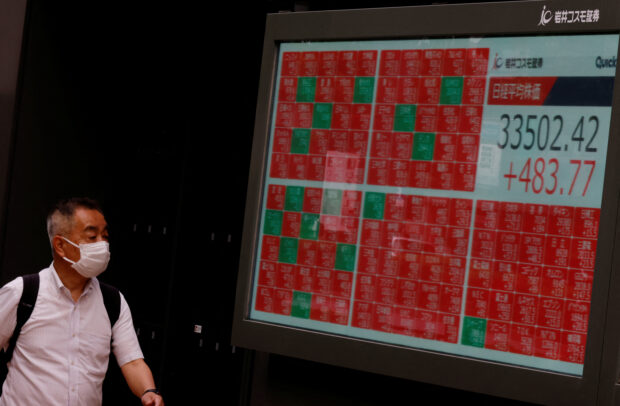

A man looks at an electric board displaying the Nikkei stock average outside a brokerage in Tokyo, Japan June 14, 2023. REUTERS/Kim Kyung-Hoon/File photo

SYDNEY – Asian share markets rallied on Thursday and the dollar was weaker after most U.S stocks edged higher and the S&P 500 recorded its longest winning streak in two years, with investors on high alert for signs that global interest rates have peaked.

MSCI’s broadest index of Asia-Pacific shares outside Japan was flat, although up 4.6 percent so far this month.

The yield on benchmark 10-year Treasury notes reached 4.5059 percent compared with a U.S. close of 4.523 percent on Wednesday.

The two-year yield, which rises with traders’ expectations of higher Fed fund rates, touched 4.932 percent compared with a U.S. close of 4.936 percent.

Australian shares were up 0.44 percent, and Japan’s Nikkei stock index was up 0.85 percent.

Hong Kong’s Hang Seng Index was up 0.11 percent in early trade while China’s blue chip CSI300 Index was 0.2 percent higher in early trade.

“Markets were relatively calm following recent volatility as participants await the release of next week’s October U.S. CPI report and try to ascertain whether last week’s moves in U.S. Treasuries, equities and the dollar are corrective or represent a fundamental shift in direction,” ANZ economists wrote.

Chinese inflation figures for October published on Thursday showed a 0.1 percent decline compared to September and a 0.2 percent fall from one year, according to official statistics.

China’s troubled property sector will be closely watched on Thursday after most major stocks rallied one day earlier following a Reuters report that Ping An Insurance Group had been asked by the Chinese authorities to take a controlling stake in Country Garden Holdings .

A spokesperson for Ping An said the company had not been approached by the government and denied the Reuters report that cited four sources familiar with the plan.

In Asian trading, the dollar dropped 0.06 percent against the yen to 150.88. It remains not far from its high this year of 151.74 on Oct 31.

The European single currency was up 0.0 percent on the day at $1.0709, having gained 1.25 percent in a month. The dollar index, which tracks the greenback against a basket of currencies of other major trading partners, was down slightly at 105.52.

The dollar has rebounded from last week’s sharp sell-off on rising confidence the Fed has ended raising rates. There is less agreement on whether a rate cut is on the horizon with inflation still above the U.S. Federal Reserve’s 2 percent target.

On Wall Street, the S&P 500 rose 0.10 percent and the Nasdaq Composite added 0.08 percent. The Dow Jones Industrial Average fell 0.12 percent.

The S&P 500 rose for the eighth consecutive day, extending its longest win streak in two years.

The Federal Reserve last week kept the benchmark overnight interest rate in the current 5.25 percent-5.50 percent range and the central bank is due to meet again mid next month.

The U.S weekly jobless claims published on Thursday will be closely watched as an indicator of the how the country’s labor market is performing. Economists predict claims will reach 219,000 after coming in at 217,000 last week.

Oil prices slid over 2 percent on Wednesday to their lowest in more than three months on concerns over waning demand in the U.S. and China. In Asia on Thursday, U.S. crude and Brent crude both rose 0.8 percent following the weak performance in the U.S. session.

Gold was slightly higher. Spot gold was traded at $1950.79 per ounce.