RE shift: What’s been done, where it lags, how to proceed

The worsening climate crisis, as seen through the catastrophic impact of natural disasters on millions across the globe, has been putting the pressure on governments to abandon fossil fuels for renewable energy (RE).

In the Philippines, the national government saw this urgency 15 years ago with the enactment of the Renewable Energy Act of 2008, which aims to promote the development, utilization and commercialization of clean energy resources.

Years later, the Department of Energy (DOE) further set this commitment in stone when it vowed to increase the share of renewables in the country energy mix from the current 22 percent to 35 percent by 2030 and 50 percent by 2040.

But this remains a challenge for a fossil fuel-dependent country, such as the Philippines, with coal still accounting for nearly 50 percent of the energy-generating capacity.

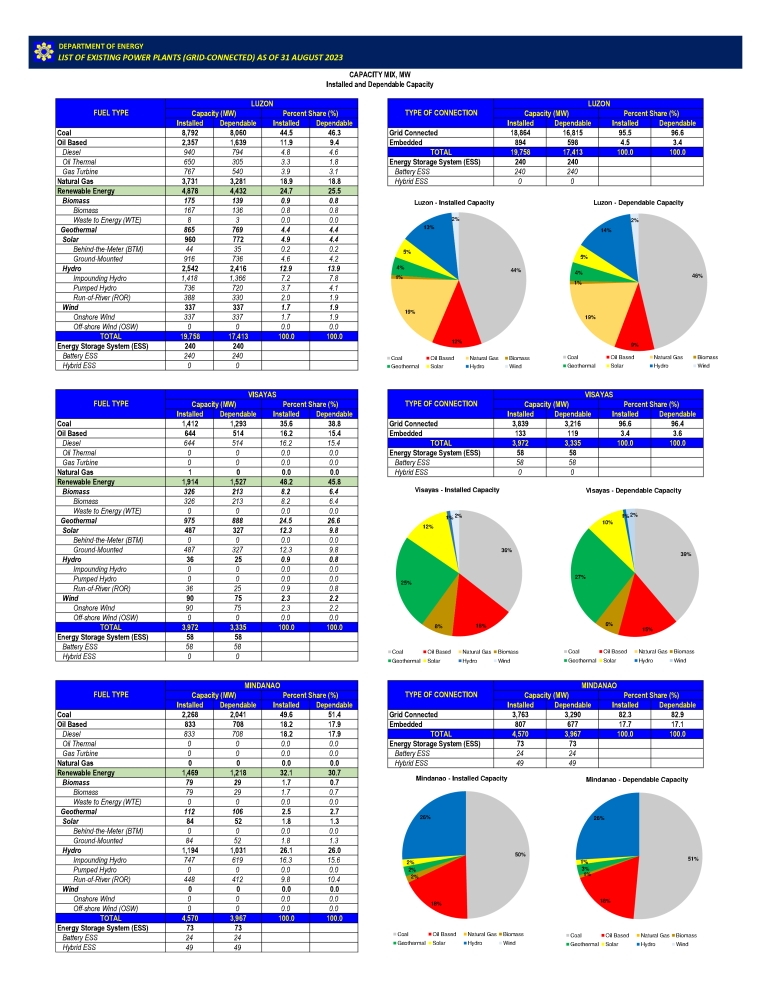

As it stands, August 2023 data from the DOE show that 12,473 megawatts of the Philippines’ 28,300-MW installed power capacity comes from coal-fired power plants. Renewable energy, such as solar, onshore wind, hydropower, and geothermal, only contributes 8,264 MW.

Staying on track

To stay on track with meeting its renewable energy targets amid growing power demand, the Philippines needs an additional 52,826 MW in capacity by 2040, according to the DOE.

The private sector—the main driver of power development in the Philippines—thus feels immense pressure to help meet these targets.

The problem, however, is that renewable energy development has been slowing down since the Renewable Energy Act of 2008 was passed into law, according to Jose Layug Jr., president of Developers of Renewable Energy for Advancement Inc.

At a recent forum, Layug lamented that only 2,699.76 MW of renewable energy was installed from 2009 to 2019, with coal still taking over.

While the private sector is keen on developing more renewable energy facilities, inefficient permitting processes are slowing them down.

“In the past and until now, the issue always is the number of permits that we need to secure from different government agencies. It’s not efficient,” Layug tells the Inquirer.

The government’s solution to this is the Energy Virtual One-Stop Shop (Evoss), a systematic, web-based filing and monitoring system for energy-related applications. It also serves as a repository of information and permits issued for energy projects.

Layug says this system needs to be utilized not only by the energy sector, but also by all other industries to fast-track renewable energy development.But it’s a good start, he says.

“The previous government had different signals to the investors and the public. This government (the Marcos administration) is clear with what it wants: It wants more renewables,” Layug adds.

