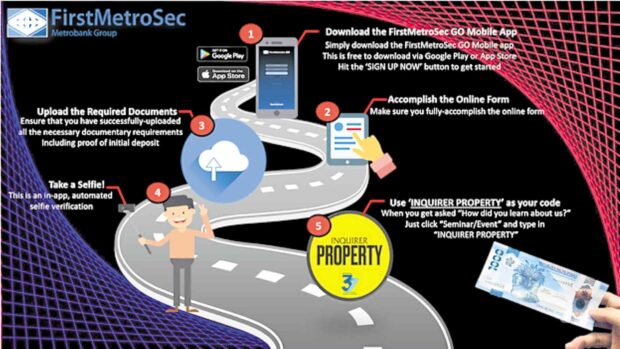

If you’re ready to join the ranks of wise investors, just pay a visit to www.firstmetrosec.com or conjure up the ‘FirstMetroSec GO’ mobile app. Complete the online registration form and send your required documents—it’s that easy!

To ensure a swift initiation into the world of investing, don’t forget to use ‘INQUIRER PROPERTY’ as your account opening code. Your journey to financial enlightenment awaits!

As you navigate the maze of investment choices, keep in mind that while Halloween thrills are fun, financial chills from scams are not. Stay vigilant, ward off the darkness of deception, and ensure your investments are a treat, not a trick.

The author, CIS, CSR, CTP, CUSP and CFMP, has 18 years of experience as an entrepreneur, real estate investor, stock broker, financial literacy advocate and public speaker. He is the vice president and head of Business Development and Market Education departments, as well as the OFW Desk, of First Metro Securities Brokerage Corporation. He also sits in Metrobank’s Financial Education Editorial Advisory Board. He may be reached via andoybeltran@gmail.com If you’re all about city life, crave convenience, and don’t mind the cozy quarters, a condo unit could be your dream nest.

The author may be reached via andoybeltran@gmail.com

If you’re ready to join the ranks of wise investors, just pay a visit to www.firstmetrosec.com and to ensure a swift initiation into the world of investing, don’t forget to use ‘INQUIRER PROPERTY’ as your account opening code. Stay vigilant, ward off the darkness of deception, and ensure your investments are a treat, not a trick.