The Philippines was a front-runner, just a few years ago, among emerging Asian nations for the development of its digital economy. It has since let others surpass it. Two key missing ingredients, data residency policy and targeted government initiatives, are needed for the archipelago to deliver on its vast digital potential.

Data localization/residency policies

Data localization and residency provides control over data, promotes economic growth derived from it, ensures local policies over its use and security are followed, and reduces the risk of losing access to data when it is stored offshore.

Indeed, data localization and residency, through onshore Data Centers (DC)—along with growth in workloads, e.g., storage, network, cloud and lately Artificial Intelligence (AI)—are the key reasons for the explosion of DC demand worldwide.

Case in point India, which has witnessed steep growth in DC demand ever since the enactment in 2018 of policy directives aimed at domestic storage of data. This was followed two years later with a DC Policy, whose vision was to propel digital economy growth, for the evolution of DC infrastructure within India. Prior to that and despite the size of its market, DC demand was stagnant. Data was moved offshore and exposed a lack of data sovereignty.

The DC infrastructure in the Philippines is today lagging comparable nations in Southeast Asia. Industry leaders are still not committing to investment and development. Others are tiptoeing into the market.

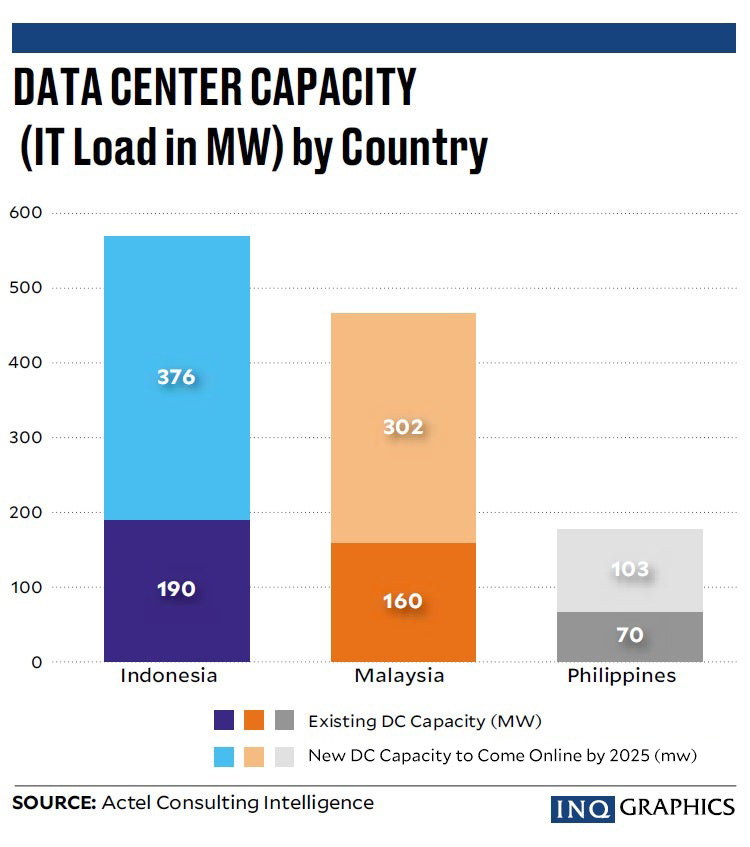

This to contrast with so-called hyperscale developments (expressed in tens of MW of capacity each) in Malaysia, a smaller market than the Philippines. The following graph contrasts the Philippines’ existing and, more worryingly, expected capacity with those of fellow Asean (Association of Southeast Asian Nations) nations, Malaysia and Indonesia.

Malaysia, arguably one of the hottest Asian DC markets this year, trailed the Philippines in market size and dynamics, just a few years ago. So, what’s the reason for this dramatic rise? Geographic proximity to Singapore, the perennial hub that is land and energy starved, helps tremendously.

This is manifested by the dramatic development of the southern state of Johor across the causeway from Singapore. Yet, this would not have been sufficient without a second key development. That is a business climate conducive to foreign direct investment (FDI).

Indeed, the latest growth of the industry coincided with a climate of stability as brought on by the government of PM Ibrahim a year ago. Critically, it has taken a pro-business approach regarding data sovereignty, i.e., data storage and processing within the shores and according to the laws of Malaysia, by facilitating the task for investors, reducing red tape, and making available the necessary resources, namely land, energy, water, and connectivity. The number of foreign operators fuelled by foreign capital flooded the market, bridging the gap with Indonesia and speeding past the Philippines, as shown in the following graph.

On energy, one cannot utter these words lately without sustainability attached, given drive for low carbon emissions. The Philippines can deliver through a mix of solar, hydro, wind and geothermal.

Another ingredient the Philippines has going for it and is indispensable for the development of the digital industry is global connectivity. These are the subsea cables that connect the domestic DCs with those overseas in Asia and across the Pacific to the United States.

Therefore, the necessary resources are available in the Philippines. What has hitherto been lacking is government incentives and facilitation through measures such as the ones implemented in Indonesia, Malaysia and India.

The Philippines should leverage land and green energy endowment versus for example Hong Kong and Singapore, which struggle with such availability, yet maintain privileged hub status within the region.

In conclusion, in order to remain attractive and competitive in the information age, including the fast-growing AI applications, the Philippines should take a page from fellow Asian countries and conduct the following:

- Enact policies for data residency/localization—this alone can turbocharge the relatively lackluster industry.

- Set up a unit whose aim is to guide and facilitate FDI into the industry and serve as conduit for foreign investors and operators to domestic utilities, property and green energy developers, connectivity providers and other ecosystem players.

The Philippines already boasts several key ingredients for success including privileged geographic location, abundant and state of the art subsea connectivity, land and associated green power generation. What has been missing but can be remedied, as long as there is a will to catch up to fellow Asian hubs, is a little support and coordination from authorities.

While Hong Kong and Singapore struggle with maintaining the same level of development due to natural constraints, others such as Malaysia, Indonesia and India have stepped in. There is no reason why the Philippines can’t join the ranks of emerging Asian digital champions. INQ

Claude Achcar (The author is managing partner of Actel Consulting, which specializes in technology consulting)