100% foreign ownership

Apart from Evoss, which was launched in 2019 through the leadership of then Senate energy committee chair Sen. Sherwin Gatchalian, the government has also allowed 100-percent foreign ownership in the renewable energy sector.

While the 1987 Constitution caps foreign ownership of businesses at 40 percent, the Department of Justice opined in October 2022 that this did not apply to renewable energy.

This has significantly increased foreign investor interest in the sector.

For instance, Copenhagen Infrastructure New Markets Fund, an affiliate of Danish fund manager Copenhagen Infrastructure Partners, has committed to invest $5 billion for the development of three offshore wind projects in the Philippines with a combined capacity of 2,000 MW.

The Philippines currently has no offshore wind facilities, but both Malacañang and the DOE are seeing to it that the investment momentum continues.

On April 19 this year, President Marcos issued Executive Order No. 21, which establishes the policy and administrative framework for offshore wind development and mandates the creation of an offshore wind task force.

For its part, the DOE has committed to converting some of the Philippines’ existing ports into integration ports that will house materials needed for offshore wind development, such as large wind turbines.

Gas ups and downs

However, energy transition, or shifting from fossil fuel-based energy sources to renewables, still proves to be difficult for developing countries, such as the Philippines.

Energy Secretary Raphael Lotilla himself has admitted that the country cannot exactly retire its coal plants overnight, and that liquefied natural gas (LNG), another fossil fuel that emits nearly as much carbon dioxide as coal, was an ideal transition fuel.

In August, the DOE issued a draft circular outlining the policy framework for LNG development as supply from Malampaya, the country’s sole indigenous gas field that generates a fifth of the Philippines’ energy requirements, continued to deplete.

The DOE went as far as proposing to require distribution utilities, such as Manila Electric Co. to source a certain percentage of their power needs from LNG facilities.

But Singapore-based investor relations firm Asia Research and Engagement (ARE) warned in a recent study that LNG emissions are expected to breach that of coal in the long term, especially when accounting for upstream emissions, or those released during shipment and production.

Kurt Metzger, ARE director for energy transition who also authored the study, tells the Inquirer that among the keys to shifting away from LNG and coal is to gradually change the existing public mindset on these fossil fuels.

“There’s a lot to be done to convince people that renewables can be a baseload, and that’s going to take quite a bit of time and investment. It’s not going to happen overnight, it’s going to be a very slow process of thinking that we can survive without coal-fired power plants,” he says. Baseload sources refer to power plants that can generate dependable power to consistently meet demand. In the Philippines, this still takes the form of fossil fuels.

Reliable transmission needed

But for renewable energy development to further accelerate, the country needs a reliable transmission network that can withstand the addition of new technology.

The National Grid Corp. of the Philippines (NGCP), the country’s lone transmission backbone operator, has been the subject of much scrutiny after the Energy Regulatory Commission flagged 37 delayed transmission projects.

Layug points out that this poses a challenge for developers, as new infrastructure cannot be constructed without a reliable transmission network that can accommodate more power.

“Generators want to build [power plants] in some areas, only to find out that there’s no transmission capacity. There needs to be coordination among the national government and the NGCP on where these power plants can be built,” he says.

Metzger also sees the power grid as the “bigger constraint” to energy transition.

“There’s still certain situations when the grid can’t take the power and you get curtailed. You’re not going to be able to build more renewables if there’s not enough transmission lines. It doesn’t make sense for developers and investors,” he says.

During the DOE’s second Green Energy Auction Program in July, in which it auctioned off 11,600 MW of renewable energy capacities that must be available in the next three years, the private sector committed to providing only a third of the total available capacity.

Both the DOE and developers pointed to the country’s transmission grid as a deterrent.

‘Much farther ahead’

In its defense, NGCP has repeatedly said that permitting, particularly for right-of-way acquisition in properties that would be affected by its projects, was the main cause of the delays.

NGCP spokesperson Cynthia Alabanza previously explained that the COVID-19 pandemic also hampered operations, and that “it’s a reality” they had to face.

Ultimately, it is a fact that the Philippines needs to accelerate energy transition to mitigate the effects of climate change. The DOE itself has said that at least 18,000 MW of additional renewable energy capacity is needed to reach its 2030 goal.

With seven years left, there is still much to be done. But developers remain optimistic that with the current transition pace and policies, the Philippines will still be on track to meet its target.

“If you follow what the government is doing now, we will be on track … The DOE is really taking the lead and showing everyone that the government is serious,” Layug says.

Metzger also points out that despite slow fossil fuel phaseout, the country remains “much farther ahead” in Southeast Asia when it comes to energy transition, considering its renewable energy policies.

“They (Philippine government) are saying all the right things about renewables to meet the 2030 and 2040 targets,” he says. INQ